Avalanche (AVAX) Technical Breakout: $30+ Surge Imminent as Charts Signal Bullish Momentum

Avalanche's technical structure flashes green across all major timeframes—setting the stage for a decisive breakout above the critical $30 resistance level.

The Setup That Has Traders Watching

AVAX consolidates in a textbook pennant formation after testing key support levels multiple times. Each bounce grows stronger than the last—classic accumulation behavior that typically precedes major moves.

Volume patterns tell the real story here. Institutional money flows into AVAX while retail investors remain distracted by meme coin mania—because nothing says 'sophisticated investment strategy' like chasing the next dog-themed token.

Breaking Through the Ceiling

The $30 barrier represents more than just psychological resistance—it's the gateway to AVAX reclaiming its 2024 highs. Technical indicators align perfectly: RSI maintains bullish divergence while MACD flips positive on weekly charts.

Market structure suggests minimal resistance above $30 until the $45-50 zone. That's where previous all-time high buyers got trapped—creating the next major test for any sustained uptrend.

While traditional finance debates yield curves and inflation data, crypto markets continue proving that sometimes the best fundamental analysis is simply watching what's actually happening on the charts.

AVAX crypto has started to draw fresh attention as both participants and market watchers point to improving technicals and strong on-chain resilience. Despite a quiet broader market, AVAX continues to show life with rising fee activity and a tightening chart structure that hints at a potential breakout.

On-Chain Activity Shows Avalanche’s Strength

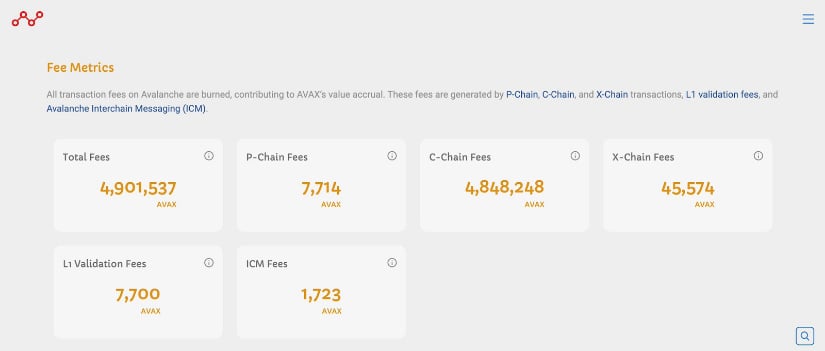

Avalanche’s latest network data continues to underline its resilience even in a quiet market phase. M. Talha Altınkaya shared that Avalanche continues to post impressive on-chain metrics. The latest Snowpeer data reveals over 4.9 million AVAX in total fees, with C-Chain fees alone exceeding 4.8 million AVAX, underscoring strong user demand and real network usage.

Avalanche’s on-chain activity remains robust, with over 4.9 million AVAX in total fees highlighting strong network usage and user engagement. Source: M. Talha Altınkaya via X

These figures reflect a healthy and active ecosystem where on-chain value continues to grow organically. With such consistent fee generation, Avalanche’s fundamentals remain among the most sustainable in the layer-1 space.

Strong Breakout Setup Points Towards $50

Technical formations now suggest that AVAX could be gearing up for its next leg higher. Razz emphasized that AVAX’s prolonged consolidation phase looks ready to resolve higher. His analysis highlights that undervalued structures like this tend to break out sharply, projecting $50 as the first major target once momentum confirms.

Avalanche’s chart structure shows tightening consolidation with higher lows forming, signaling growing bullish pressure towards the $50 target zone. Source: Razz via X

The chart also shows a clean higher low formation, indicating that buying strength has been returning. If volume sustains NEAR key resistance zones, AVAX crypto could see a strong upward continuation in the coming sessions.

AVAX Crypto Technical Outlook

Momentum is gradually recovering as buyers defend the lower boundary of the range. According to emirhan’s setup, AVAX is currently trading near a decisive point. A confirmed breakout above the dotted trendline resistance could open room for a MOVE into the blue box zone, aligning with the next cluster of liquidity.

AVAX holds key support near $20 as momentum builds for a breakout toward the $25–$27 zone. Source: emirhan via X

Price structure suggests a gradual recovery, with support levels forming between $19 to $21 and a potential upside path towards $25 to $27 if momentum follows through. The pattern remains constructive as long as higher lows are maintained.

Momentum Building for AVAX in Q4

The previous Q4 performance remains a strong reference point for Avalanche’s potential this cycle. Viktor pointed out that Avalanche’s performance in Q4 2023 was one of the strongest examples of reversal momentum in the market. After spending nearly two years in a downtrend, AVAX rallied from $9 to $50 within two months, showing how powerful its recovery phases can be.

Avalanche’s past Q4 rally from $9 to $50 highlights its explosive recovery potential, fueling Optimism for another strong quarter ahead. Source: Viktor via X

Such historical behavior reinforces the bullish narrative for the current quarter as well. If similar market conditions align, Avalanche could once again be preparing for a major trend shift, echoing the same kind of momentum that defined its Q4 comeback story.

Final Thoughts: Q4 Could Be AVAX Crypto’s Turning Point

Avalanche’s mix of strong on-chain growth and clean technical structure paints a constructive picture heading into Q4. Consistent fee generation and network activity reflect real adoption rather than speculative spikes, a sign that fundamentals are driving this move. With buyers regaining confidence and structure tightening, the stage looks set for a possible breakout similar to the explosive Q4 2023 recovery.

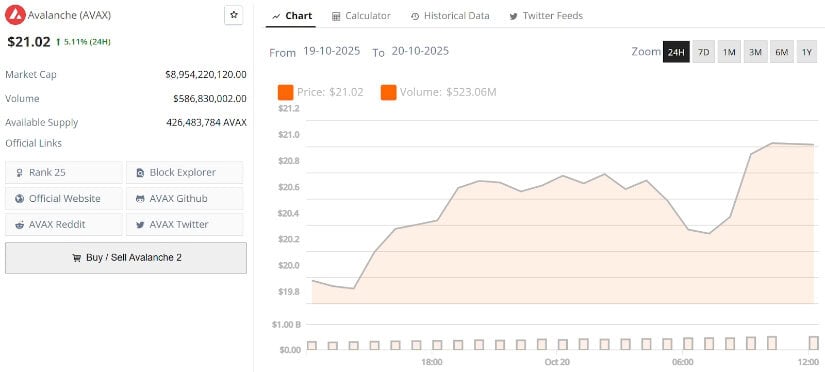

Avalanche’s current price is $21.02, up 5.11% in the last 24 hours. Source: Brave New Coin

From an AVAX price prediction perspective, sustained momentum could push prices towards the $50 zone. Historical Q4 performance, coupled with current accumulation behavior, indicates that Avalanche may once again deliver one of the strongest recoveries among top layer-1 networks this cycle.