Monero’s Bullish Pattern Signals Potential Rally - Here’s Why XMR Could Break Out

Monero's chart flashes a classic bullish formation that traders haven't seen in months—and the technicals suggest this privacy coin might be gearing up for a serious move.

Pattern Recognition: Ascending Triangle Nears Completion

The setup shows consistent higher lows meeting horizontal resistance, creating that textbook triangle shape that technical analysts love to see. Volume patterns support the breakout thesis, with accumulation happening quietly beneath the surface while traditional finance folks debate inflation metrics that stopped being relevant in 2020.

Market Context: Privacy Coins Face Regulatory Scrutiny

XMR's potential surge comes amid increased regulatory chatter about privacy-focused assets—because nothing gets bureaucrats more excited than trying to track what they can't understand. Meanwhile, institutional money keeps pouring into transparent blockchains while quietly hedging with actual privacy solutions.

Price Targets: Where Technicals Suggest XMR Could Head

The measured move projection from the pattern's width points to significant upside if resistance breaks—which would make Monero one of the few assets actually delivering on cryptocurrency's original promise of financial sovereignty. Not that your traditional portfolio manager would know anything about that while rebalancing their third bond fund of the quarter.

Timing The Breakout: Watch These Key Levels

Traders are eyeing the resistance zone like hawks, with breakout confirmation requiring a decisive close above that critical level. Failure to hold would invalidate the pattern, but the momentum buildup suggests this might be one of those rare moments when charts actually matter more than Fed meeting minutes.

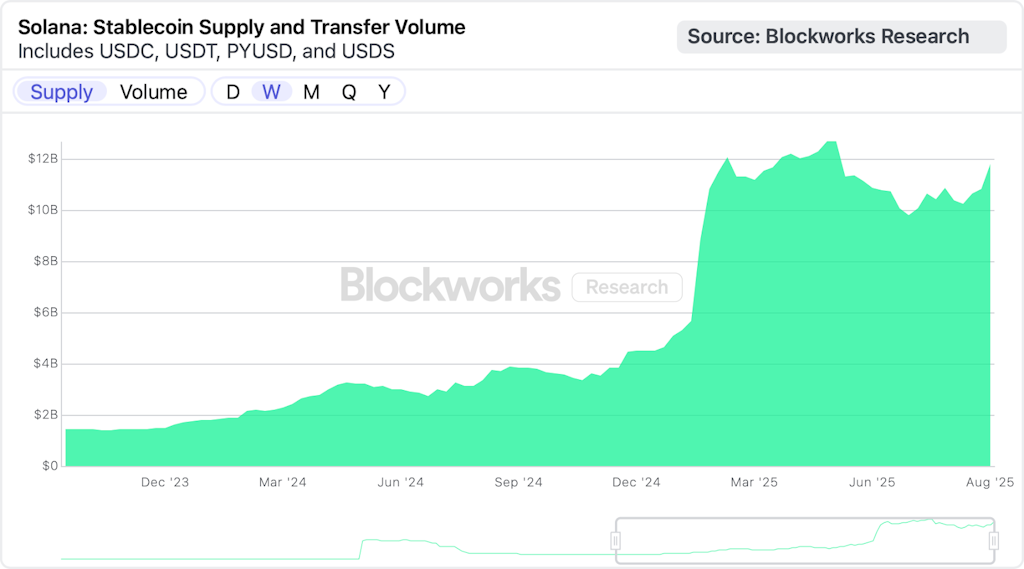

Solana stablecoin supply and transfers | Source: Blockworks Research

Meanwhile, solana has emerged as a high-throughput stablecoin rail, processing around $11 billion in daily transfers across tokens like USDC, USDT and PYUSD.

The network handles roughly 3 billion monthly transactions (excluding validator votes), far outpacing ethereum in raw activity. Stablecoin volume spikes have helped to drive Solana DEX trading to nearly $300 billion in monthly spot volume, cementing its role as a low-cost complement to Ethereum’s liquidity-heavy ecosystem.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.