Optimism (OP) Defies Market Pressure: Holds Firm Above Weekly Open With Strong Rebound

Layer 2 contender Optimism (OP) refuses to buckle under bearish pressure, staging a textbook-perfect bounce from key support levels.

Price action shows OP clinging stubbornly above its weekly opening price—a psychological victory for bulls after recent market turbulence. The rebound suggests accumulation by institutional players who still believe in Ethereum's scaling narrative (despite what the 'ETH killers' crowd would have you believe).

Technical indicators hint at growing momentum, though traders should watch for potential resistance near the local high. Meanwhile, Bitcoin maximalists are muttering about 'altcoin dead cat bounces' while secretly FOMO-ing into SOL bags.

One thing's clear: in crypto's perpetual casino, even Layer 2 tokens get their day in the sun—until the next shiny scaling solution distracts the degens.

Market structure has shifted in favor of buyers, with technical charts suggesting a potential push toward the internal range point of control (POC). Traders are closely monitoring whether the coin can sustain this position to confirm continuation toward mid-range resistance levels.

Optimism Price Analysis Highlights Structural Shift and Strong Bounce

In a recent post on X, analyst Carl Moon highlighted the resilience of the asset’s latest price recovery. He noted that the coin is “looking good here,” emphasizing the strong bounce and sustained hold above the weekly open. According to Moon, the first resistance to monitor lies NEAR the internal range POC, which has historically acted as a key mid-range liquidity zone.

Source: X

The chart shared by Moon shows that the recent low established near $0.33–$0.34 marked a decisive turning point, followed by a notable shift in market structure. This transition from a downtrend to higher highs indicates that buyers have regained technical control. However, Moon also underscored the importance of the weekly open holding as a short-term support level, warning that any loss below could invalidate the near-term bullish case.

Optimism Price Analysis Reflects Measured Market Outlook Despite Volatility

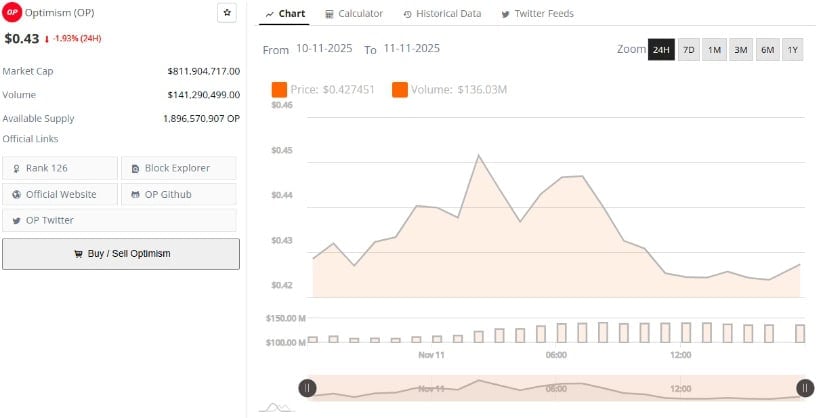

Data from BraveNewCoin shows that the coin is currently priced at $0.43, reflecting a 1.93% decline over the past 24 hours. The network maintains a market capitalization of approximately $811.9 million, with a daily trading volume of $141.3 million and an available circulating supply of 1.89 billion tokens.

Source: BraveNewCoin

The token ranks #126 by market capitalization, situating it in the mid-cap category among ethereum Layer 2 ecosystem projects. Despite recent volatility, the asset remains supported by fundamental adoption factors, including the network’s ongoing expansion into scaling infrastructure for Ethereum mainnet transactions.

Weekly Support Holding as Buyers Rebuild

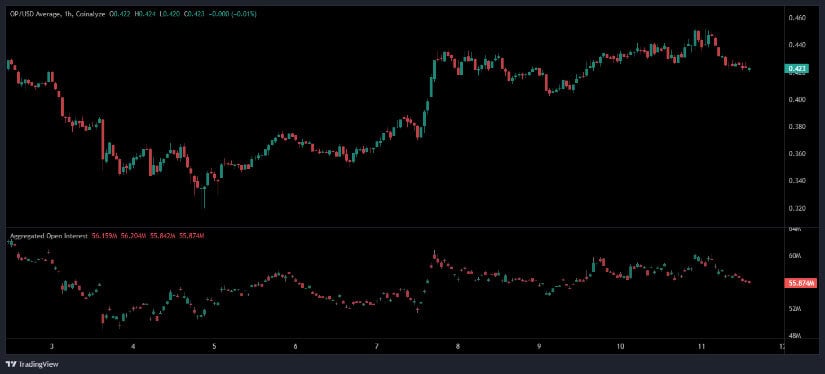

According to Open Interest, the token is trading near $0.423 on the Binance chart, with the price consolidating just above the weekly open at $0.4287. Analysts note that maintaining this zone is critical for confirming a sustained upward trajectory. The internal range POC near $0.4597 stands out as the next resistance level where profit-taking or short-term rejection could occur.

Source: Open Interest

The chart also indicates that open interest has slightly declined from the $56 million region to around $55.8 million, suggesting that Leveraged traders are gradually exiting positions rather than building new aggressive longs. Despite this, the spot market structure remains constructive, with higher lows and consistent volume support across 1-hour and 4-hour timeframes.

If Optimism holds the weekly open as support, traders expect continuation toward $0.48–$0.50, a zone that marks both structural resistance and a liquidity cluster from October’s mid-range activity. Failure to defend this level, however, could return price action to the $0.38–$0.40 range, where prior demand reemerged.