Hyperliquid (HYPE) Price Prediction: Bulls Battle $50 Barrier as Shorts Circle Below

HYPE faces its moment of truth at the $50 resistance level—a make-or-break zone that could define its trajectory for weeks to come.

The Bull Case: Momentum Builds

Buyers are digging in, showing unusual resilience against bearish pressure. The $50 level isn't just psychological—it's become the line in the sand where bulls are making their stand. Break through, and we could see rapid acceleration toward higher targets.

The Bear Threat: Shorts Gather Strength

Meanwhile, short positions are accumulating, betting the resistance holds. They're counting on traditional market mechanics—you know, the ones that actually require fundamentals—to push prices lower. Their playbook? Force rejection at $50 and trigger a cascade of stop losses.

Market Mechanics at Play

This isn't just technical analysis—it's a classic crypto showdown. Liquidity pools cluster around the $50 mark, creating a gravitational pull that could snap prices in either direction. The battle between leveraged longs and opportunistic shorts creates the kind of volatility that makes traditional finance guys clutch their pearls.

Final Take

Either HYPE punches through $50 with conviction, or it faces a swift retreat. In crypto, resistance levels aren't just numbers—they're proving grounds. Because nothing says 'sound investment' like watching traders gamble on whether a digital token can clear an arbitrary price point that would make any sane financial analyst question their career choices.

Hyperliquid has been holding near key resistance levels, but its recent behavior is stirring debate on whether buyers can maintain control or if bears are preparing for another move lower. Market positioning, whale activity, and shifting trend structures are all pointing to a cautious Hyperliquid Price Prediction in the short term.

Hyperliquid Price Holds Below $50 as Resistance Stays Firm

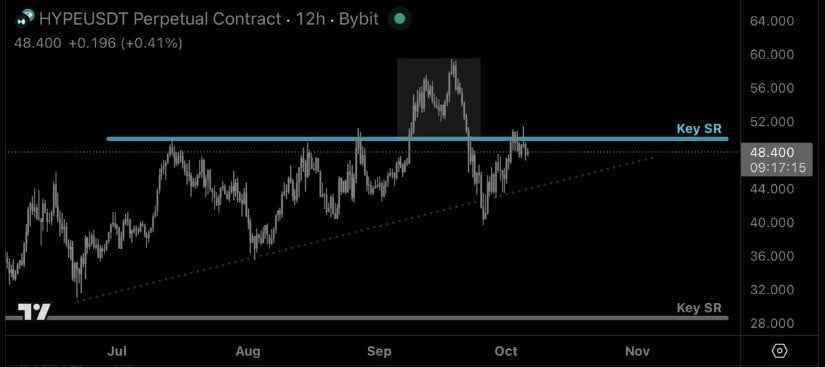

Price action on HYPE continues to respect the $48 to 50 band, but the structure has shown multiple failures to sustain above prior highs. Tyler’s chart highlights how each breakout attempt stalls around the same region, suggesting that resistance is becoming more reinforced rather than weakening.

Hyperliquid struggles to reclaim the $50 zone, with repeated rejections signaling strong resistance overhead. Source: Tyler via X

The repeated failures to clear this area suggest bears still control short-term momentum. Unless buyers can secure acceptance above $52, dips back towards $46 to 45 remain on the table, keeping the market cautious despite broader optimism.

Whale Positioning Data Creates Pressure

Whale positioning shows a clear tilt toward shorts, with 53.5% of large accounts leaning bearish. Out of the $9.73B in open interest, $5.21B is short compared to $4.53B long. Margin distribution also tilts slightly to the short side, reflecting how aggressive whales are in defending resistance.

Whale data shows 53.5% of large accounts leaning short on HYPE, keeping pressure on bulls at the $50 resistance. Source: Sweep via X

This imbalance doesn’t guarantee a breakdown but makes it harder for bulls to push higher without liquidating some of that short exposure. Sweep’s data paints a backdrop where if $50 breaks decisively, shorts could get trapped, but until then, the bearish bias remains supported by positioning.

Hyperliquid’s Short-Term Structure Turning Heavy

Intraday structure on HYPE shows weakness, with recent candles breaking out of a bear flag formation. Key supports are marked around $47.3 and $46.1, with lower bands stretching into $44.9. Unless buyers reclaim $49.5 to 50, the bias in the short term leans towards further dips.

HYPE’s intraday structure weakens as a bear flag breakdown threatens key $47–46 support levels. Source: 0xleegenz via X

0xleegenz emphasized that while he remains cautiously bullish, the range is narrowing and the tape favors sellers in the immediate sessions. If $47 fails to hold, the next reaction point could be $45, where a stronger bounce attempt might finally emerge.

Formation Change: Higher Highs to Lower Highs

After weeks of trending upward, HYPE has now printed its first lower low, which breaks the prior rhythm of higher highs. This structural change signals vulnerability, and unless the current local resistance is cleared, another lower high could FORM to confirm bearish control.

Hyperliquid shifts from higher highs to lower lows, signaling a pivotal test of momentum around the $50 mark. Source: Sjuul via X

Crypto analyst Sjuul highlighted that this is a sensitive turning point, where momentum can either shift back upward or give way to a deeper retracement. A failure to reclaim $50 WOULD leave the market exposed to downside continuation, while a breakout above this zone would negate the lower-high formation and restore bullish confidence.

Closing Thoughts

Hyperliquid sits at a pivotal moment with resistance still unbroken, whales leaning short, and trend structure flashing early warning signs. Yet, the same factors could quickly flip if $52 falls, turning shorts into forced buyers and restoring bullish confidence.

For now, HYPE participants are watching whether support at $47 to $45 holds and if the $50 to $52 resistance level flips. The outcome here will likely decide upon breakout or breakdown from either of these technical levels.