Solana Hunts for Its Wall Street Champion as Institutional Adoption Heats Up

Solana's quest for a Wall Street heavyweight backer intensifies as institutional crypto demand surges.

The High-Stakes Search

Major financial players remain cautious—hedge funds dip toes while traditional banks watch from sidelines. No JPMorgan or BlackRock stepping up yet, despite Solana's blistering transaction speeds and growing developer ecosystem.

Wall Street's Crypto Dilemma

Institutions want blockchain efficiency without regulatory headaches. Solana delivers the tech—but compliance departments still sweat over gray areas. Meanwhile, crypto-native firms build infrastructure that might eventually bypass traditional finance entirely.

Timing Is Everything

The right Wall Street endorsement could trigger a flood of institutional capital. Wrong partner? Might just add another layer of bureaucracy to slow things down. Because nothing innovates like a committee of risk-averse bankers reviewing every blockchain transaction.

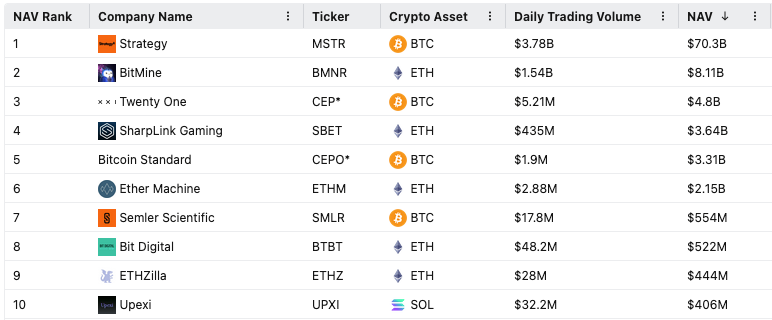

The ten largest DATs. Source: Blockworks Research

The ten largest DATs. Source: Blockworks Research

Behind the scenes, DAT executives are casting around in search of public-facing Solana advocates.

One person involved in a Solana DAT recounted asking ChatGPT who Michael Saylor’s equivalent could be for a Solana treasury company. The chatbot listed Helius CEO Mert Mumtaz, Asymmetric CEO Joe McCann, Solana co-founder Raj Gokal, and Solana Foundation CEO Lily Liu.

The problem with well-known Solana figures like these is that they tend to have “something [else] going on,” as a different person working at a DAT put it.

In a text, Mumtaz said he has been “approached by roughly all [Solana DATs] to be involved in varying capacities,” noting that he hasn’t made any final decisions and adding: “[I’m] overall interested in the long-term health of solana above all and am trying to figure out how best I can help with that.”

McCann, who until recently WOULD frequently post about Solana to more than 100,000 X followers, was tapped as CEO of a potential $1.5 billion Solana DAT. The deal fell apart after a limited partner in McCann’s hedge fund posted about the fund’s poor performance on X, Blockworks previously reported. McCann did not return a request for comment.

Gokal and a representative for Liu did not return requests for comment on whether they intend to formally get involved in DATs.

Galaxy Digital, Multicoin Capital, and Jump crypto are reportedly plotting a $1 billion Solana DAT raise, according to Bloomberg. Such a deal would involve two names that came up in conversations about potential Solana DAT leaders: Galaxy CEO Mike Novogratz and Multicoin managing partner Kyle Samani. But both already have day jobs, so it’s unclear whether they’d want to take on a role akin to being CEO of a publicly traded company.

Samani and Novogratz did not comment on their roles in the reported DAT.

Among the CEOs of existing Solana DATs, Sol Strategies CEO Leah Wald shows promise as a public face for Solana, boasting a sizable online following and an impressive institutional crypto resume. However, she has (so far) played a more behind-the-scenes role as the Canadian holding company awaits a hoped-for Nasdaq listing.

“I don’t see myself as a Saylor or a Lee. I’m secretly an introvert, and that job would mean way too much public speaking. That’d be like being scared of heights and then deciding to become a window washer on skyscrapers,” Wald said in a text.

Due to the slim pickings in Solanaland, some DATs are thinking the right person might be a relative unknown to Solana folks — as Saylor and Lee were to bitcoin and ether before assuming their current roles.

“In Tom Lee you have two things: He is very comfortable on CNBC, and he speaks to TradFi. I have been looking and have not found who that person would be,” said one person working on a Solana DAT, who said they had considered making inroads with candidates ranging from former WHITE House communications director Anthony Scaramucci to the meme stock influencer Roaring Kitty.

Potential leaders also don’t come cheap. Former BlackRock executive Joseph Chalom received a $7 million stock grant plus a potential salary and long-term incentive bonus in the millions to become co-CEO of SharpLink Gaming, the second-largest ETH treasury company.

Looking at Chalom’s compensation package, one Solana DAT executive said the price tag “could be well worth it” for SharpLink. Even so, the executive noted, getting Wall Street compliance departments to sign off on DAT partnerships can be a challenge.

“Our issue is not getting it in front of these crazy high-level people, it’s the strict compliance side of things” that is making it hard to get well-known Wall Streeters on board, they said.

It’s nevertheless becoming clear that Solana DATs intend to start rolling out their own versions of Saylor and Lee.

Last week, the crypto investment platform CoinList sent some investors an email, reviewed by Blockworks, which advertised an “upcoming SOL treasury company coming imminently to the public market.”

“This anticipated vehicle is currently in stealth, and we cannot disclose the details. If completed, it will be the largest SOL treasury vehicle on the market with some of the most prominent industry backers, and the likely ‘Saylor of Solana,’” the email said.

The deal is expected to close and be announced on September 8th, the email said. CoinList did not return multiple requests for comment.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.