XRP Price Alert: Death Cross Threatens at $2.70, But Grayscale ETF Filing Ignites Bullish Momentum

XRP faces technical turbulence as death cross pattern emerges—traders brace for short-term volatility while institutional interest heats up.

The Technical Pressure Cooker

That dreaded death cross formation at $2.70 signals potential near-term pain for XRP holders. Technical charts flashing warning signs as the 50-day moving average dips below the 200-day—classic bearish territory that typically triggers sell-offs among nervous investors.

Institutional Cavalry Arrives

Grayscale's ETF filing changes the entire narrative. Suddenly, traditional finance players are circling XRP like Wall Street sharks smelling blood in the water—except this time they're bringing billions in potential investment capital.

Market sentiment splits between technical purists reading the charts and crypto maximalists betting on the ETF effect. Because nothing says 'legitimacy' like financial institutions finally realizing they can make money from the technology they spent years dismissing.

The battle lines are drawn: short-term technical pain versus long-term institutional gain. XRP's next move could define its trajectory for the coming year.

Adding a bullish twist, Grayscale’s recent XRP spot ETF filing has sparked excitement in the market, highlighting the potential for increased institutional adoption. This development positions XRP for a possible rebound, balancing short-term risks with long-term growth opportunities.

Death Cross Raises Short-Term Concerns

On the technical front, XRP has recently formed a death cross on its 10-day and 20-day Exponential Moving Averages (EMAs) at the $2.70 level. Technical analyst @ChartNerdTA explains that “death crosses are lagging indicators and typically mark the worst of the pain on formation,” often signaling that short-term downward momentum has peaked.

XRP hits a $2.70 death cross on its 10/20 EMAs, signaling short-term pain with support NEAR $2. Source: @ChartNerdTA via X

The same analysis notes potential support zones in the $2.00 vicinity, with further downside possible if selling pressure persists. Despite this, the macrostructure of XRP remains intact, indicating that the broader trend is not yet compromised. Analysts highlight that past corrections following death crosses have sometimes paved the way for renewed upward momentum.

Hidden Bullish Divergence Provides a Silver Lining

Despite bearish short-term indicators, a hidden bullish divergence has emerged on XRP’s monthly chart. Analyst @jaydee_757 points out that “XRP’s monthly lows are rising while RSI forms lower lows, signaling a potential continuation of the bullish trend if $2.09 support holds.”

XRP’s hidden bullish divergence remains intact if $2.09 holds, setting the stage for a potential rise while “dumb money” acts as exit liquidity. Source: @jaydee_757 via X

This divergence suggests that, even amid recent price drops, underlying momentum could support a recovery. JD emphasizes trading discipline, cautioning against HYPE surrounding events like Ripple’s Swell 2025 or the CLARITY Act (H.R.3633), stating that such distractions often cause retail investors to act as “exit liquidity” during price surges.

