Sui (SUI) Shatters Resistance Walls - $3 Breakout Imminent as Bulls Charge Forward

Sui isn't just climbing - it's demolishing resistance levels like they're made of paper. The cryptocurrency just blasted through key technical barriers that had traders sweating for weeks.

The $3 Gateway

Market watchers are glued to screens as Sui approaches the magical $3 threshold. This isn't just another number - it's the line between consolidation and explosive growth. Break through this psychological barrier, and we're looking at territory that could redefine Sui's position in the Layer 1 landscape.

Technical Momentum Builds

The charts don't lie - this rally has legs. Each resistance level crumbled faster than the last, suggesting institutional money might finally be waking up to what retail investors spotted months ago. Though let's be real - half the 'institutional experts' are still trying to figure out how to spell blockchain while their interns make the actual trades.

Sui's current trajectory reads like a trader's fantasy - but in crypto, today's breakout can become tomorrow's 'remember when.' The smart money's watching whether this surge has substance or if we're just watching another coordinated pump before the inevitable 'market correction.' Either way - buckle up.

Market observers see this as a sign of renewed bullish momentum in the short term, highlighting the volatile yet promising nature of Sui’s price movement.

The current sui price action has fueled optimism in both retail and institutional communities. Traders monitoring the SUI chart point to the formation of a bullish ascending triangle, which historically signals strong upward potential. With ongoing developments in the Sui blockchain ecosystem and increased community engagement, many analysts now consider this an important juncture for SUI coin price prediction.

Technical Analysis: Ascending Triangle Indicates Potential Upside

Examining the 4-hour SUI/USDT chart reveals an ascending triangle pattern, characterized by gradually higher lows and a horizontal resistance at $2.75. Such a formation often precedes a breakout, suggesting that the token may be gearing up for a significant price move. Should sui successfully retest this resistance level and hold it as new support, the path toward $3 and potentially higher becomes more plausible.

SUI is approaching a potential breakout above $2.75, with the ascending triangle pattern signaling a possible MOVE toward $3. Source: @x0mario via X

Candlestick data from late October indicates growing buying pressure among short-term traders, which adds credibility to the bullish outlook. Analysts emphasize that technical patterns alone cannot guarantee price performance, but combined with strong community support and ecosystem expansion, SUI could see a meaningful rally in the coming weeks. Traders and investors are keeping a close watch on intraday fluctuations, using Sui charts to time entries and exits effectively.

Market Dynamics: Supply Events and Short-Term Volatility

While the technical indicators are positive, market participants must consider upcoming supply-related events. Between October 27 and November 3, 2025, a $653 million token unlock event is scheduled, releasing additional SUI tokens into circulation. This sudden increase in supply could lead to temporary price swings and heightened volatility, even as the broader trend remains bullish.

Sui was trading at around $2.62, down 2.45% in the last 24 hours. Source: Brave New Coin

Analysts caution that such events often attract both speculative activity and short-term selling pressure, which may obscure the true trajectory of SUI price today. However, seasoned traders view these periods as opportunities to accumulate tokens at favorable prices. By monitoring the SUI token price alongside market volume and sentiment indicators, investors can better navigate these fluctuations.

Broader Market Sentiment and Ecosystem Growth

Long-term projections for SUI remain promising. Some experts anticipate that the SUI crypto price prediction could reach $9 by the end of 2025, driven by sustained adoption and the continued development of the Sui ecosystem. The network’s high-speed Layer-1 architecture, parallel transaction processing, and growing Web3 integration make it an attractive option for developers and investors alike.

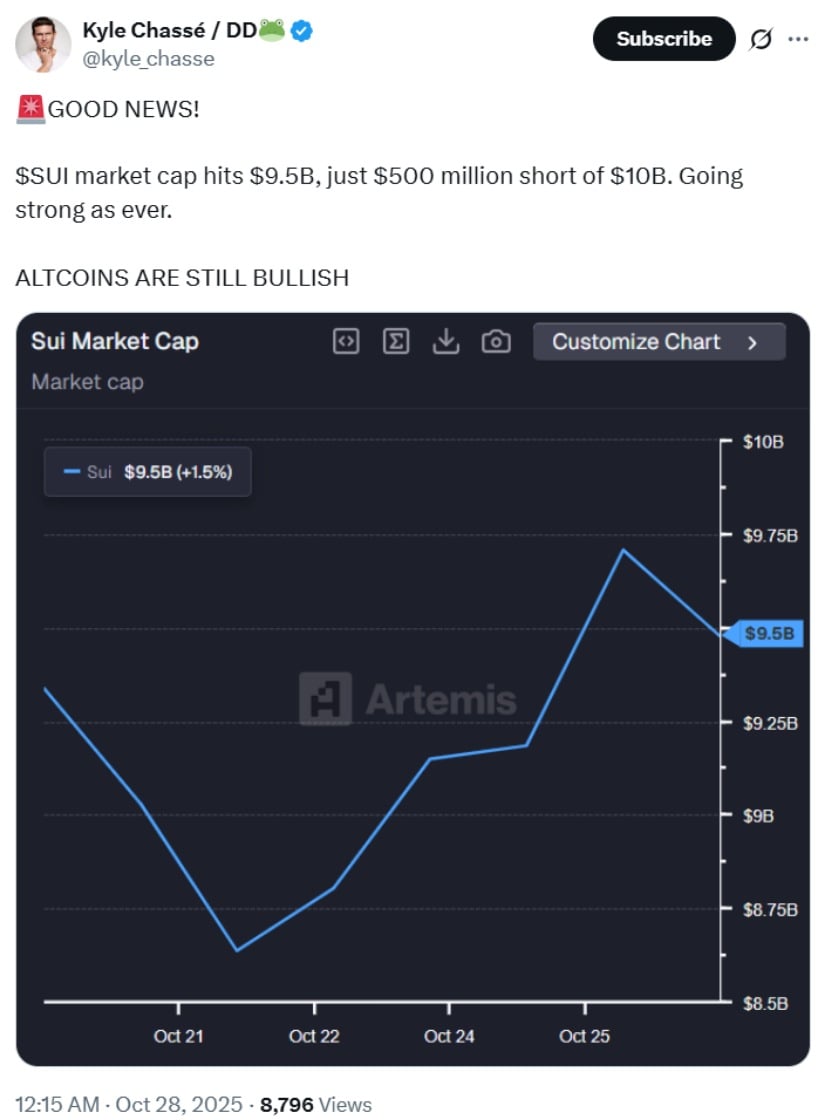

SUI’s market cap reaches $9.5B, approaching the $10B milestone amid continued bullish momentum in altcoins. Source: @kyle_chasse via X

Community activity continues to reinforce Sui’s bullish narrative. Initiatives such as persistent developer advocacy, ecosystem collaborations, and daily promotion streaks reflect a strong commitment to building a resilient network. Cross-ecosystem partnerships, including those with projects like PEAQ, further demonstrate the token’s potential within decentralized physical infrastructure and broader Web3 applications.

Final Thoughts

Sui’s recent breakthrough above resistance levels highlights its potential to reach new highs in the NEAR term. While technical patterns point to a possible rally toward $3+, market participants should remain mindful of supply-driven volatility from the token unlock event.

With a combination of strong ecosystem development, community engagement, and favorable market dynamics, SUI maintains a compelling position among Layer-1 blockchain tokens. Traders and investors will likely continue watching Sui closely as it navigates this critical phase of price movement.