The Productivity Bull Case for Almost Everything: Why 2025’s Tech Stack Is Fueling Unprecedented Growth

Forget the doom-scrolling. The real story isn't about market dips—it's about a silent, compounding revolution in how value gets created. From decentralized finance to AI-driven workflows, the tools for explosive productivity are here, and they're being adopted at a pace that makes traditional software rollouts look glacial.

The New Stack Cuts Out the Middleman

Smart contracts automate compliance. AI agents handle repetitive analysis. Blockchain-based settlement happens in minutes, not days. This isn't just incremental improvement; it's a fundamental rewiring of economic plumbing. The friction that once defined global finance and corporate operations is being systematically deleted.

Capital Flows Where Productivity Lives

Money has a funny way of finding efficiency. While legacy institutions debate risk models, capital is migrating to protocols and platforms that demonstrate measurable output per unit of input. The metric that matters now is throughput—of transactions, of data, of decisions. The systems that maximize it are winning.

Of course, Wall Street will try to package this into a fee-laden ETF eventually—some things never change. But the genie's out of the bottle. The bull case isn't for a single asset; it's for the entire, interconnected engine of modern productivity that's finally hitting its stride. The only question left is who builds the infrastructure, and who's left paying rent on the old one.

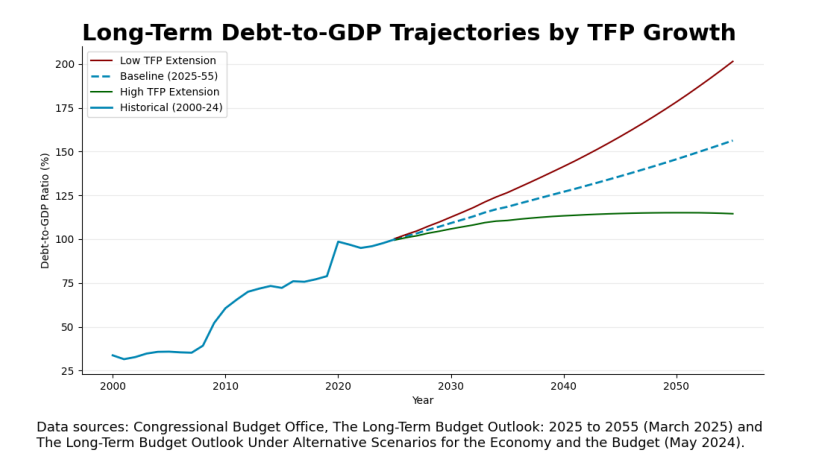

Given the seemingly hopeless state of government finances, maintaining today’s level of indebtedness is a dream scenario that seems too good to be true.

But researchers at Anthropic think we can do even better.

Anthropic conducted a study of 100,000 Claude.ai conversations to “estimate how long the tasks in these conversations would take with and without AI assistance, and study the productivity implications across the broader economy.”

Its conclusion? LLMs could raise total factor productivity by 1.1 percentage points.

1.1%!

If 0.5% would stabilize the US government’s finances for decades, what would 1.1% do? It would probably fix almost everything.

There are reasons to be skeptical of this optimistic forecast, of course.

The study finds, for example, that Claude saves teachers four hours of labor by creating curricula in just 11 minutes. But estimating how such time-savings might lead to higher economic output requires the kind of economic modelling that’s full of best-guess assumptions and false precision.

So, even if Anthropic is right about the time savings, it might be wrong about productivity: It might be that we use all the time AI saves us to do something economically unproductive, like watch more TikTok videos or read more newsletters.

In that case, AI would raise our welfare (more free time) but not our wealth (more economic output) — still great news for people, but no help to governments hoping for a silver bullet solution to their debt problem.

Conversely, there are reasons to think Anthropic’s model is being too pessimistic: “We don’t take into account the rate of adoption” it explains, “or the larger productivity effects that would come from much more capable AI systems.”

In other words, its study assumes we continue to use AI only as we do now and that we’re still using today’s language models, unimproved, for another 10 years.

Language models get noticeably better every few months and we’ve only just started learning how to use them — so Anthropic is right to say its estimate might represent an “approximate lower bound on the productivity effects of AI.”

If so — if 1.1% is the lower bound for AI-induced productivity — we might pay down government debt and have much more time for TikTok.

And that’s only taking into consideration AI’s impact on non-physical work — just wait until we get robots!

To dismiss such Optimism entirely is to think the trillions of dollars that corporations are planning to spend on AI capex and R&D will all be wasted.

Which it might be — technology revolutions don’t always arrive on schedule.

But the biggest reason for optimism is that Anthropic’s 1.1% estimate is based solely on AI “making existing tasks faster to complete” — its model does not account for AI’s potential to completely change the way we complete those tasks.

“Historically,” Anthropic notes, “transformative productivity improvements — from electrification, computing, or the internet — came not from speeding up old tasks, but from fundamentally reorganizing production.”

There’s no way to model these new ways of doing things, but it seems likely its impact will be bigger than the one Anthropic has tried to measure.

Anthropic’s researchers are careful to caveat their hopeful findings by enumerating the limitations of their methodology and documenting the many assumptions they’re making.

And even if all those assumptions work out and AI productivity solves the US government’s debt problem, lawmakers will probably spend their way right back into it.

But given the 100% probability everyone seems to put on looming fiscal disaster, even a small chance Anthropic’s estimates prove correct is a reason to update our priors: The US government’s finances are not as intractable as we think, and the US dollar is not as doomed as we think.

In the long run, productivity is almost everything — and AI might be on the verge of making us a lot more productive.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.