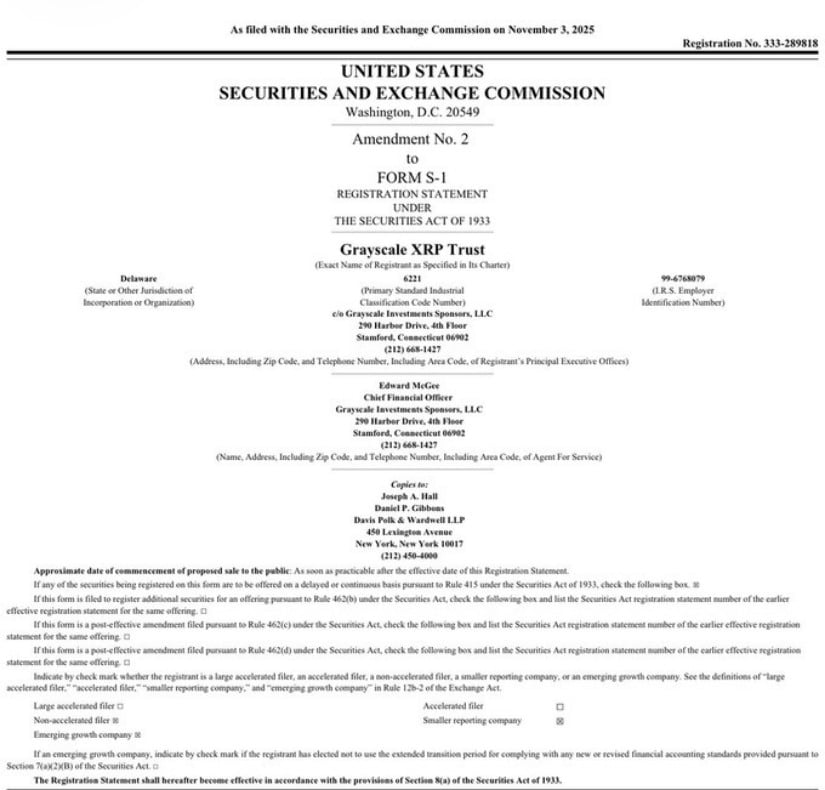

Grayscale XRP ETF Filing Boosts Market Sentiment

Adding a bullish catalyst to XRP’s outlook, Grayscale Investments recently submitted Amendment No. 2 to Form S-1 for the Grayscale XRP Trust. This filing moves the trust closer to launching a spot XRP ETF, which could open the cryptocurrency to regulated institutional investment in the U.S.

Grayscale files a new amendment for its XRP ETF, fueling Optimism for institutional adoption. Source: @Steph_iscrypto via X

Crypto commentator @Steph_iscrypto reports, “BREAKING: Grayscale just submitted a fresh amendment for its $XRP ETF,” sparking optimism across the community. Several X users highlighted the potential impact on XRP’s price, noting that ETF approval could drive inflows and possibly push XRP toward new all-time highs.

Industry observers note that the filing follows a growing trend of institutional adoption for digital assets, with regulated ETFs providing safer avenues for large-scale investors. The SEC’s EDGAR database confirms the amendment, signaling a formal step toward mainstream access.

Final Thoughts

XRP is navigating a challenging period, with the recent death cross at $2.70 signaling short-term pressure. However, technical insights like the hidden bullish divergence on the monthly chart, combined with institutional developments such as the Grayscale XRP spot ETF filing, suggest that upside potential remains.

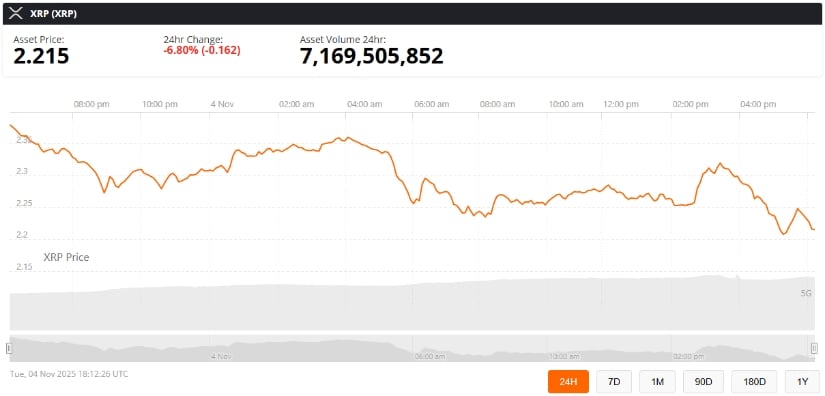

XRP was trading at around $2.21, down 6.80% in the last 24 hours at press time. Source: xrp price via Brave New Coin

Investors should stay cautious but remain attentive to these positive catalysts. Balancing short-term technical risks with long-term growth opportunities may provide the best strategy for navigating XRP’s evolving market landscape.