XRP Targets $2.40 Breakout - These Altcoins Are Primed to Explode in Major Rally

XRP eyes critical $2.40 resistance as crypto markets heat up

ALTCOIN FRENZY IGNITES

While XRP traders watch the $2.40 level like hawks, several alternative cryptocurrencies are stealing the spotlight. The breakout potential has investors scrambling to position themselves before what could be the next major market move.

MARKET MOMENTUM BUILDS

Technical indicators suggest we're approaching a tipping point. The $2.40 barrier represents more than just a number—it's the gateway to what could become one of 2025's most significant crypto rallies. Market sentiment hasn't been this bullish since the last regulatory uncertainty cleared.

OPPORTUNITY KNOCKS TWICE

Seasoned investors know that when major assets like XRP approach key psychological levels, the entire ecosystem feels the ripple effects. The smart money's already positioning—because nothing makes traditional finance guys sweat like watching crypto bypass their carefully constructed gatekeepers.

Get ready—this could get interesting fast.

KEY POINTS:

![]() $XRP consolidated tightly between $2.34 and $2.39 before a breakout to $2.45 likely deciding its next major move.

$XRP consolidated tightly between $2.34 and $2.39 before a breakout to $2.45 likely deciding its next major move.

![]() ETF decisions and Ripple’s $1B capital raise are creating a high-volatility setup that could spill into the broader altcoin market.

ETF decisions and Ripple’s $1B capital raise are creating a high-volatility setup that could spill into the broader altcoin market.

![]() Bitcoin Hyper ($HYPER) leads the Layer-2 narrative with $24.3M raised as investors seek scalable Bitcoin exposure.

Bitcoin Hyper ($HYPER) leads the Layer-2 narrative with $24.3M raised as investors seek scalable Bitcoin exposure.

![]() Meme-utility projects like PepeNode ($PEPENODE) and Aster ($ASTER) are gaining traction as traders start positioning for new liquidity.

Meme-utility projects like PepeNode ($PEPENODE) and Aster ($ASTER) are gaining traction as traders start positioning for new liquidity.

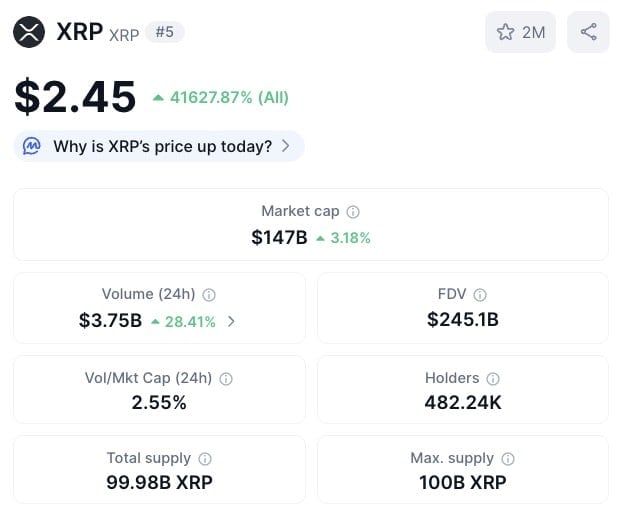

$XRP was building momentum for days before eventually breaking above $2.40 and is currently sitting at $2.45. If it manages to hold its position, it could trigger the next major leg higher.

With an ETF decision due before October 25, $XRP is really looking like a loaded spring under a chart.

Strategists see two possible paths forward. Either $XRP briefly falls to around $1.55 before attempting a structural recovery towards the $7–$27 range, or it confirms this breakout and starts a new impulse MOVE upward.

Recent spikes in volume support a positive narrative. Volume has reached $3.75B in the last 24 hours, up a whopping 28.37%.

Source: CoinMarketCap

$XRP’s RSI has reset from prior highs, volatility appears to have declined, and it looks like we’re in a period of mass accumulation — a textbook pre-breakout period.

Macro conditions are also amplifying the setup. Roughly $19B in crypto liquidations hit the markets last week due to renewed U.S.-China trade tensions. Adding more fuel to this fire is Ripple’s proposed $1B fundraise to accumulate $XRP and the SEC’s ongoing review of six spot $XRP ETFs.With lighter exposure to leverage and rising cash collateral, it could be a sign that traders are preparing for a volatility shock.

