Unlocking Tomorrow: How Onchain Assets & Smart Contracts Are Reshaping Reality

Forget sci-fi fantasies—the future of ownership is being built onchain right now. Smart contracts aren't just automating transactions; they're rewriting the rules of asset control.

The Key to Everything

Imagine a world where your car unlocks when your NFT wallet pings it—no middlemen, no rental agreements, just code executing flawlessly. That's not a 2030 prediction; it's 2025's bleeding edge.

Wall Street's Cold Sweat

While TradFi still struggles with 3-day settlements, blockchain-based assets transfer instantly. Some hedge funds are paying 7-figure premiums just to retrofit legacy systems—poetic justice for an industry that mocked crypto's 'immaturity.'

The revolution won't be centralized. It'll be self-executing.

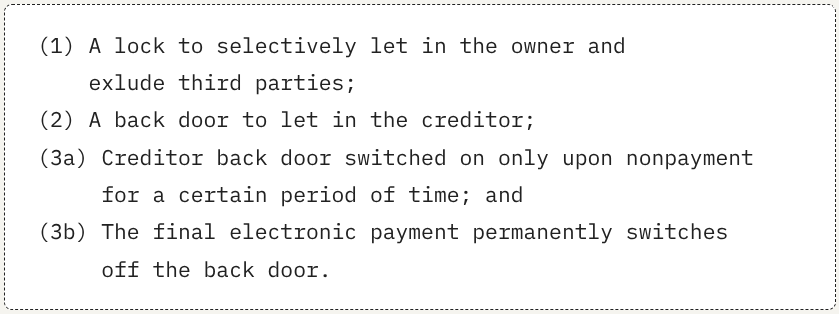

Nothing exactly like that has happened as of yet, but Szabo was at least directionally correct — on two counts: Smart contracts exist, on ethereum and elsewhere, and auto-loan lenders are securing their collateral with remote locks.

Starter interrupt devices (SIDs) that allow lenders to remotely disable a car when a borrower has fallen behind on their payments have become popular with sub-prime auto lenders in recent decades.

This raises some obvious questions: What if you need the car to get to work to make money to catch up on your loan? What if you’re doing 80 on the freeway when your lender decides to disable your auto?

Unlike Joe Chip’s door, you can’t drop coins into the dashboard of a SID-disabled car to unlock it. And good luck getting someone on the phone at the lender to plead your case or even make a payment.

You could, however, quickly top up your payment via smart contract, on a smart phone with a digital wallet.

This is not a new idea, either.

In 2015, Slock.it promised exactly the kind of digital locks (Slocks) that Joe Chip negotiated with: “With Slock, the person who rents your house pays directly to the lock itself. The lock enters into a smart contract with the renter.”

For reasons that remain unclear, Slocks didn’t catch on — or get into production, even.

(The Slock.it team may have taken their eyes off the ball when their side project, The DAO, nearly sank Ethereum.)

But it might also be that they were just early.

If so, now may finally be the time for blockchain-based smart locks.

The infrastructure is built: Chains are fast, transactions are cheap, frontends are user-friendly.

TradFi wants to tokenize everything: Crypto assets have flopped this year, but the enthusiasm for bringing real-world assets onchain has only grown.

Investors want alternative assets: The demand for productive yield outside the shrinking universe of public equities is seemingly insatiable.

Smart contract smart locks might be the way to provide it.

Consider Turkey, for example, where borrowers pay 5% per month on their auto loans, which works out to over 100% per year — 70 percentage points above inflation.

If those loans were tokenized and governed by a smart contract that automatically disables a car when a borrower defaults, wouldn’t that attract investors from everywhere?

BlackRock’s Larry Fink said this week that “tokenization can greatly expand the world of investable assets beyond the listed stocks and bonds that dominate markets today.”

Philip K. Dick predicted the technology. Nick Szabo wrote the manual.

Now, finance just needs to build the door to this investors’ utopia.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.