Chainlink Price Prediction: LINK Accumulation Explodes as Exchange Supply Plummets to Critical Levels

Whales are gobbling up LINK while exchanges run dry—this could get interesting.

The Great Chainlink Exodus

Exchange reserves are bleeding out faster than a DeFi protocol with unaudited code. Supply on trading platforms has hit multi-year lows while accumulation patterns scream institutional interest. When the big players start hoarding instead of trading, you know something's brewing.

Oracle Network Shows Its Teeth

Chainlink's price action mirrors the supply crunch—consolidating at key support levels while fundamentals strengthen. The oracle network continues dominating real-world asset tokenization while traditional finance still struggles to understand basic blockchain concepts. Typical Wall Street—always late to the party but shows up expecting the best seats.

Market Mechanics Favor Bulls

Scarcity plus demand equals one thing in crypto mathematics: upward pressure. With less LINK available for quick selling and more moving into cold storage, the stage sets for potential volatility. Remember when your economics professor said supply and demand determine price? They weren't talking about magic internet money, but the principle still applies—even if the asset would give them a heart attack.

When exchanges can't meet demand, prices find new equilibrium zones. Usually much higher ones. The cynical take? Another cycle of artificial scarcity narrative driving speculative frenzy—because in crypto, sometimes the perception of value creates more profit than actual utility. But who's counting when the charts are green?

Exchange balances have dropped to their lowest levels in months, reflecting a growing belief that the asset could be on the verge of another major rally. With sentiment turning positive and momentum improving, analysts are eyeing $46 as a possible upside target in the medium term.

Chainlink Holders Accumulate as Exchange Balances Decline

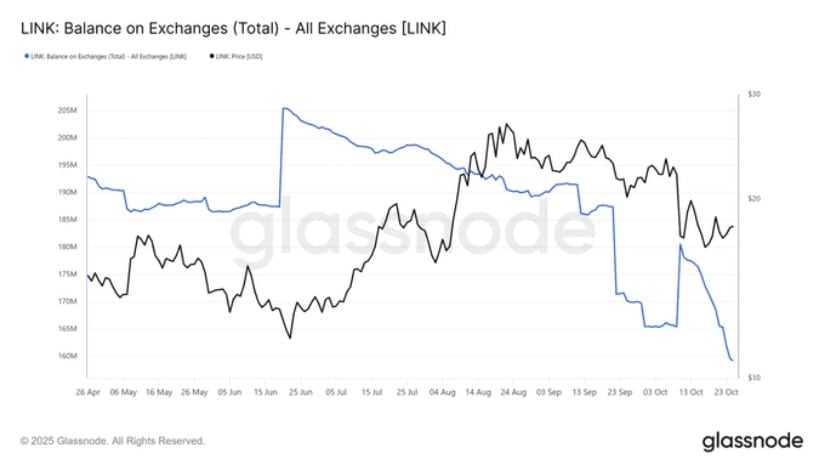

On X, Tom Tucker shared a compelling on-chain analysis that highlights a strong accumulation trend among chainlink holders. According to Tucker, the asset balance on exchanges shown by the blue line on the Glassnode chart has declined sharply since mid-October. This pattern often signals that holders are withdrawing their tokens from exchanges into cold storage, reducing selling pressure and suggesting growing confidence in the coins’ long-term outlook.

Source: glasssnode

Tucker’s analysis further revealed that the Holder Accumulation Ratio now stands at 98.9%, meaning nearly all active token addresses are currently adding to their positions. Historically, such high accumulation levels have preceded major coin rallies, as seen during previous market cycles. Reduced exchange reserves alongside concentrated accumulation often create a supply squeeze, where limited available liquidity drives rapid price increases. If this trend persists, Tucker projects that the asset could extend its climb toward the $46 level, marking a significant gain from its current range.

Chainlink Maintains Steady Gains Above $18.50

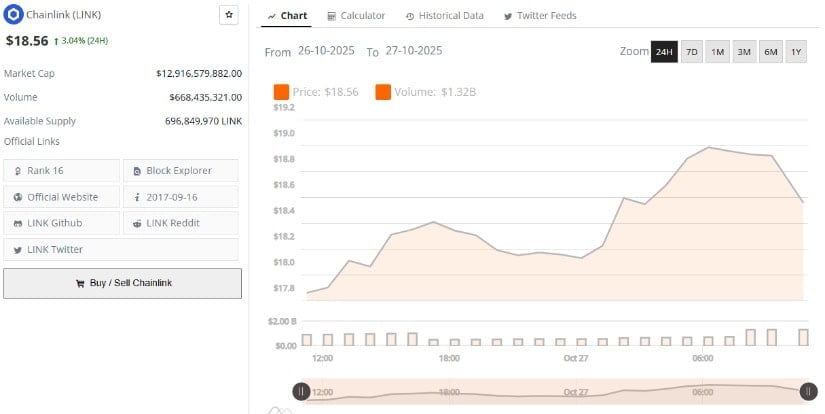

Data from BraveNewCoin shows that Chainlink’s current price is $18.56, up 3.04% in the last 24 hours, with a market capitalization of $12.91 billion. Trading volume over the same period stands at approximately $668.4 million, and the circulating supply sits at 696.8 million tokens. The coin remains ranked among the top 20 cryptocurrencies, reflecting strong liquidity and sustained investor interest.

Source: BraveNewCoin

The ongoing price strength coincides with a shift in on-chain dynamics and network activity. The sustained upward momentum has allowed the asset to stabilize above the $18 level, which now serves as local support. If demand continues to grow, analysts expect a test of the $19.50–$20 resistance zone. A clean breakout above this region could validate the bullish accumulation thesis, setting the stage for a continuation toward $25 and potentially $46 over the coming months.

Technical Indicators Signal Momentum Recovery

As of October 27, TradingView data shows LINK/USDT trading at $18.88, posting a 1.78% daily increase. The daily chart identifies a key resistance level at $19.53, where previous price reactions have occurred multiple times. Maintaining support above $18.20–$18.40 remains crucial for the current upward trend to sustain.

Source: TradingView

The Relative Strength Index (RSI) currently stands at 48.64, close to the neutral zone, signaling a balanced market but with improving momentum compared to previous sessions. Its moving average value of 40.80 reflects an upward recovery from oversold territory, hinting at the early stages of a bullish shift. Meanwhile, the MACD line (–0.82) recently crossed above the signal line (–1.06), while the positive histogram reading (0.24) confirms short-term buying momentum.

Although the crossover remains below the zero line, suggesting the broader trend is still stabilizing these signals collectively point to a gradual return of buyer strength. Sustained closes above $19.50 WOULD confirm a technical breakout and could propel the asset toward the $22–$25 range, aligning with the accumulation-based forecast shared by on-chain analysts.