If you’re interested in the crypto market, this matters because liquidity rotation often follows the same pattern: majors move first, then capital pours into the best altcoins.

If $XRP begins another megamove toward ATHs, many sectors across crypto could see fresh capital — from Bitcoin’s new execution layer in bitcoin Hyper ($HYPER) to meme-utility plays like PepeNode ($PEPENODE) and DeFi tokens such as Aster ($ASTER) leading the next wave.

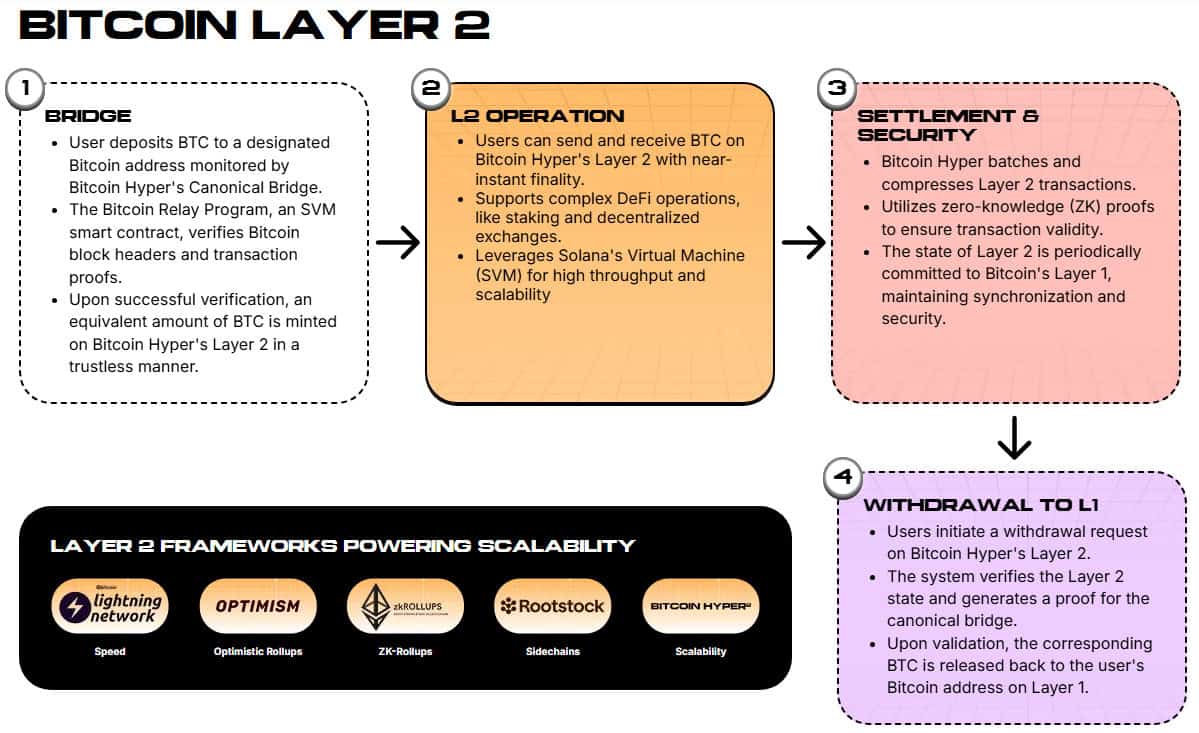

1. Bitcoin Hyper ($HYPER) – Bitcoin’s Layer 2 Momentum Play

If $XRP’s potential ETF approval revives institutional interest in legacy assets, Bitcoin will undoubtedly benefit. And Bitcoin Hyper ($HYPER) sits squarely at that crossroad.

Bitcoin Hyper is designed to provide Bitcoin with the speed and scalability it has always lacked. It brings Solana-grade performance to the network through the Solana VIRTUAL Machine (SVM).

In practice, Bitcoin Hyper bridges your $BTC into its LAYER 2 environment, mirrors it 1:1, and settles all transactions back on Bitcoin’s main chain using zero-knowledge (ZK) proofs. The result: sub-second transactions, near-zero fees, and native access to staking and DeFi tools.

