Coinbase Integrates Solana Trading: A Major Step for Institutional Crypto Adoption

Coinbase just plugged directly into Solana. This isn't just another listing—it's a full-scale infrastructure play that brings one of crypto's most active ecosystems to Wall Street's digital doorstep.

The Institutional On-Ramp Widens

By embedding Solana's native trading capabilities, Coinbase effectively bypasses the need for complex, multi-step workarounds. Traders can now access SOL and its sprawling universe of tokens with the same click they use for Bitcoin and Ethereum. It cuts out friction, slashes settlement times, and opens the floodgates for capital that's been waiting on the sidelines for a cleaner entry point.

Why This Move Matters Now

The timing isn't accidental. With regulatory frameworks solidifying and institutional demand searching for yield beyond the blue-chip cryptos, Solana's high-throughput network presents a compelling narrative. It's a bet on the future of decentralized applications and the financial activity they generate—activity that now has a direct pipeline to traditional finance portfolios.

One cynical finance jab? It's the classic playbook: first ignore an innovation, then dismiss it, then fight it, and finally, build a revenue stream on top of it. The suits are finally here.

The bottom line: This integration is less about a single token and more about legitimizing an entire layer of the crypto economy. It signals that for big players, the conversation has shifted from 'if' to 'how'—and speed matters.

Indices

Markets leaned modestly risk-on over the last session, with crypto and growth assets leading while defensives lagged. BTC outperformed on the day (+1.6%), while the Nasdaq 100 (+0.1%) and Gold (+0.1%) were effectively flat, and the S&P 500 slipped modestly (-0.4%), reinforcing the view that incremental risk appetite was concentrated squarely in crypto rather than across broader macro assets. Intraday volatility was noticeable across all lines, but dips were consistently bought, particularly during the US trading window.

Within crypto, today’s tape was defined by aggressive rotation into trading themes. Launchpads (+3.9%) led the complex by a wide margin, followed by the Solana ecosystem (+2.3%) and DEXs (+2.1%). Crypto Miners (+1.9%), tokens with Buybacks (+1.9%), Exchange tokens (+1.9%) and plays like RWA (+1.9%) also finished green. On the other side, several categories saw sharp givebacks. Gaming (-6.4%) was the clear laggard, with Lending (-3.7%), Revenue Leaders (-3.5%), ethereum ecosystem (-3.5%), and Memes (-3.4%) all posting steep declines.

Within Revenue Leaders, HYPE (-3.0%) continues to underperform as concerns around sustainability, take fees and competition arise. Meanwhile, AAVE (-3.8%) was the worst performing asset in the index as concerns around Aave Labs and DAO alignment continue. This is despite Aave founder Stani Kulechov swapping almost $10 million of wrapped ETH into AAVE to signal “alignment” with the token.

Overall, the market action suggests tactical rotations rather than a broad risk-off shift. Volatility remains elevated and flows appear selective. Sustained follow-through will likely depend on BTC’s ability to hold recent gains and reassert leadership.

Market Update

Jupiter has integrated with Coinbase’s onchain trading stack to power swaps for Solana-based assets, bringing one of Solana’s most important liquidity layers directly into a mainstream crypto interface. The integration allows users to trade Solana tokens via Coinbase’s onchain experience, while Jupiter handles routing and execution across Solana DeFi in the background.

On average, Jupiter generates around $4 million in monthly revenue from its aggregator (ultra) offering and this integration paves the way to monetize this further.

So what’s actually happening? Well, rather than listing new solana assets directly on a centralized order book, Coinbase is leaning into onchain rails. Jupiter acts as the execution engine, aggregating liquidity across Solana DEXs, optimizing routes, and settling trades onchain, while Coinbase provides the distribution, UX, and on- and off-ramps. For users, this means access to a much broader universe of Solana tokens than would typically be available through centralized listings, without needing to leave the Coinbase ecosystem.

