Bitcoin (BTC) Price Prediction: Consolidation at Liquidity Cluster Signals Potential $116K Breakout

Bitcoin hovers near critical liquidity levels as traders watch for the next major move.

The Consolidation Zone

BTC's current positioning around key liquidity clusters suggests we're witnessing the calm before the storm. Market makers are building positions while retail investors nervously check their portfolios every five minutes—because that's definitely how successful trading works.

The $116K Question

All eyes are on the $116,000 resistance level that could trigger the next major bullish wave. Technical indicators show accumulation patterns mirroring previous breakout scenarios, though traditional finance analysts remain skeptical while simultaneously missing every major crypto trend since 2017.

Breakout mechanics point to a potential surge that would leave Wall Street veterans scrambling to explain how an 'internet coin' outperformed their entire portfolio. The liquidity cluster acts as both support and springboard—when it goes, it's going fast.

Meanwhile, banking institutions continue charging fees for basic transfers while calling cryptocurrency the speculative one. The irony practically trades at a premium.

After a recent pullback from its all-time high of $126,198, Bitcoin has stabilized around key support zones, showing resilience amid market volatility. Analysts are closely monitoring BTC’s next moves, as historical patterns suggest potential short-term rallies if these levels hold.

Bitcoin Holds Key Support

According to recent market data, bitcoin has maintained a vital support zone around $103,000–$104,000. On October 24, 2025, BTC traded at approximately $109,474, up 1.8% over 24 hours after testing lows near $106,778. This comes following a 13% pullback from its all-time high of $126,198 recorded on October 6.

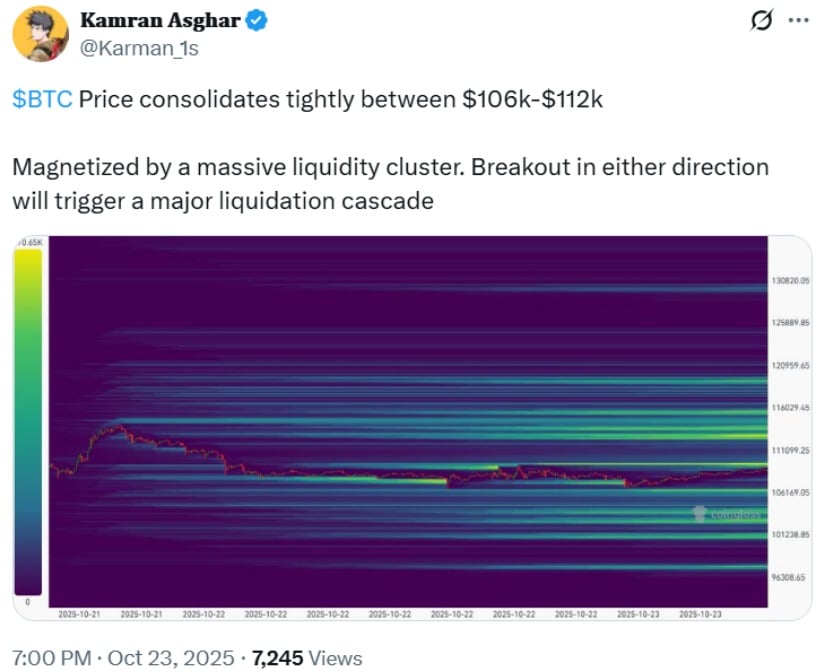

Bitcoin holds key support, setting the stage for a potential rally toward $116K resistance. Source: @Karman_1s via X

Market analyst Kamran Asghar tweeted, “$BTC holding the Support Zone. The path to retesting the $116k resistance is opening up.” Historical patterns suggest that such support holds have often preceded 5–10% short-term rallies, occurring in 68% of instances since 2021, per CoinMetrics data.

Consolidation Between Liquidity Clusters

Bitcoin’s price has been consolidating tightly between $106,000 and $112,000, drawn toward a dense liquidity cluster. Liquidity heatmaps indicate areas where large orders are concentrated, which often act as magnets for price action.

Bitcoin consolidates between $106K–$112K, drawn to a massive liquidity cluster, with a breakout likely to trigger significant liquidations. Source: @Karman_1s via X

As Asghar noted, “Breakout in either direction will trigger a major liquidation cascade.” Past events support this: during October 10–11, 2025, a downward breakout from similar liquidity zones resulted in $19 billion in liquidations, with BTC plunging 14% amid escalating U.S.-China trade tensions before recovering.

This tight consolidation NEAR liquidity clusters highlights the potential for significant short-term volatility, suggesting that traders should monitor these levels closely when considering how to invest in Bitcoin or planning trades around BTC futures.

Historical Bottoming Patterns Point to Upside Potential

Technical analysts are also observing a triple lower low pattern forming in 2025. BTC has bottomed out three times this cycle—in April, June, and October. According to crypto commentator BitBull, “I guess we’ll now teleport to a new ATH in the coming weeks.”

Bitcoin forms a triple lower-low pattern this cycle, hinting at a potential surge toward a new all-time high in the coming weeks. Source: @AkaBull via X

Historically, such multi-low formations during bull cycles have preceded substantial upward movements. Following the April dip to around $77,000, Bitcoin surged over 50% to mid-year peaks. These patterns align with broader cycle lows and halving multiples, suggesting potential gains of 4–6x over extended periods.

Market Risks and Macro Considerations

Despite technical optimism, macroeconomic factors remain a critical influence. Trade tensions, U.S. rate expectations, and global economic policies could pose headwinds to Bitcoin’s rally toward $116,000 or beyond.

Analysts recommend that investors remain cautious and consider risk management strategies, particularly during periods of BTC liquidation heatmap alerts or sharp corrections. This also emphasizes the importance of understanding how Bitcoin mining works and how liquidity events can impact overall Bitcoin market cap and BTC price movements.

Looking Ahead: Will Bitcoin Break $116K?

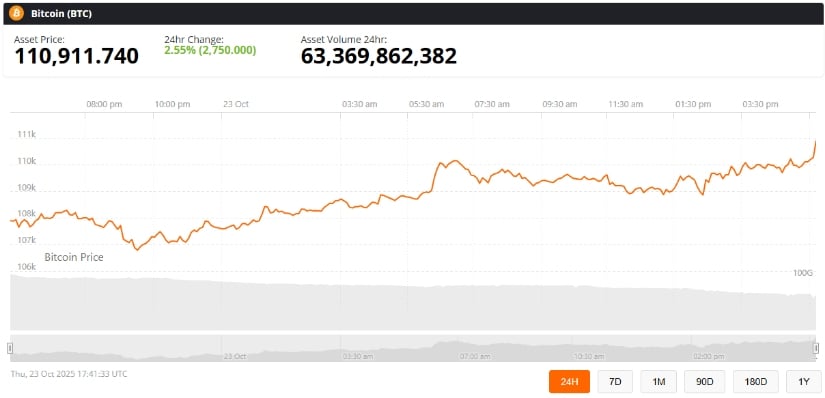

Currently, Bitcoin trades near $109,700, recovering from recent lows around $106,700. If support levels continue to hold and liquidity clusters act as springboards rather than barriers, BTC could retest its previous resistance near $116,000 in the coming weeks.

Bitcoin (BTC) was trading at around $110,911, up 2.55% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

For investors tracking Bitcoin, the ongoing BTC consolidation offers both opportunities and risks. With historical precedents and technical indicators pointing toward potential upside momentum, the market is carefully watching whether Bitcoin can sustain its current level and MOVE closer to a new all-time high.