Cardano Whales Gobble Up ADA as $0.60 Support Sets Stage for Explosive Breakout

Whales are circling Cardano's waters—and they're hungry for more ADA.

The $0.60 Battle Line

Cardano's foundation at $0.60 isn't just holding—it's becoming a springboard. Institutional players keep loading their bags while retail investors nervously watch the charts. This isn't your typical crypto volatility; it's accumulation with purpose.

Breakout Imminent

Technical patterns scream bullish convergence. Every test of that $0.60 zone brings more buyers than sellers—classic accumulation behavior before major moves. The whales know something the rest of the market might be missing.

Market Mechanics at Play

Liquidity pools are shifting, order books show massive buy walls, and derivatives data reveals smart money positioning for upside. Meanwhile, traditional finance analysts still can't decide whether crypto is 'real'—proving once again that Wall Street's crystal ball needs polishing.

When whales feed this aggressively at key levels, history suggests they're not dining alone for long.

Whales are quietly returning to Cardano, signaling renewed confidence in ADA’s long-term outlook. Large transfers worth millions have been spotted leaving exchanges. As for the price, its stabilizing NEAR $0.60, while on-chain activity is showing healthy growth.

Smart Money Accumulating Cardano

Cardano appears to be entering a strong accumulation phase, with whale activity steadily increasing across major exchanges. On-chain data highlighted by Jack shows exchange outflows at multi-million-dollar levels, suggesting that large holders are moving ADA off exchanges, a typical precursor to long-term accumulation.

From a technical standpoint, ADA Cardano price is rebounding from its key zone near $0.58–$0.60, with a structure resembling a potential double-bottom formation. If this range holds, the next target sits near $0.74 to $0.80, marking the neckline of this developing pattern. This gradual shift from distribution to accumulation suggests smart money may already be positioning for ADA’s next expansion phase.

Potential Bottom Forming Near $0.60 for Cardano Price

Price action continues to show resilience around the $0.60 support zone, where cardano price has bounced multiple times over recent months. As noted by Crypto Pulse, this level aligns with the 200-day moving average and prior structural lows.

A clean close above $0.66 to $0.68 could confirm the local bottom, potentially setting up a mid-term move towards $0.85 to $1.00. Fundamentally, development activity and network adoption remain strong, providing confidence that this consolidation could be the final leg before a broader upward cycle. If bulls can maintain momentum, the next few days may mark a significant turning point for Cardano Price Prediction.

On-Chain Growth Strengthens the Bullish Case

Cardano’s network health continues to improve, as TapTools reported over 100,000 new wallets added within the past 60 days. This steady growth reflects increasing participation and renewed trust in the ecosystem, especially during a phase of market-wide consolidation.

Such on-chain expansion often precedes price recoveries, showing that users are actively accumulating and engaging with the network. Combined with whale accumulation and healthy transaction metrics, these data points strengthen the bullish narrative for ADA heading into the next quarter. Sustained growth at this pace could help stabilize long-term valuations above $0.60 and attract renewed investor confidence.

Cardano Price Analysis

EliZ’s chart reveals that ADA is forming a rounded reversal structure on the 4-hour timeframe, resembling an inverted head-and-shoulders formation around the $0.60 neckline. The price appears to be coiling just below resistance, with minor dips being absorbed quickly by buyers, suggesting a base is being built for the next leg higher.

A confirmed breakout above $0.66 WOULD validate this bullish reversal, with measured targets pointing towards $0.75 to $0.80. On the downside, the $0.58 region remains crucial, losing it could delay recovery momentum.

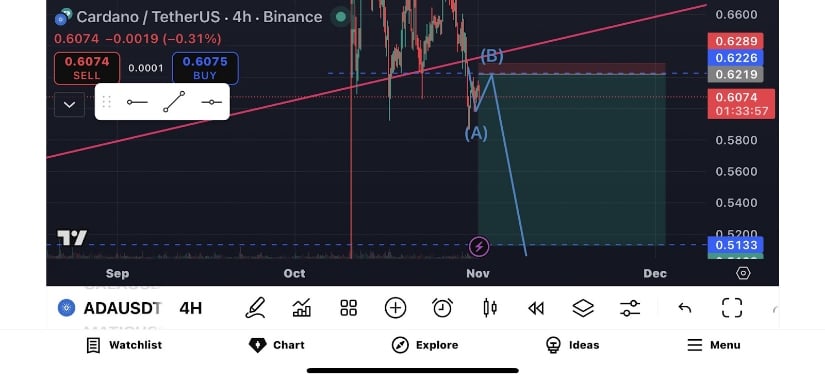

Contrary View: Deeper Retracement Still Possible for Cardano

While most indicators lean bullish, Crypto_freakk07’s Elliott-based chart suggests a possible short-term correction before full recovery. The wave structure points to an ongoing A–B–C correction, with the current B wave retesting prior resistance near $0.62. If this pattern completes, ADA cardano price could revisit the $0.51 to $0.52 zone before establishing a firm macro bottom.

This scenario aligns with prior market behavior, where ADA often retests lower supports before resuming its uptrend. If the corrective leg does occur, it could provide an ideal reaccumulation opportunity for traders watching for long-term entries.

Final Thoughts

Cardano’s structure continues to show encouraging signs of stability after the corrective round. The $0.58 to $0.60 accumulation zone has become a defining line between bearish continuation and early recovery. On-chain signals, increasing wallet growth, and whale activity all support the case for gradual upside continuation.

If the current momentum extends and Cardano price clears $0.68 resistance, the next upside targets range between $0.85 and $1.00 in the coming days. However, participants should remain alert to short-term retracements towards $0.52 if selling pressure resurfaces. Overall, the setup favors patient accumulation, with conditions aligning for Cardano to potentially start its next upward cycle into year-end.