It does this all without sacrificing Bitcoin’s Core security model. The project has already raised over $24.3M, with tokens priced at $0.013145. Analysts forecast a Bitcoin Hyper price prediction of $0.15 being possible in 2026.

Discover how to buy Bitcoin Hyper in our step-by-step guide.

Staking yields are currently reaching 49% for early investors. Additionally, whale activity has been significant lately, with several six-figure purchases signaling strong confidence that Bitcoin Hyper can become Bitcoin’s long-awaited execution layer.With $BTC forever in the spotlight, $HYPER could capture the next FLOW of capital.

Visit the Bitcoin Hyper presale to get in early before the next price jump.

2. PepeNode ($PEPENODE) – Gamified Mining Meets Meme Utility

While $HYPER focuses on scaling infrastructure, $PEPENODE taps into the meme-utility wave — a sector that often roars back to life when market volatility returns.

It’s the first “mine-to-earn” meme coin, transforming traditional passive holding into an interactive experience where users can build virtual server rooms, acquire Miner Nodes, and compete for yield on leaderboards.

Instead of needing costly GPUs or complicated rigs, everything operates virtually. Holders of $PEPENODE can expand their setups, upgrade nodes, or sell them at any time to recover their tokens — all while earning rewards through active participation.

It’s a fully gamified, community-driven mining system where engagement directly influences demand. As a result, the project has already raised over $1.88M, with tokens priced at $0.0011094 and staking yields reaching up to 681% APY — one of the highest returns available on the market now.When capital rotates into mid-caps after an $XRP breakout, projects blending meme culture with yield mechanics tend to move first. $PEPENODE fits that profile cleanly by being a utility-focused meme play.

Join the PepeNode presale to access massive staking rewards.

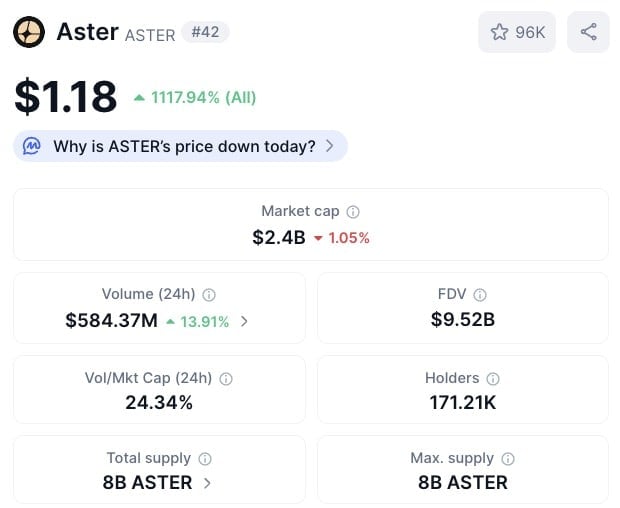

3. Aster ($ASTER) – DeFi Exchange with a Bullish Chart Setup

ETF Optimism often boosts on-chain trading volumes, and Aster ($ASTER) will no doubt benefit from this. It’s a next-generation decentralized exchange combining both spot and perpetual markets under one roof, operating across BNB Chain, Ethereum, Solana, and Arbitrum.

Aster’s true edge lies in its MEV-free execution, yield-bearing collateral options like $asBNB and $USDF, and its intuitive one-click Simple Mode for retail traders. Experienced traders can switch to Pro Mode for advanced tools such as hidden orders, grid trading, and perpetual stock pairs.

Source: CoinMarketCap

The project currently has a $2.4B market cap, over $580M in 24-hour trading volume, and more than 171K holders — an impressive foundation for a relatively new mid-cap DeFi token.

Technically, analysts reveal a Bullish Butterfly harmonic pattern, which suggests a reversal toward $1.59 if $ASTER breaks the $1.21 resistance level with volume.

That setup mirrors $XRP’s own compression structure — signs of coiled momentum before potential expansion. Aster is one of the few DeFi plays showing both technical and fundamental upside heading into Q4 ETF headlines.

Buy $ASTER on Binance today.

$XRP’s tightening setup could trigger the next major rotation across altcoins if ETF approvals land in its favor. $HYPER, $PEPENODE, and $ASTER are poised to capture different slices of that momentum.