ARB Primed for $0.60 Breakout as On-Chain Metrics Shatter Records

Arbitrum's network activity just hit unprecedented levels—and the charts are taking notice.

Network Momentum Builds

Transaction volumes across Arbitrum's layer-2 solution surged past previous all-time highs this week. Daily active addresses smashed through resistance levels while gas fees remained surprisingly stable—a rare combination that typically precedes major price movements.

The Technical Setup

ARB consolidates below the critical $0.60 resistance level that's repelled bulls three times since August. Each failed breakout attempt created stronger support around $0.52, forming what technical analysts call a 'compression pattern'—the kind that often leads to explosive moves.

Institutional Interest Grows

Whale wallets holding over 1 million ARB tokens increased their positions by 14% in the past month. Meanwhile, decentralized exchange volumes on Arbitrum-based platforms doubled—proving that when traditional finance gets nervous, crypto natives just build faster.

Market watchers note the timing coincides with Ethereum's ongoing scaling challenges. Arbitrum processes transactions at roughly one-tenth of Ethereum's mainnet costs—a value proposition that's suddenly looking very attractive to developers fleeing high gas fees.

The $0.60 barrier represents more than just a psychological level. Breaking it would trigger algorithmic buy orders from trading bots and likely force short sellers to cover their positions—creating the kind of feedback loop that turns resistance into support.

Of course, in crypto, record-breaking metrics sometimes just mean record-breaking losses for late entrants. But this time, the fundamentals might actually justify the hype.

ARB is showing fresh signs of strength after defending key support, with participants watching closely as it builds a higher-low structure that hints at a possible breakout if momentum holds. With technicals aligning and on-chain activity reaching record levels, the ARB price prediction narrative is starting to gain momentum.

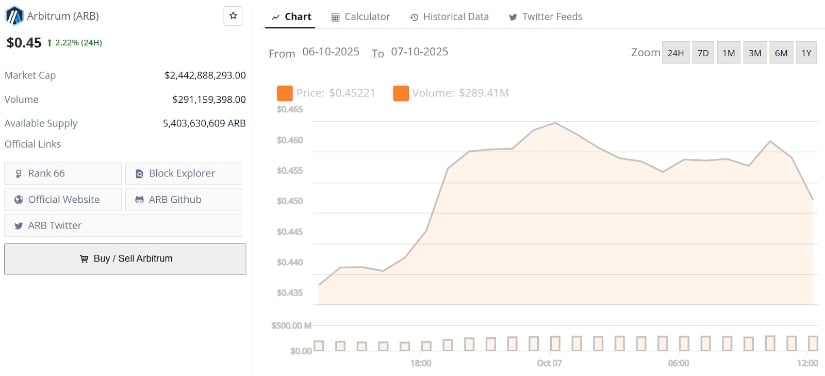

Arbitrum’s current price is $0.45, up 2.22% in the last 24 hours. Source: Brave New Coin

ARB Price Breaking Its Bullish Setup

ARB has pushed back above $0.46, showing signs of recovery after testing the $0.42–$0.43 demand zone. The 12H chart highlights a higher low structure forming, supported by MACD signals tilting back toward the positive side. A sustained move above $0.48 WOULD strengthen the case for continuation, with targets lined up towards $0.51 and $0.53.

ARB rebounds above $0.46, building a higher-low setup that signals breakout potential ahead. Source: Muhammad Uzair via X

Muhammad Uzair’s chart points to a breakout scenario where volume expansion could fuel a push higher. If momentum continues, ARB would need to next break the $0.53 resistance level to continue trending further higher.

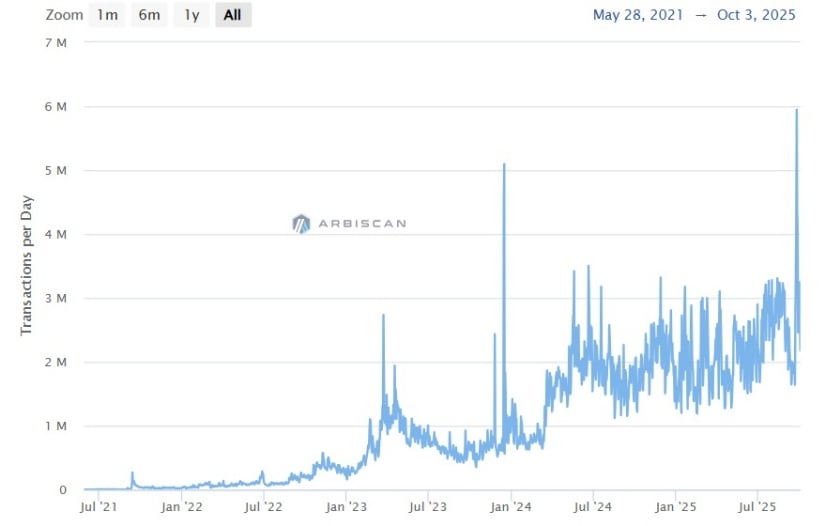

Bullish On-Chain Strength Backs the Arbitrum Rally

On-chain momentum continues to build as Arbitrum recently crossed 6 million daily transactions, its highest level yet. This growth represents a sharp climb from just 1 million in early 2024, showing that activity on the network is not only consistent but expanding at scale. Such a surge in usage often positively impacts the price as well.

