BNB Bulls Target $1150 Breakout as Solana Echoes BNB’s Rally Pattern

BNB charges toward the $1150 threshold as momentum builds for a major breakout.

The Pattern Repeats

Solana mirrors BNB's explosive 2024 surge trajectory, creating parallel bullish formations across both assets. Technical indicators align as institutional money flows into both tokens despite traditional finance skeptics still questioning whether crypto is just sophisticated gambling with better marketing.

Market structure suggests the $1150 resistance level could crumble under sustained buying pressure. Trading volumes spike as derivatives markets position for potential upside volatility. The breakout watch intensifies with every candle close above key support zones.

History doesn't repeat but it often rhymes—and right now Solana is singing BNB's 2024 tune while traders place their bets on who hits new ATHs first.

Meanwhile, solana shows a bullish re-accumulation pattern, mirroring its historic breakout. Analysts forecast a breakout-driven rally for both coins, supported by strong institutional interest and rising trading activity.

Binance Coin Encounters Resistance Near Key Supply Zones

Analyst CW shared a chart showing Binance Coin encountering two major sell walls before reaching the $1,190 resistance level. The chart identifies red-marked resistance areas as zones of concentrated sell orders. The first resistance zone lies around $1,120–$1,150, where recent price attempts have repeatedly stalled. The second zone, near $1,180–$1,190, acts as the final obstacle before a potential continuation toward $1,200.

BNBUSDT Chart | Source: x

On the lower end, green zones between $1,040 and $1,000 mark the areas where buyers have consistently absorbed selling pressure. This setup points to a range-bound structure where bulls accumulate near support while bears dominate near resistance. For a sustained upward move, the asset needs to close above $1,150 and turn it into support. Until then, a rejection could trigger a pullback toward the $1,050–$1,000 range, although maintaining a price above these levels WOULD signal ongoing accumulation by long-term participants.

Solana’s Chart Mirrors the altcoin’s 2024 Breakout Pattern

Analyst Alex Clay compared Solana’s long-term structure to Binance Coin’s trajectory before its explosive 2024 rally. According to his analysis, Solana has spent roughly 658 days in a re-accumulation phase, similar to its pre-breakout pattern. Such extended accumulation periods often precede sharp upward movements once resistance is cleared.

BNB Chart | Source:x

The weekly chart shows Solana trading NEAR $188 within a consolidation range between $140 and $210. Institutional participation and on-chain activity have supported steady accumulation in this zone. Clay’s projection suggests that a confirmed breakout above $210 could propel Solana toward the $600–$800 range, resembling its previous surge. The pattern signals an advanced accumulation stage where volatility narrows, indicating that momentum could build quickly once resistance breaks.

Price Activity and Market Metrics

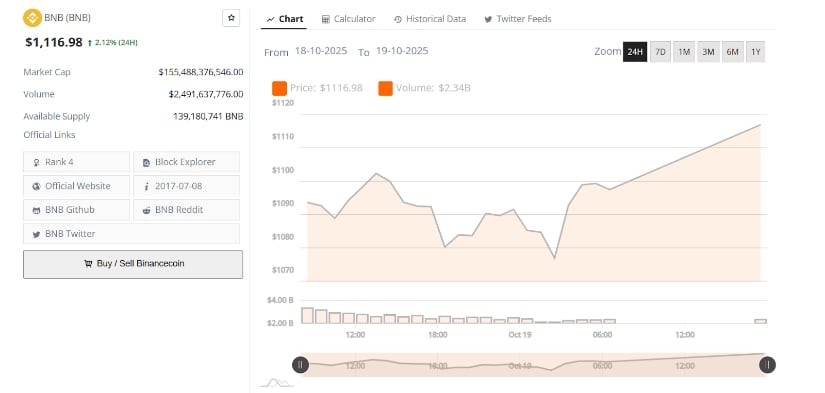

Binance coin is trading at $1,116.98, registering a 2.12% gain over the past 24 hours. The token’s market capitalization is $155.48 billion, supported by a 24-hour trading volume of $2.49 billion. Its circulating supply of 139.18 million reinforces a deflationary structure that limits dilution, distinguishing it from many higher-supply altcoins.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

The intraday chart shows price fluctuations between $1,070 and $1,120, revealing moderate volatility. After briefly dipping near $1,080, the token rebounded strongly, reflecting renewed demand from short-term traders. Volume spikes during upward moves point to active accumulation near the $1,090–$1,100 zone. This buying behavior indicates that traders are responding to key technical levels, particularly ahead of resistance at $1,150.

Broader Market Context and Technical Outlook

The broader market is showing gradual stabilization, and the price behavior reflects cautious Optimism among participants. The presence of clear demand zones signals underlying strength, while the repeated testing of resistance suggests that a breakout attempt may soon emerge. Sustained volume expansion could confirm renewed bullish participation if the token closes above $1,150.

Solana’s structural comparison to the altcoin adds context to market sentiment across major altcoins. Both assets demonstrate prolonged consolidation followed by narrowing volatility ranges—a typical precursor to strong directional moves. If Solana replicates its earlier expansion phase, it could strengthen the case for broader market recovery and renewed investor confidence in leading blockchain assets.