Hyperliquid (HYPE) Price Prediction: Bulls Charge Toward $50 Breakout as Momentum Accelerates

HYPE bulls are mounting their assault on the $50 fortress—and this time, they've brought reinforcements.

The Technical Takeover

Hyperliquid's chart patterns scream accumulation. Every dip gets bought, every resistance level gets tested harder than the last. The $50 barrier isn't just psychological—it's the line separating consolidation from explosion.

Momentum indicators flash green across the board. Volume surges as traders position for what could be the breakout play of the quarter. Shorts are getting nervous while long-term holders just keep stacking.

Market Mechanics in Motion

Liquidity pools above $50 are looking increasingly vulnerable. The order book shows thin resistance once HYPE punches through that magic number. We're watching classic breakout formation—the kind that makes technical analysts drool and risk managers lose sleep.

Institutional money is quietly building positions too. Because nothing says 'serious investment' like chasing 100x returns while pretending it's about the technology.

The $50 breakout isn't just possible—it's becoming inevitable. The only question is how violent the move will be when it finally happens. Buckle up.

Hyperliquid’s recent surge has captured traders’ attention, as strong buy pressure and consistent buybacks continue to fuel its momentum. The HYPE token has reclaimed key resistance levels with impressive conviction, while rising on-chain activity and bullish technical signals.

Momentum Builds as Hyperliquid Tests Key Resistance

Hyperliquid continues to display strong momentum, confirming a clean breakout from its previous descending wedge. The price has reclaimed the $46 to $47 region and is now pressing against the 0.618 Fibonacci confluence NEAR $50.7, which aligns with horizontal resistance. The MACD indicator has flipped bullish, showing expanding momentum and rising histogram bars, a sign of renewed buying pressure.

Hyperliquid’s breakout above $47 highlights growing bullish momentum, with price now eyeing the crucial $50.7 resistance zone. Source: Lark Davis via X

A sustained breakout above $50.7 WOULD likely open the door toward the next resistance at $60, marking a potential retest of the all-time high. As long as the structure maintains higher lows above $44 to $45, the broader trend remains decisively bullish, with the next impulse wave likely forming in the days ahead.