Arbitrum’s daily transactions hit a record 6 million, cementing its place among the most active blockchain networks. Source: crypto Miners via X

Crypto Miners highlighted how this level of activity places ARB among the most actively used chains in the market. With transaction throughput climbing alongside developer participation, the fundamentals provide strong backing for price resilience even during broader volatility.

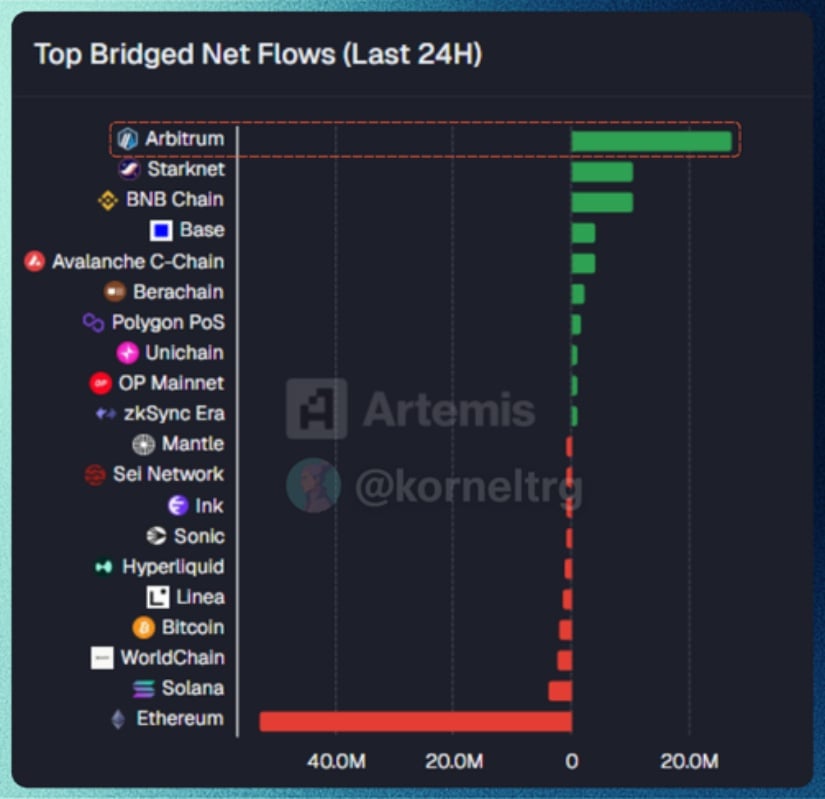

Net Flows Reinforce Arbitrum’s Dominance

Capital inflows remain another key strength for ARB, with on-chain data showing it led all chains in bridged net flows over the past 24 hours. This consistency in liquidity support has made Arbitrum stand out, proving that demand is not limited to short bursts but rather a sustained trend. Korneltrg emphasized that for ARB this steady liquidity foundation builds confidence that larger players are positioning for upside, further fueling the bullish momentum already visible on technical charts.

Arbitrum leads all chains in bridged net flows. Source: Korneltrg via X

ARB Arbitrum Important Technical Levels

Price action continues to show resilience, with sellers repeatedly failing to push ARB below the $0.42 zone. A clean close above $0.45 sets the stage for a bullish continuation, with volume profile clusters indicating upside targets at $0.53, $0.56, and even $0.60 if momentum accelerates.

ARB defends the $0.42 zone as accumulation builds, with upside targets stretching towards $0.60. Source: Hieu via X

ARB chart highlights how order FLOW has absorbed attempts to break support, signaling accumulation beneath the surface. Crypto analyst Hieu’s believes that if combined with improving structure, this creates a setup where a controlled retracement could flip into another leg higher.

Community Sentiment Turns Bullish on ARB

Alongside technicals and on-chain strength, market sentiment is also leaning bullish for ARB. Ripple Bull Winkle noted that ARB remains one of the standout undervalued assets heading into this cycle, grouping it with other high-potential names like Ondo.

This reinforces the growing confidence within the crypto community that ARB’s blend of high activity, liquidity inflows, and strong technical defense could set it apart from other altcoins. As optimism builds, the narrative around ARB price Prediction being undervalued may start attracting broader participation.

Final Thoughts

ARB is showing the right mix of technical strength and on-chain momentum that participants usually look for before a breakout. With higher lows holding and volume starting to build, the setup remains constructive as long as the $0.42 to $0.43 zone continues to defend. A decisive push through $0.53 would likely shift sentiment into full bullish mode, with targets towards $0.56 and even $0.60 not out of reach if momentum accelerates.

While the risk of short-term pullbacks remains, the combination of network activity, liquidity inflows, and bullish community sentiment makes ARB one of the altcoins to keep a close eye on this cycle.