Coinbase CEO Reveals Crypto Market Structure Bill is 90% Ready – Traders Flock to $BEST for Explosive Gains

Crypto's regulatory fog lifts as Coinbase's chief drops a bombshell: The long-awaited market framework is nearly finalized. Here's why traders are piling into $BEST—and what Wall Street won't tell you.

### The 90% Solution: How Regulation Could Ignite Crypto's Next Rally

Brian Armstrong's update isn't just bureaucratic progress—it's rocket fuel for digital assets. With institutional players sidelined by uncertainty, this bill could unlock billions in sidelined capital. Cue the altcoin scramble.

### Why $BEST Became the Market's Dark Horse

While Bitcoin hogs headlines, savvy traders are front-running regulatory clarity. The token's unique positioning in compliance tech makes it a hedge against both overreach and anarchy. (And yes, some old-fashioned FOMO.)

### The Fine Print That Could Make or Break Your Portfolio

Watch for loopholes that let VCs game the system—again. Every regulatory 'win' comes with hidden traps (remember how MiCA crushed privacy coins?). This time, the smart money's betting on infrastructure plays.

As Washington inches toward clarity, one truth remains: The house always wins. But for once, crypto might get a seat at the table—even if it's the kids' section.

KEY POINTS:

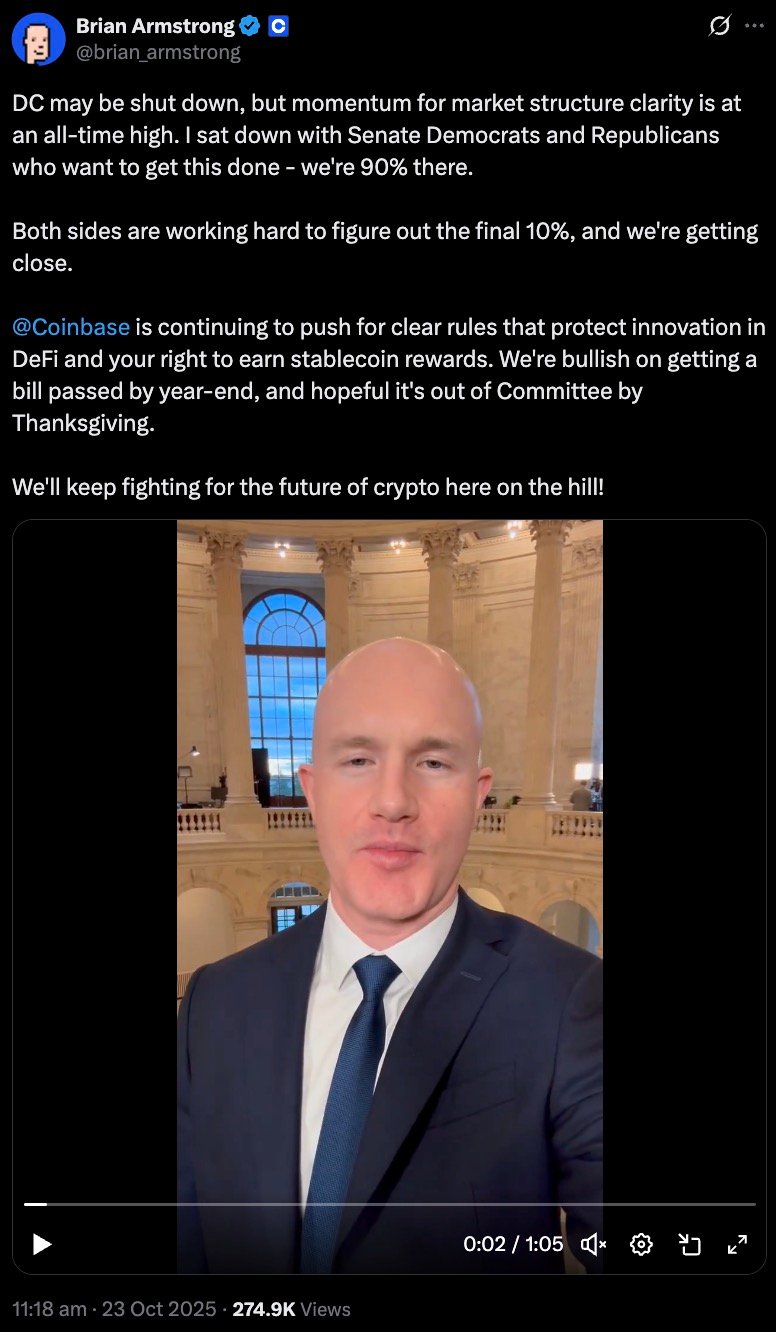

![]() Coinbase CEO Brian Armstrong says the U.S. crypto market structure bill is 90% done due to a rare bipartisan alignment.

Coinbase CEO Brian Armstrong says the U.S. crypto market structure bill is 90% done due to a rare bipartisan alignment.![]() The CLARITY Act would split oversight between the SEC and CFTC.

