What’s Next for Crypto Markets as Fed Rate Cut Holds Firm?

Fed rate cuts are sending crypto into overdrive—and this is just the beginning.

Liquidity Unleashed

Cheap money floods risk assets faster than Wall Street can print 'diversification' reports. Bitcoin's already tasting $100K, while altcoins ride the wave like surfers catching a monetary tsunami.

Institutional FOMO Meets Retail Mania

Hedge funds pile in, chasing yields that traditional finance can't match. Meanwhile, retail investors bypass sluggish brokers for instant crypto exposure—no permission needed.

Regulatory Whack-a-Mole Continues

Watch regulators scramble as decentralized protocols outpace their rulebooks. They'll try to tame this beast, but innovation moves at blockchain speed, not bureaucracy speed.

Just remember: when the Fed cuts rates, someone's always left holding the bag—usually the ones who thought 'this time it's different' for traditional assets.

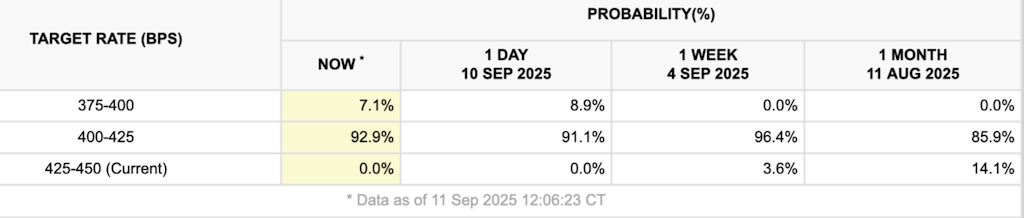

Source: FedWatch

Source: FedWatch

“This comes on the heels of yesterday’s PPI report, which pointed to a sharp softening of producer prices, suggesting that pipeline inflation pressures are easing,” Hernandez explained. “Together, the CPI and PPI data support the view that the Fed can afford to cut rates at their FOMC next week, increasing investor confidence across risk assets.”

Along with the CPI and PPI prints, we saw initial claims for state unemployment benefits rise to 263,000 last week. This was above some expectations and the highest total in about four years.

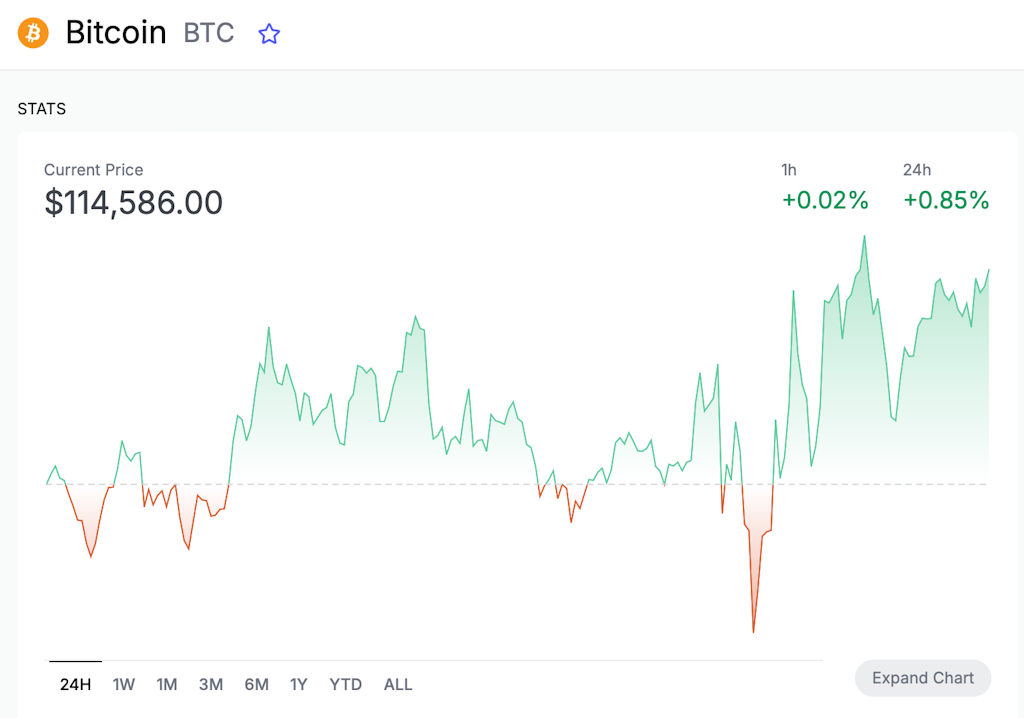

Loading Tweet..Bitcoin ROSE above $114,000 yesterday before retreating a bit. It then reached as high as $114,700 this morning. It wasn’t far off that level at 1:45 pm ET:

Bitcoin’s next key technical level is just above $115,000, Hernandez explained — “where significant liquidation clusters could fuel increased volatility.” A Fed rate cut and dovish guidance could lead BTC even higher, he said.

“The rate cut opens the door for risk-seeking investors to look beyond Bitcoin too — to tokens like solana and XRP, whose ETFs are highly anticipated to debut this fall,” the 21Shares pro argued.

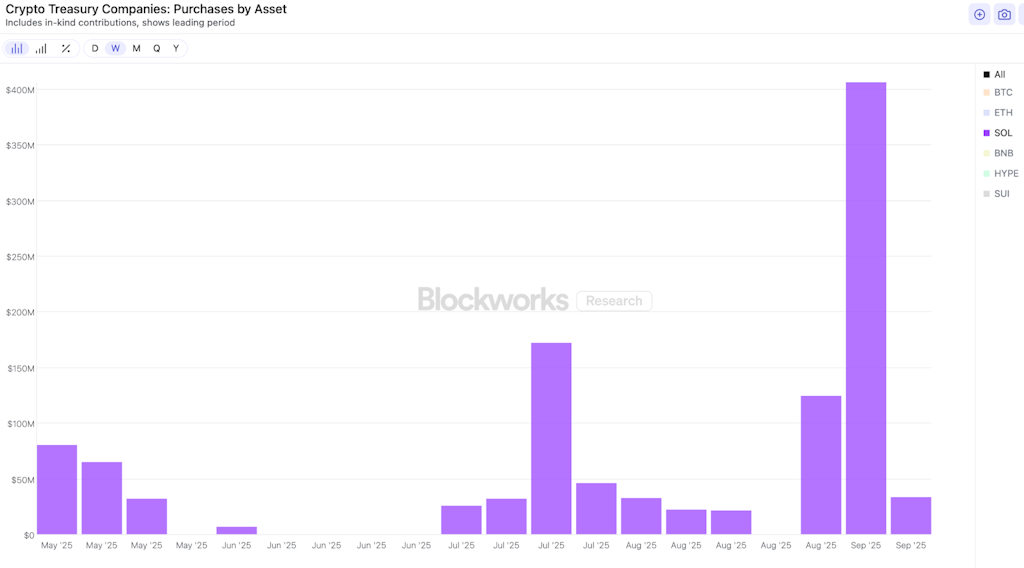

The SEC is set to rule on various US solana ETF proposals by Oct. 10. Not to mention, we saw corporate buying of SOL spike last week, per Blockworks Research data.

These SOL buys are much smaller than those by companies acquiring BTC and ETH, but they’re becoming more frequent nonetheless. The below chart shows the same time span but with more assets — giving us a sense of the different scales of acquisition.

Bitwise’s Matt Hougan noted in his latest CIO memo, called Solana Season: “Its promoters argue that Solana is the only blockchain fast enough to support the tokenization of major assets at a global scale.”

There’s that word tokenization again. I’m doing my best to give it a rest.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.