Why Base Absolutely Needs Its Own Token in 2025

Base Token Launch: The Missing Piece in Coinbase's Layer-2 Puzzle

Decentralized Governance Demands Native Assets

Without a native token, Base remains tethered to corporate oversight—a contradiction to crypto's core ethos. Tokens distribute voting power, align community incentives, and transform users into stakeholders rather than just customers.

Economic Flywheel Ignites Network Effects

Tokens create self-sustaining ecosystems. Transaction fee sharing, staking rewards, and protocol-owned liquidity bootstrap engagement far beyond what pure ETH gas economics can achieve. It’s the difference between renting and owning the infrastructure.

Competitive Positioning in the L2 Arms Race

Every major Layer-2—Arbitrum, Optimism, Polygon—runs on native tokens. Base risks becoming a ghost chain without the speculative grease that fuels developer attention and user adoption. Even the most idealistic protocols eventually bow to tokenomics.

Monetization Beyond Venture Capital

Let’s be real—this is about revenue diversification. Tokens create treasury assets, fund grants, and provide exit liquidity without diluting equity. Because why let VCs capture all the upside when you can retail-ize the risk? Classic crypto finance.

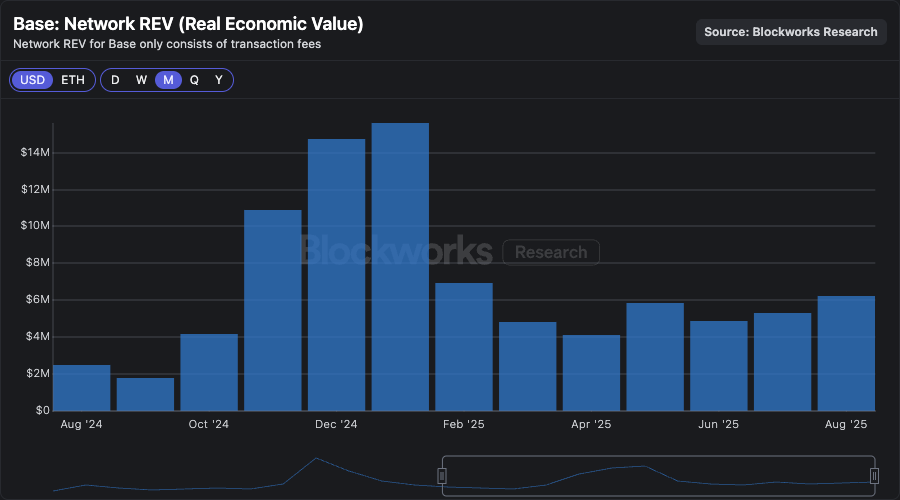

In August, Base generated $6.2 million in network REV, annualized out to $75 million. Base remains one of the only L2s without a token.

