Dogecoin Defies Gravity: DOGE Holds Critical $0.20-$0.22 Support Zone as Whales Gobble Up Positions

Memecoin heavyweight Dogecoin is flashing bullish signals as it maintains crucial support levels despite market turbulence. Whale wallets are accumulating DOGE at current prices, setting the stage for a potential explosive move upward.

The Whale Accumulation Pattern

Large investors aren't just dipping toes—they're diving headfirst into DOGE positions between $0.20 and $0.22. This accumulation phase suggests institutional money might be betting on the meme coin's staying power beyond internet hype.

ETF Optimism Fuels Rally Prospects

With cryptocurrency ETF approvals becoming the financial world's favorite regulatory drama, Dogecoin stands to benefit from the rising tide. The $0.29 resistance level now appears within striking distance—a 30%+ surge from current support zones.

Technical Setup Favors Bulls

The $0.20-$0.22 range has transformed from resistance to reliable support—a classic bullish reversal pattern. Each test of this zone has seen increased buying volume, creating a spring-loaded technical setup.

While Wall Street debates whether dog-themed digital assets deserve a place in serious portfolios, DOGE continues doing what it does best: making skeptics question their investment thesis while rewarding those who understand that in crypto, sometimes the joke's on the traditional finance crowd.

After a turbulent week in the crypto market, DOGE slipped to around $0.2238, reflecting an 18% weekly decline. Despite the drop, trading activity remains robust, signaling strong investor interest and growing anticipation for a possible price recovery. Market watchers are closely monitoring the $0.20–$0.22 support zone, which could determine whether Dogecoin continues its rally or faces further correction.

Whale Accumulation Boosts Confidence

Whale activity has been a significant factor in Dogecoin’s outlook. In the past 48 hours, large holders reportedly accumulated $2 billion in DOGE. Wallets holding between 100 million and one billion Doge have steadily increased their balances, suggesting growing confidence among institutional and high-net-worth investors.

Dogecoin (DOGE) needs to maintain the $0.22 support to strengthen prospects for a rebound toward $0.29. Source: Ali Martinez via X

A recent withdrawal of 122 million DOGE from Binance suggests smart money accumulation, a MOVE that could set the stage for a larger rally before year-end.

ETF Listing Adds Institutional Weight

Dogecoin’s institutional adoption received a boost with the listing of the 21Shares dogecoin ETF on the Depository Trust and Clearing Corporation (DTCC) platform. The ETF provides traditional investors with exposure to DOGE, potentially reinforcing the token’s $0.20–$0.22 support zone.

BREAKING:![]() 21Shares Spot Dogecoin ETF listed on DTCC under ticker $TDOG. Source: Ash crypto via X

21Shares Spot Dogecoin ETF listed on DTCC under ticker $TDOG. Source: Ash crypto via X

Santiment analysts have suggested that ETF speculation, combined with high whale accumulation, could amplify DOGE’s stability and increase demand in the NEAR term.

Technical Indicators Show Mixed Signals

Dogecoin’s technical outlook remains uncertain as the token hovers near the $0.22 support zone, retracing from recent highs of $0.271. The Relative Strength Index (RSI) sits around 40, placing it close to oversold levels.

Dogecoin is testing the $0.22 support amid heavy institutional accumulation, with strong bullish sentiment keeping a rebound toward $0.30+ in focus. Source: TWJ News via X

This suggests that while bearish momentum still dominates, the possibility of a reversal is increasing if buying pressure strengthens. At the same time, the Moving Average Convergence Divergence (MACD) continues to reflect downside pressure, though its lines remain tightly aligned—a setup that often precedes quick shifts in trend when traders re-enter the market.

Adding to this technical picture, analyst Trader Tardigrade highlighted that DOGE recently completed a retest on a symmetrical triangle pattern. Such patterns often indicate consolidation before a potential breakout. If buyers step in, this setup could provide the foundation for the next upward surge, reinforcing the importance of the $0.22 support zone in shaping short-term Dogecoin price predictions.

Short-Term Outlook: $0.29 Rebound or Deeper Correction?

The immediate future for Dogecoin looks binary. Should the $0.22 support level hold, a reversal WOULD see DOGE rise to $0.29, with potential targets of $0.35, $0.55, and even $1 should the momentum carry over to year-end. Conversely, failure to hold this floor could see prices drop to $0.18, $0.14, or, worst case, $0.08.

Market commentator CryptoTony cautioned that ongoing corrections could push DOGE down to $0.21 before any sustained bounce, noting that the $0.22 and $0.20 levels remain critical in shaping the near-term trend.

Looking Ahead: Dogecoin at a Crossroads

Dogecoin is at a crossroads. Strong whale purchases, ETF backing, and significant support levels of $0.20–$0.22 support potential reversal. However, bearishness and the risk of further decline warrant caution in monitoring these levels closely.

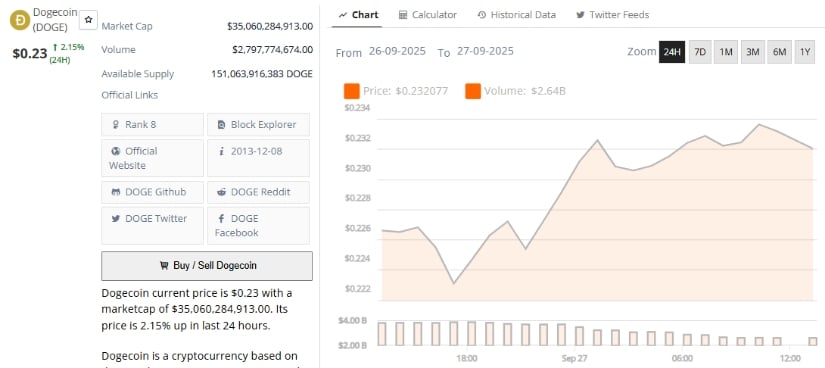

Dogecoin was trading at around $0.23, up 2.15% in the last 24 hours at press time. Source: Brave New Coin

For traders and investors, the next few days will be decisive in deciding the fate of Dogecoin. Holding the support may unlock a pathway toward $0.29 and beyond, while failure could prolong the downturn.