🚀 XRP Soars to $2.44: 8% Daily Surge Sparks Rally—Here’s Why

XRP just punched through resistance levels like a hot knife through butter—clocking a blistering 8% gain to hit $2.44. Traders are scrambling for answers, and we’ve got the breakdown.

The Catalysts Behind the Surge

Market whispers point to a perfect storm: institutional accumulation, bullish technicals, and a sudden spike in derivatives activity. Meanwhile, Bitcoin maximalists are busy explaining why this is ‘just a dead cat bounce.’

Liquidity Floodgates Open

On-chain data reveals whales moving stacks—likely frontrunning another wave of retail FOMO. Exchanges are reporting order book imbalances, with bids stacking faster than a DeFi rug pull investigation.

Will the rally hold? That depends on whether the SEC suddenly remembers XRP exists. For now, enjoy the ride—and maybe hedge with some stablecoins before the suits on Wall Street ‘discover’ crypto again tomorrow.

After a week of sideways trading and brief dips near $2.20, the xrp price today has regained momentum on the back of strong buying volume and bullish sentiment. Analysts point to ETF speculation, institutional investments in Ripple, and signs of large-holder accumulation as key catalysts fueling this rebound.

ETF Momentum Sparks Renewed Market Excitement

One of the most influential drivers behind the XRP price surge is growing optimism surrounding potential spot XRP ETF approvals in the U.S. Several major issuers, including 21Shares, have recently filed amendments to their registration statements, reportedly triggering a 20-day SEC review window.

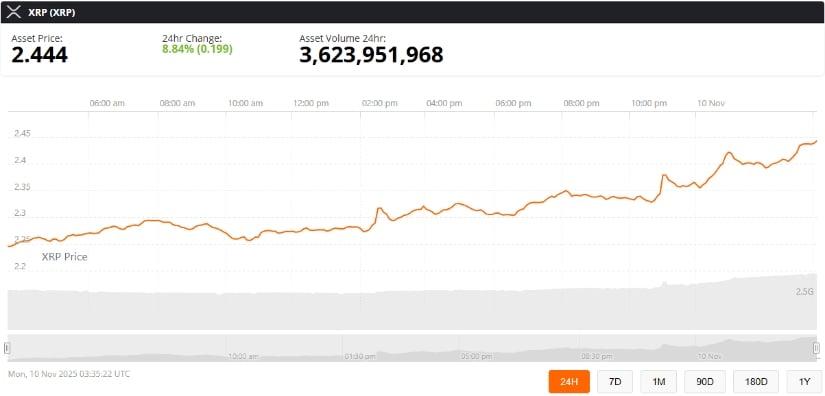

XRP was trading at around $2.44, up 8.84% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Analysts suggest that such administrative milestones increase the likelihood of an eventual SEC approval. A green light for a Grayscale XRP ETF or similar products could open a regulated gateway for institutional investors to gain exposure to Ripple (XRP), amplifying demand across retail and professional channels.

Several XRP ETF issuers have withdrawn their delaying amendments, initiating the SEC’s 20-day review window that could lead to automatic approval if no objections arise. Source: @PieterCryptoX via X

As crypto markets continue to digest this development, traders see the ongoing ETF momentum as a near-term bullish catalyst for the price of XRP.

Market Infrastructure Readiness Adds Confidence

Beyond regulatory expectations, Ripple XRP news today points to growing signs of market infrastructure readiness. Several spot-XRP products have appeared in the Depository Trust & Clearing Corporation (DTCC) listings—a step widely interpreted as preparation for settlement and custodial operations.

Nine spot XRP ETFs have been listed on the DTCC, indicating operational readiness ahead of a potential launch later this month. Source: @Xaif_Crypto via X

This technical milestone signals that issuers are laying the groundwork for institutional inflows once regulatory approval is granted. Such readiness often serves as a confidence boost for traders, reinforcing the narrative that Ripple XRP is approaching a new phase of mainstream financial integration.