The CLARITY Act would split oversight between the SEC and CFTC.![]() The final 10% debate is focused on DeFi and stablecoin rewards, with Armstrong pushing for yield earning to be allowed.

The final 10% debate is focused on DeFi and stablecoin rewards, with Armstrong pushing for yield earning to be allowed.![]() $BEST is gaining attention for powering Best Wallet’s ecosystem of presale access, staking rewards, reduced fees, and the upcoming Best Card for real-world spending.

$BEST is gaining attention for powering Best Wallet’s ecosystem of presale access, staking rewards, reduced fees, and the upcoming Best Card for real-world spending.

Coinbase CEO Brian Armstrong says the long-debated U.S. crypto market structure bill is “90% there.”

He goes on to point to a rare bipartisan alignment around the Digital Asset Market Clarity Act, known as the CLARITY Act. Despite the ongoing government shutdown, it appears lawmakers from both parties have been working behind closed doors to finalize the final 10% of the framework.

Source: @BitcoinMagazine on X

This isn’t just another policy debate — it could set the rules of the road for America’s entire digital asset economy. Coinbase CEO Brian Armstrong sat down this week with heavy-hitters on both sides of the aisle, including Senate Majority Leader Chuck Schumer, Senator Cynthia Lummis, Senator Kirsten Gillibrand, and Senator Tim Scott, signaling just how seriously Washington is taking crypto.

The legislation already cleared the House in July with a resounding 294–134 vote, and now rests with the Senate Banking Committee. If it makes it through there, it could reach the Senate floor before year’s end — a potential watershed moment for U.S. crypto regulation.

Under the current draft of the bill, the Commodity Futures Trading Commission (CFTC) WOULD oversee sufficiently decentralized networks. At the same time, the Securities and Exchange Commission (SEC) would retain authority over tokens that function as investment contracts.The goal is simple but long overdue: to end the regulatory gray zone that leaves crypto projects guessing which rules apply. By drawing a clear distinction between the SEC and CFTC, the bill promises a definitive rulebook — one that finally allows innovators to operate without second-guessing every move.

What’s left on the table is the toughest 10%: how to treat DeFi and stablecoin yield. Armstrong is pushing for a middle ground — regulate centralized exchanges, but leave open-source protocols untouched, while keeping yield opportunities on the table for everyday users.

He also strongly warned against removing stablecoin rewards. Armstrong argued that consumers should be free to earn yield on regulated assets, just like users do in traditional savings accounts.

Source: @brian_armstrong on X

His Optimism has definitely lifted sentiment. Traders now see the bill as a signal that crypto in the U.S. is moving toward legitimacy. And with that clarity coming to custody and compliance, crypto wallet infrastructure sits in the spotlight.

That’s why projects like Best Wallet Token ($BEST) are grabbing a lot of attention, as it stands to benefit from a clear and compliant U.S. crypto stance.

Regulatory Clarity Could Reshape Wallet Adoption

Wallets are the frontline of crypto regulation. They don’t just store digital assets — they’re the entry point to DeFi apps and services. That makes them unavoidable in any framework that deals with custody or compliance.

If lawmakers draw clear lines on custody and yield, self-custody wallets with transparent on-chain activity could emerge as the trusted middle ground — safer than centralized exchanges, yet more accessible than raw DeFi.

The GENIUS Act was passed earlier this year to regulate stablecoins. This already set a precedent. It proved Congress is very serious about bringing structure to digital finance.

Stablecoins and wallets go hand in hand: one moves money, the other stores it. Together, they’re how most users interact with crypto.As regulation catches up, wallets offering verified presales access and a user-first design are the best placed to grow. And that’s where $BEST comes in.

$BEST Gains Momentum as Trust Becomes Currency

Best Wallet is part of a newer generation of crypto wallets built for security, speed, and trust. It’s designed to challenge older platforms like MetaMask by merging storage, presale access, and yield features into one streamlined and easy-to-use app.

Its foundation rests on Fireblocks Multi-Party Computation (MPC) security — the same infrastructure used by big institutions. This gives you self-custody without sacrificing safety.

Fueling the entire ecosystem is the Best Wallet Token ($BEST). Holding $BEST unlocks reduced transaction fees, early access to new presales, and boosted staking rewards.

Best Wallet will soon launch the Best Card, a crypto debit card that allows users to spend their digital assets in real-world transactions. Cashback is available on every purchase — and once again, reduced fees if you hold and stake $BEST.

Learn how to buy Best Wallet Token in our step-by-step guide.

The Wallet’s “Upcoming Tokens” feature lets you join in vetted presales directly within the app. This eliminates mirror-site scams and speeds things up for retail buyers.

So far, the project has raised over $16.6M, with tokens priced at $0.025835 and early buyers getting 79% staking rewards. Analysts believe a Best Wallet Token price prediction of $0.143946 is possible in 2026 after a successful launch and continued adoption. That’s a 5–6x from its current presale price.With lawmakers nearing a decision and traders seeking safety plus yield, $BEST looks well-positioned for the next wave of regulated, trust-seeking crypto adoption.

Join the Best Wallet Token presale today and start earning rewards.