Sui (SUI) Price Prediction: Bullish Breakout Targets $7.60 as Key Support Levels Defend Territory

Sui rockets toward $7.60 as bullish momentum builds

The Unbreakable Floor

Support levels aren't just holding—they're defying gravity. While traditional markets wobble over interest rate speculation, Sui's technical foundation remains rock solid. Key resistance levels crumble as buying pressure intensifies, creating a perfect storm for upward movement.

The $7.60 Horizon

Traders eye the $7.60 target like hawks circling prey. The chart pattern screams breakout potential, with volume indicators confirming the bullish narrative. Forget sideways action—this is momentum building toward a decisive move.

Market Mechanics in Motion

Institutional money flows into the ecosystem while retail traders scramble for position. The technical setup mirrors classic breakout patterns that typically precede significant price appreciation. Fibonacci extensions align perfectly with the projected target zone.

Another day, another crypto prediction—but this time, the charts actually tell a coherent story instead of the usual hopium-fueled fantasy. Sometimes even broken clocks get it right.

After peaking near $3.50 in October 2025, the price of Sui has cooled to around $2.38 as of early November, reflecting the broader crypto market’s correction phase. Despite the decline, analysts note that the token continues to find firm support around the $1.80–$2.10 levels that have historically sparked major rallies.

Market observers point to an ascending trendline pattern on the daily SUI/USD chart, suggesting that the token may soon break out of its consolidation range between $2.30 and $2.50. This trendline, if maintained, could serve as the launchpad for a strong MOVE toward $7.60, the first major upside target identified by multiple analysts.

Technical Analysis Suggests a Breakout Setup

Recent chart analyses highlight that sui is forming a bullish structure supported by an ascending trendline. Traders are closely watching this setup, viewing it as an indication of strength amid a volatile market.

When market momentum shifts upward, $SUI is expected to rally sharply toward its first target of $7.60. Source: @JamesEastonUK via X

However, not all analysts are convinced the path upward will be smooth. Some expect a short-term liquidity sweep—a temporary dip below support levels—before a sustained uptrend takes hold. This could see the token briefly touch the $1.50 zone before rebounding, a move that opportunistic traders may interpret as a “buy-the-dip” opportunity.

Token Unlock May Test Market Sentiment

One of the most closely watched events in the NEAR term is the upcoming token unlock scheduled for December 1, 2025. Approximately 43.92 million SUI tokens, valued at around $105 million, are set to enter circulation. Historically, token unlocks tend to introduce short-term selling pressure as early investors and project contributors gain access to their allocations.

SUI may face a short-term dip to $1–$1.50 following the upcoming 43.92M token unlock, presenting a potential buying opportunity for a bullish move toward $10–$20. Source: @CryptoPatel via X

Sui’s unlocks have historically represented around 1.19% of its total supply each month, occasionally triggering temporary corrections of 10–20%. Yet, analysts note that in previous bull market phases, the SUI market has shown a strong ability to absorb this new supply quickly, often rebounding shortly after. The coming unlock could, therefore, act as both a challenge and a test of the project’s growing investor confidence.

Expanding Ecosystem Strengthens Long-Term Outlook

Beyond technical patterns, Sui’s ecosystem growth continues to provide fundamental support for its bullish thesis. The blockchain has seen increasing adoption in decentralized finance (DeFi), gaming, and NFT applications, positioning it as one of the most active high-performance Layer-1 networks. The recent $2 million funding round for HyperSui, a perpetual DEX built on Sui, further underscores developer confidence in its infrastructure.

SUI remains technically strong, consolidating above a key macro support zone within a bullish structure that signals a potential reversal ahead. Source: @Degen_Hardy via X

As the total value locked (TVL) in Sui-based DeFi platforms surpasses $1.2 billion, the network’s ecosystem expansion is driving Optimism among long-term investors. Analysts projecting medium- to long-term price targets between $7.70 and $11.20 often cite this growth as a key factor supporting their forecasts.

Outlook: Bulls and Bears Face Off

If Sui maintains its current support and successfully breaks above its consolidation range, a move toward $7.60 becomes increasingly likely. Such a rally WOULD signal a strong technical recovery and renewed market confidence in Sui’s blockchain ecosystem. Conversely, failure to hold the $2.00 support level could lead to a short-term correction toward $1.50 before any meaningful rebound occurs. Suis

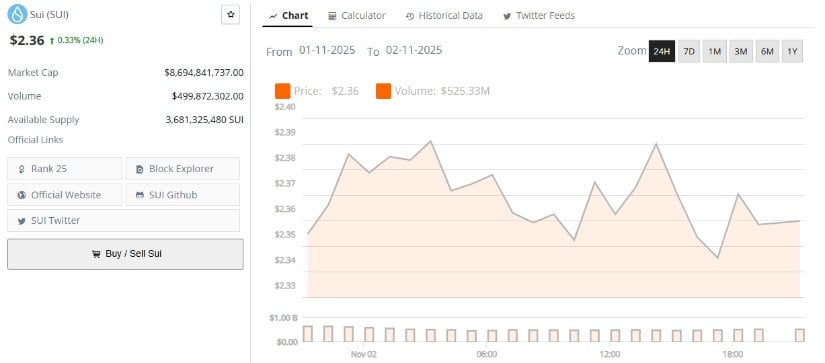

Sui was trading at around $2.36, up 0.33% in the last 24 hours. Source: Brave New Coin

The SUI price prediction remains cautiously optimistic. The token’s current setup combines solid technical structure with fundamental momentum from its expanding ecosystem. While the upcoming token unlock could introduce temporary pressure, strong market absorption and ongoing developer activity may help Sui sustain its upward trajectory toward the $7.60 target—a level that could redefine its 2025 outlook.