Ethereum’s Fusaka Upgrade Goes Live Today: What You Need to Know

The Ethereum network just leveled up. Fusaka—the latest major upgrade—hits the mainnet today, promising to slash fees, boost throughput, and reshape the developer landscape. It’s not just another patch; it’s a foundational shift.

Why This Upgrade Matters

Fusaka targets Ethereum’s perennial pain points head-on. Transaction costs get a haircut—some estimates point to reductions of up to 40% for standard swaps. Network capacity expands, potentially handling 20% more transactions per second without breaking a sweat. For developers, new opcodes and precompiled contracts unlock smarter, more complex decentralized applications. The goal? Making Ethereum leaner, meaner, and ready for the next wave of adoption.

Under the Hood: The Key Changes

Dive into the technical specs, and you’ll find the magic in the details. A revamped fee market dynamically adjusts gas prices based on network demand—bye-bye to those painful, unpredictable spikes. State expiry mechanisms begin a long-term cleanup of blockchain bloat. And enhanced cryptographic primitives lay the groundwork for a future where privacy and scalability aren’t mutually exclusive. It’s a surgical upgrade, tweaking the engine while the car is still racing down the highway.

The Market’s Knee-Jerk Reaction

As with any major Ethereum event, traders are watching the charts. Initial price action post-announcement was volatile—a classic ‘buy the rumor, sell the news’ dance. Some analysts whisper about a potential re-rating of ETH’s valuation if the upgrade delivers on its promises. Others, ever the cynics, note that even the slickest tech can’t outrun a macro downturn or the whims of crypto Twitter sentiment. After all, in this market, a successful upgrade sometimes just means the crash happens on a faster, cheaper blockchain.

The Road Ahead

Fusaka isn’t the finish line; it’s a crucial mile marker. It paves the way for ‘The Verge’ and ‘The Splurge’—future upgrades focused on statelessness and further optimization. Today’s activation is a stress test of Ethereum’s governance and deployment machinery. Watch the network metrics over the coming weeks: stable gas prices and rising developer activity will be the true report card. The upgrade is live. Now, the real work begins.

Indices

Markets leaned firmly risk-on, with crypto broadly outperforming traditional assets. BTC (+5.8%) sat mid-pack, while equities were muted. The S&P 500 (+0.3%) and Nasdaq 100 (+0.9%) barely budged. Gold (-0.3%) slipped, and crypto miners were the clear outlier to the downside (-8.7%), suggesting profit-taking and sensitivity to BTC’s consolidation.

The crypto sector breadth was exceptionally strong. Oracles, lending and the broader ethereum ecosystem led the board, signaling a clear rotation back into core infrastructure and high-utilization protocols. DeFi, Modular, the Solana ecosystem, and perps followed close behind with similarly solid showings, pointing to broad appetite for beta across liquid alt sectors. Lower down the stack, L2s, AI plays, launchpads and gaming tokens all moved higher, while more speculative areas like memes lagged. The only clear pockets of weakness were crypto equities and miners especially, which saw meaningful pullbacks.

The MOVE fits with improving sentiment as macro headwinds ease. Yields stabilized, liquidity indicators firmed, and positioning metrics suggest investors are adding risk after a muted stretch. Strong rebounds in infra sectors imply expectations for higher onchain activity and potential catalysts from upcoming protocol upgrades. Looking ahead, attention turns to macro prints later this week, which could test the durability of this risk-on tone. Volatility remains compressed, but with crypto sector dispersion widening, traders should expect sharper rotations as narratives evolve.

Market update

Today is Fusaka day in Ethereum land, the second upgrade this year (the Pectra hard fork was in May). It’s not often that Ethereum has two upgrades in one year, and that’s because Fusaka is more of a half-upgrade, according to Gabriel Trintinalia, protocol engineer at Consensys. “During the initial development of the Fusaka upgrade, any feature that carried a risk of delaying the fork, such as those requiring more research or having high complexity, was deprioritized and removed from the scope,” Trintinalia told Blockworks.

There are 12 EIPs scheduled for inclusion in this upgrade, with the headliner being PeerDAS. PeerDAS introduces data availability sampling, which allows validators to share the load of blobs, effectively allowing for an increase in blobs per block. There is one upgrade being overlooked, but first, some background:

Blobs have failed to hit their target of six per block, and just when it looked like they were about to, Ethereum is looking to raise the target again. Technically, Fusaka will not be raising the blob target, but is instead introducing Blob Parameter Only (BPO) hard forks. This creates a separate and easier process to adjust blob storage parameters. So instead of waiting for a major upgrade, Ethereum can make smaller, more frequent adjustments to blob capacity.

The larger point still stands: With supply exceeding demand, the blob gas price has been largely immaterial (apart from a few blips here and there when the blob price reached a measly 1 gwei).

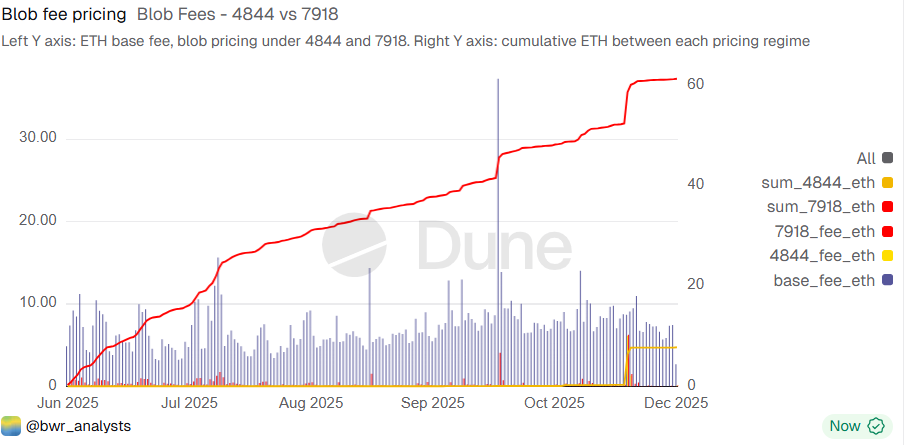

Post-Pectra, between June and October, Ethereum generated around $900 in blob fees. The brief spike in November brought this to ~$23,000. Still not material, but it highlighted the order-of-magnitude difference when blobs actually have a market.

This is why EIP-7918 needs more attention. It addresses the blob fee market problem by introducing a reserve price tied to execution costs (a floor price of sorts). When L2 execution costs dominate blob costs, this prevents the blob fee market from becoming ineffective at 1 wei. For example, as shown below, if EIP-7918 was introduced on June 1, 2025, burnt blob fees WOULD have been nearly 8x more. The upgrade isn’t only a reserve pricing model, it also presents more price stability and predictability, avoiding dramatic fee spikes when the blob market becomes inelastic.

Together with PeerDAS and BPO, this suggests that as Ethereum scales L2 capacity, blob fees should go up as well (historically, this relationship has been strictly inverse). For ETH holders, this, combined with L1 scaling, can hopefully return the ETH supply to a deflationary phase.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.