Institutional Investment Strengthens Ripple’s Position

Adding to the optimism, Ripple recently secured a $500 million strategic funding round at a valuation of roughly $40 billion, backed by Fortress Investment Group, Citadel Securities, and Pantera Capital. This capital injection reflects institutional confidence in Ripple’s long-term strategy, including its RLUSD stablecoin, treasury solutions, and prime brokerage services.

The investment also reassures markets that Ripple is expanding its ecosystem beyond payments into broader financial services—a MOVE that could strengthen the fundamental utility of XRP as a liquidity bridge asset.

Analyst Perspectives and Market Sentiment

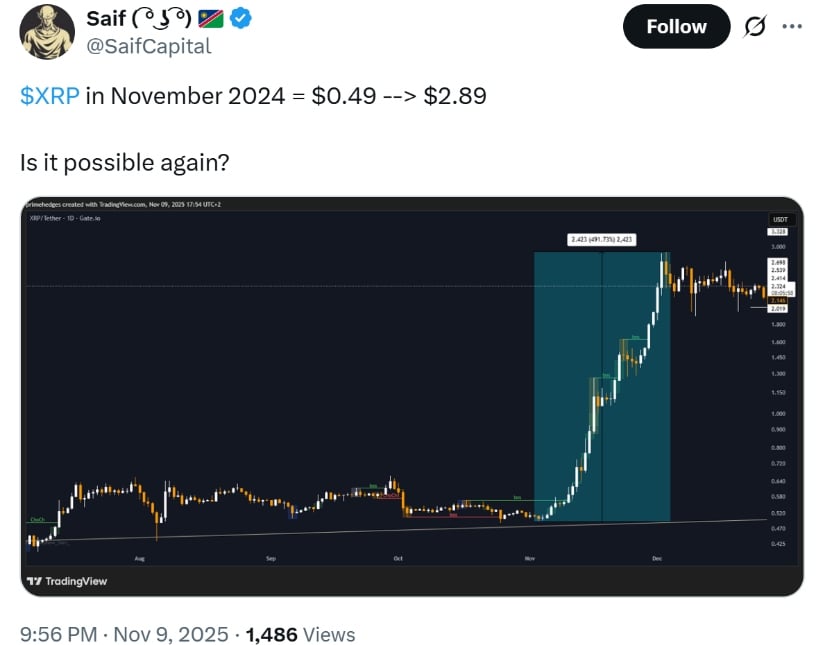

The current rally has reignited social media debates about XRP price predictions and the possibility of a new all-time high. On X, user @SaifCapital reminded followers that “XRP in November 2024 was $0.49 → $2.89. Is it possible again?” referencing the token’s 490% surge after Ripple’s partial victory in the XRP SEC lawsuit.

XRP surged 490% in November 2024, rising from $0.49 to $2.89, driven by Ripple’s partial SEC victory and anticipation surrounding its RLUSD stablecoin launch. Source: @SaifCapital via X

Meanwhile, crypto analyst @Cryptollica shared a multi-part fractal analysis projecting a possible $10 XRP price target, citing historical chart cycles and long-term bullish structures. However, most market analysts remain cautious, noting that such levels WOULD likely require regulatory clarity and ETF approvals before materializing.

Outlook: What’s Next for XRP Price Prediction 2025?

With the current XRP price hovering around $2.44, traders are watching whether the asset can sustain momentum above $2.40 and push toward the $2.80–$3.00 resistance zone in the coming weeks.

Cryptollica’s analysis predicts an upcoming “Part 3” XRP surge to $10, based on a 2014–2028 logarithmic chart identifying repeating fractal cycles and historical trend patterns. Source: @Cryptollica via X

While technical indicators show short-term strength, analysts emphasize that the next major catalyst could come from either SEC developments regarding ETFs or continued institutional expansion of Ripple’s ecosystem.

If these trends align, XRP price prediction 2025 scenarios range from conservative targets near $5 to more ambitious projections around $10, though market participants acknowledge that such gains depend heavily on regulatory and macroeconomic factors.