On-Chain Catalysts Reinforce the Bullish Momentum

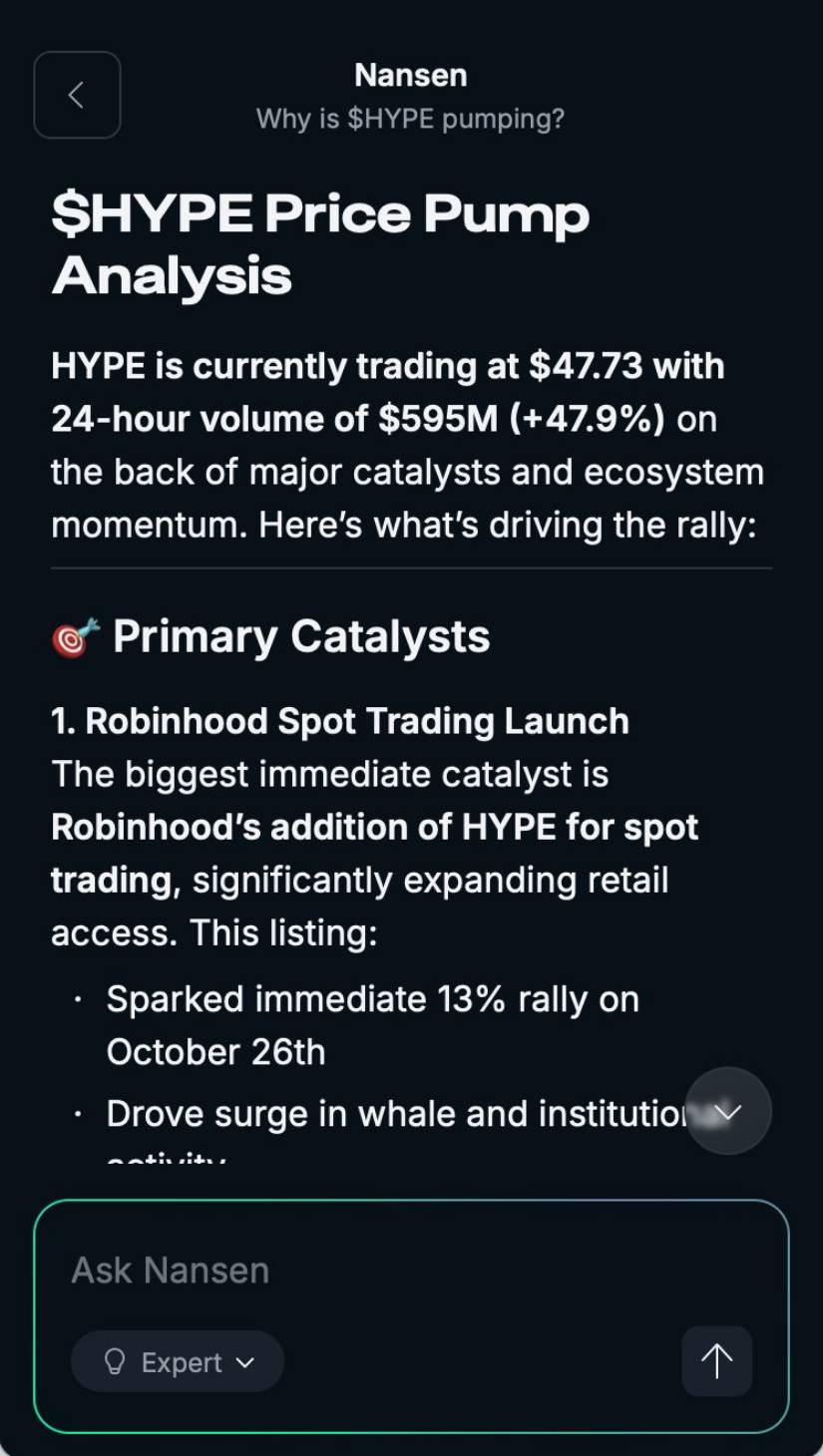

Nansen’s data reinforces Hyperliquid’s rally from a structural perspective. The asset’s Robinhood listing and HIP-3 upgrade have combined to create a surge in both retail and institutional demand. Over $595 million in daily trading volume has been recorded, highlighting significant inflow strength as shorts continue to close while whales maintain long exposure.

Hyperliquid’s on-chain surge reflects strong ecosystem growth, fueled by its Robinhood listing and HIP-3 upgrade driving over $595M in daily volume. Source: Nansen via X

These developments illustrate that smart money remains engaged, and despite partial profit-taking, net accumulation persists. The combination of exchange listings, protocol upgrades, and liquidity expansion reflects an ecosystem-wide strengthening, suggesting Hyperliquid’s recent pump is backed by fundamental growth rather than speculative spikes.

Retracements Could Offer Opportunities for Reload

StefanB’s technical setup presents two ideal reload zones for Hyperliquid near $40.26 and $33.40, with the latter aligning with previous breakout support. The broader structure continues to respect a pattern of higher lows, signaling an active accumulation phase rather than distribution.

Hyperliquid’s retracement zones near $40 and $33 signal prime accumulation areas as the structure continues forming higher lows. Source: StefanB via X

If Hyperliquid breaks above $51.21, the MOVE could accelerate sharply, potentially triggering the next leg higher. Conversely, dips into the lower bands would likely serve as accumulation opportunities, especially if volume stabilizes around those zones.

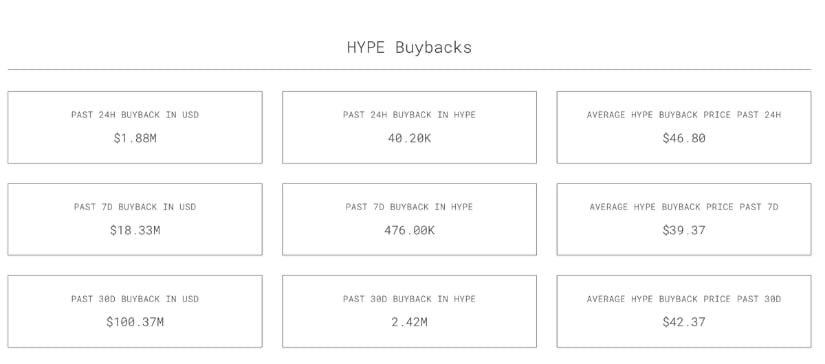

Consistent Buybacks Strengthen Long-Term Valuation

Tobias Reisner’s data confirms $1.8 million in buybacks over the past 24 hours and more than $100 million over the past 30 days, marking one of the most aggressive repurchase programs in the sector. The average buyback price sits around $46.80, showing strong institutional conviction even at current elevated levels.

Hyperliquid’s $100M monthly buyback program underscores strong institutional conviction, reinforcing long-term valuation stability. Source: Tobias Reisner via X

Buybacks serve as a direct supply reduction mechanism, supporting price stability and reinforcing long-term investor confidence. Such consistent repurchases often act as an underlying price floor, making Hyperliquid’s market structure more resilient against volatility. If this pace continues, the cumulative supply reduction could meaningfully enhance Hyperliquid Price prediction.

Final Thoughts: Hyperliquid’s Structure Remains Firmly Bullish

Across both technical and on-chain dimensions, Hyperliquid’s setup remains robust. Rising volume, healthy MACD signals, strategic buybacks, and ecosystem upgrades are all converging to strengthen market confidence.

While minor pullbacks towards $40 to $44 may occur, these are more likely to serve as reloading points rather than breakdown signals. A decisive breakout above $50.7 would confirm bullish continuation, setting the stage for a Hyperliquid price prediction targeting the $60 mark.