Cardano Bulls Charge: ADA Defends $0.50, Aims for $0.85 Breakout in November Rally

Cardano (ADA) stages a fierce rebound from the $0.50 support level as crypto traders pile into the recovery narrative.

The Setup:

After testing a critical demand zone, ADA bulls are now targeting the $0.85 resistance—a 70% upside move from current levels. The November rally could ignite if Bitcoin holds steady.

Why It Matters:

A clean breakout above $0.85 would confirm the end of ADA's 18-month bear market. But let’s be real—this is crypto, where ‘confirmed breakouts’ often last just long enough for retail traders to FOMO in.

Traders Watching:

Daily closes above $0.60 for momentum confirmation. Failure to hold $0.50 risks a retest of June lows—because nothing says ‘market recovery’ like a 20% rug pull.

After weeks of steady declines, Cardano price is finally showing signs of strength as price rebounds sharply from the $0.50 zone. This renewed strength comes amid growing optimism in the ADA community, with participants eyeing whether this bounce can evolve into a full-fledged recovery towards the $0.70 to $0.85 range.

Cardano Rebounds From $0.50 Support Zone

Cardano price is showing its resilience again as price bounces from the $0.50 psychological level, a region that has acted as a major support multiple times this year. The current rebound follows a clean defense of horizontal structure and wick rejections that indicate strong dip absorption by buyers. The chart also suggests a descending channel with the lower boundary now being tested, hinting that ADA cardano price may be forming a potential bottoming pattern.

Cardano price rebounds from the $0.50 support level, signaling renewed buying interest and potential base formation. Source: Rand via X

For participants, reclaiming $0.56 to $0.58 WOULD be the first structural confirmation of recovery, with upside continuation likely towards $0.70 if volume expands. On the downside, losing $0.50 could reintroduce pressure towards $0.44, but for now, momentum favors cautious accumulation as long as support holds firm.

Cardano Price Prediction: Bulls Eye Recovery Towards $0.85

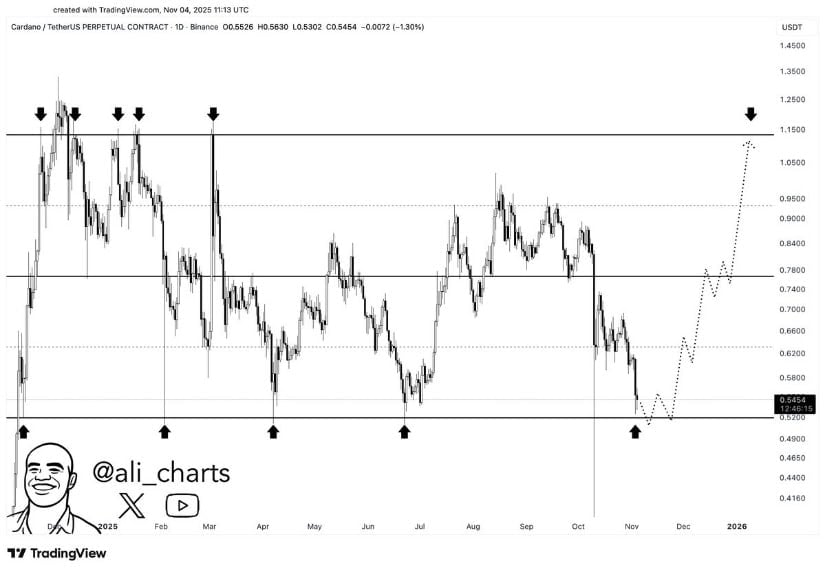

Ali Martinez’s chart highlights how $0.52 remains a historically reliable level that has triggered multiple rebounds since late 2024. This horizontal zone coincides with the lower range of ADA’s macro consolidation channel, making it a critical pivot point for trend direction.

Cardano continues to defend the $0.52 support zone, with bullish momentum building toward the $0.85 resistance ranges. Source: Ali Martinez via X

From a technical perspective, Cardano price continues to trade between $0.52 support and $0.85 resistance, forming a potential accumulation range. If buyers maintain control, the next rally could aim for $0.74–$0.85, aligning with the midpoint of the broader range. A break above this threshold would confirm a trend reversal structure, potentially opening the door for a retest of $1.00 resistance.

Growing Utility Strengthens Long-Term ADA Outlook

Beyond technicals, Cardano’s fundamentals continue to build momentum. A recent update shared by TapTools cites The Motley Fool’s report, which deems $1 ADA “very plausible” given Cardano’s integration of the new x402 transaction standard developed by Masumi. This standard allows AI agents to transact and pay per request using crypto.

Cardano’s integration of the x402 AI transaction standard boosts its long-term utility and adoption potential. Source: TapTools via X

Such developments position cardano as one of the few networks bridging blockchain with emerging AI infrastructure. As this adoption narrative strengthens, investor confidence may return faster than expected, especially as Cardano price nears historically undervalued levels.

RSI Oversold: Room for Short-Covering Bounce

On the technical front, Cardano’s momentum indicators are painting a textbook setup for a short-term relief rally. The daily RSI hovers around 30, signaling oversold conditions comparable to earlier reversal phases. CryptoCeek highlights that a push above $0.62 could flip sentiment bullish again, particularly if short positions start unwinding.

Cardano’s RSI nears oversold territory, hinting at a possible short-covering bounce if $0.62 resistance breaks. Source: CryptoCeek via X

Cardano price structure shows $0.50 acting as near-term demand, while a clean break above the descending trendline could unlock targets towards $0.74. Conversely, a breakdown below $0.50 exposes $0.40, though that remains a less likely scenario unless broader market weakness accelerates.

Final Thoughts

Cardano price is approaching an inflection point. With strong technical support at $0.50 to $0.52, oversold RSI readings, and renewed confidence from both participants and fundamental analysts, the probability of a rebound is rising.

If price reclaims $0.62 to $0.65, ADA Cardano price could enter a new short-term bullish phase targeting $0.74 and $1.00, supported by improving on-chain innovation and the AI-driven x402 transaction narrative. Overall, Cardano looks primed for a stabilization phase that could evolve into a stronger recovery if buyers sustain this critical support zone.