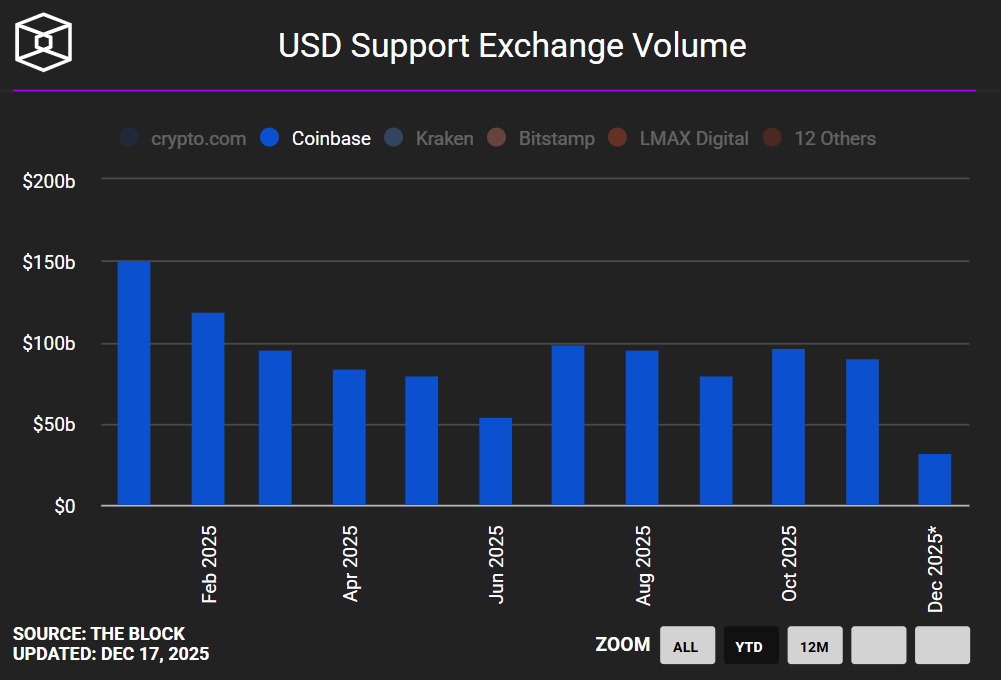

Coinbase is one of the leading exchanges in the world, with a large user base with roughly $80-$100 billion in average monthly trading spot volume.

Similarly, Jupiter already sits at the center of Solana spot trading activity, with roughly $50 billion in monthly trading spot volume.

Together, they significantly expand how Solana-native assets reach retail users. Notably, Coinbase isn’t competing with Solana DeFi primitives here, it’s embedding them. This reflects a broader shift where centralized platforms increasingly act as frontends to onchain liquidity. The logic behind this is that onchain trading removes the long lead times associated with centralized exchange listings, allowing markets to FORM where liquidity already exists. Amid a market downturn, this integration may act as a rerating catalyst for both COIN and JUP by expanding trading volume and revenue potential.

However, permissionless markets cut both ways. Access to more tokens also means exposure to illiquid or malicious assets, so verification, liquidity checks and trade sizing remain essential. The Jupiter-Coinbase integration is less about a single partnership and more about a structural shift, where major exchanges increasingly rely on DeFi infrastructure to deliver broader market access and Solana’s trading stack becomes harder to ignore.

Fundraising and M&A update

Crypto M&A activity has experienced drastic growth over the past several quarters. M&A volume in November 2025 alone reached approximately $10.7 billion, driven largely by Naver’s acquisition of Dunamu (operator of the Upbit exchange) for $10.3 billion.

This follows a strong Q3 2025 where crypto M&A topped $10 billion for the first time, doubling the previous record of $5 billion and representing a 30x jump compared to the same period in 2024. By November 2025, total M&A deal value reached $8.6 billion across 133 deals (excluding the Dunamu mega-deal), exceeding the combined total of the previous four years. M&A has grown from $457,000 in Q1 2021 to $4.2 billion in Q2 2025, which represents a roughly 9000x increase.

The surge has been led by major exchanges executing aggressive expansion strategies. Coinbase completed six acquisitions in 2025, including the $2.9 billion purchase of Deribit, the current leading crypto options platform. Ripple acquired four companies, including the $1.25 billion purchase of prime brokerage Hidden Road, while Kraken completed five acquisitions, including NinjaTrader for $1.5 billion and Small Exchange for $100 million. Recent deals show continued momentum into December, with Paribu acquiring CoinMENA for $240 million, Stripe acquiring wallet provider Valora, Kraken purchasing tokenization firm Backed, and Galaxy acquiring liquid staking protocol Alluvial.

Crypto fundraising has grown approximately 41%: from the previous cycle peak of $4.63 billion in January 2021 to the new high of $6.52 billion in July 2025.

Fundraising activity has been robust throughout 2025, though with more variation month to month. Fundraising peaked in July 2025 at $6.5 billion before decreasing to around $4-5 billion monthly through Q3 and Q4. Notable recent raises include Kraken securing $800 million across two rounds in November (including $200 million from Citadel Securities at a $20 billion valuation), Kalshi raising $1 billion at an $11 billion valuation for its prediction markets platform, Monad completing a $188 million public sale at a $2.5 billion valuation, and RedotPay closing a $107 million Series B for its crypto payments infrastructure. Year-to-date fundraising through November 2025 totaled approximately $36 billion, a significant recovery from the crypto winter years of 2023-2024 when monthly fundraising often struggled to exceed $1 billion.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.