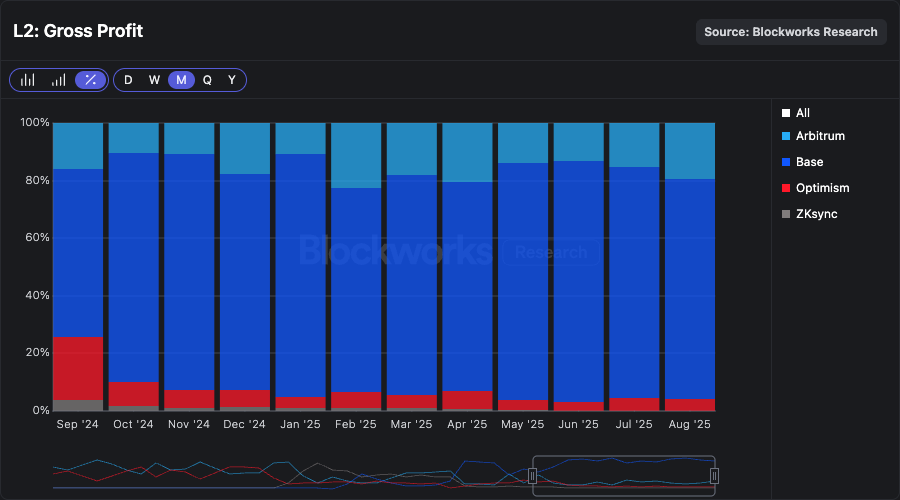

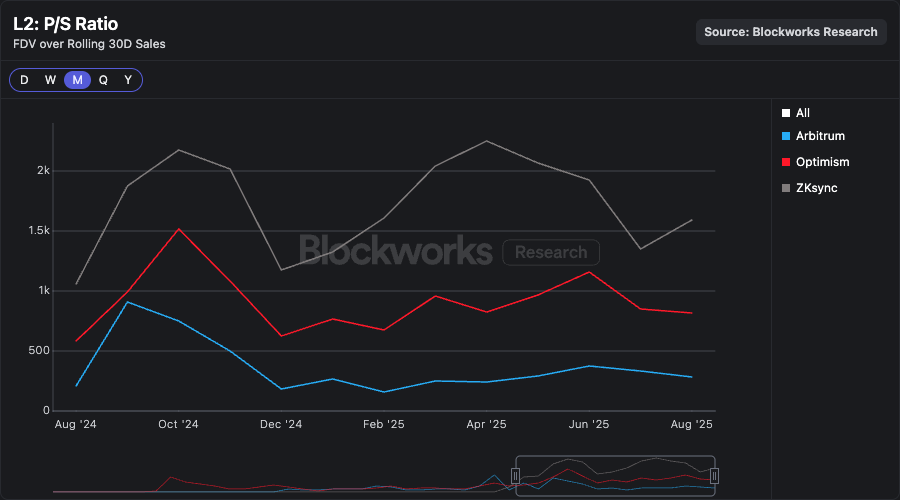

As the largest L2 generating the most in profits, what could the Base token be worth? Examining some competitor L2s (Arbitrum, Optimism, and ZKsync), show these tokens trade at lofty price-to-sales ratios of 280x, 820x, and 1600x, respectively. This puts the sector mean at a P/S of 900x.

Applying this 900x multiple to Base’s $75 million in annualized REV puts a potential FDV on a Base token at $67 billion. To be priced in line with ARB at a 280x multiple, this would price Base’s token at a $21 billion FDV. Are these projections “fair-value” for a Base token? Absolutely not. But it does go to show the market value it could command is consistent with the sector’s multiples.

The napkin math forecasts are dramatic. Could launching a token really create tens of billions in market value for stakeholders? Coinbase equity is trading at a $84 billion market cap. This puts Coinbase at 7x last quarter’s sales, annualized, while revenues from Base account for less than 1% of the company’s topline sales. Would reattributing this revenue stream from equity holders to an L2 token really deserve a 100x higher multiple? Unlikely; the multiples in the sector are outrageous to begin with.

It’s worth mentioning also that the implications of a Base token would be rife with regulatory scrutiny. Currently, the cash flows of Base’s operations are owned by COIN shareholders, a publicly-listed, registered security. Could a Base token reasonably have a claim on the L2’s cash flows without rugging existing shareholders? And, if the token has no claim, what is it really for?

Decision makers at Coinbase have likely already surveyed the valuation landscape amongst L2s, and they know full well they are sitting on the cash cow of this sector. The decision to launch a token presents tradeoffs, and tradeoffs that may actually favor shareholders. Consider this thought experiment: Say the Base token had a claim on 100% of Base’s gross profit. Coinbase could allocate itself, arbitrarily, two thirds of the Base token supply, with the remainder allocated to ecosystem users and builders. In doing so, Coinbase would forgo $25 million in annual revenue in exchange for a balance sheet asset that perhaps may be worth $14-$44 billion. Forgo $25 million annually in exchange for a one time receipt of tens of billions in token value? I’d take that trade.

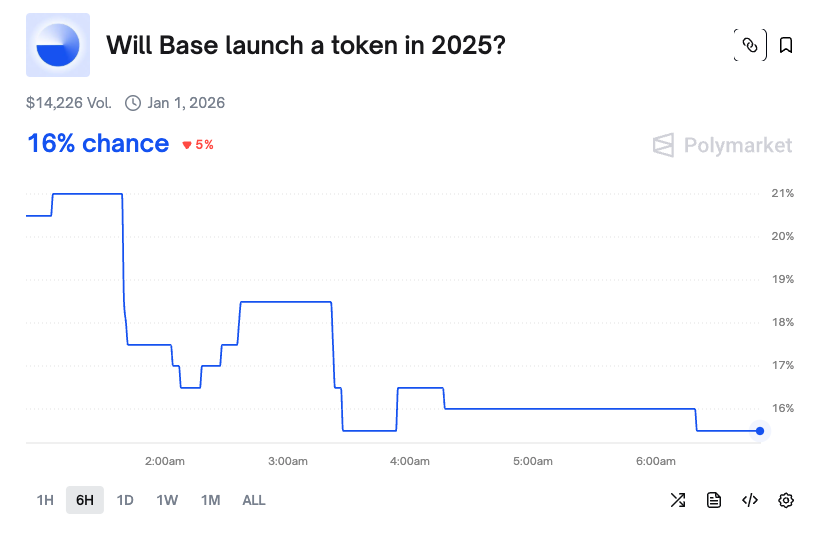

While the moonpath on a Base token, its market value, the potential wealth effect of a sizable airdrop, and the implications for ecosystem applications like Aerodrome (which traded 10% higher on the news) present a fun exercise, Polymarket’s line on a Base token is pricing the under that it will launch this year.

This market has the probability that Base will launch a token in 2025 at just 16%, suggesting these are matters for next year.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.