Bitcoin Dips—But Institutional Whale Gobbles Up $835.6M in Bold Accumulation Play

Market tremors meet megabuyer conviction

While retail traders panic-sell, one heavyweight strategy firm just doubled down—hard. The $835.6M purchase screams contrarian bet as Bitcoin wobbles. Wall Street’s latest ‘buy when there’s blood’ play? Or another case of overleveraged suits chasing last cycle’s ghost?

Funny how ‘risk management’ always means ‘other people’s money.’

Altcoins have similarly not fared well. The only sectors which have outperformed BTC are RWA and no-revenue indices. No-revenue tokens have outperformed slightly due to XRP holding up better than BTC (down only -6.36% over the past week), and RWA tokens have been held up by OUSG (+0.73%) and HASH (-3.44%) this past week.

In terms of worst performers, we’ve seen the crypto-miner, solana Eco, and Modular indices bear the brunt of the pain. Notably, within Solana Eco, MPLX is down -42.36% over the past week (due to an exploit/incident during the PSG1 launch), and JTO is down -26.81% (possibly due to the announcement of Harmonic as a competitor).

Charts for The Week

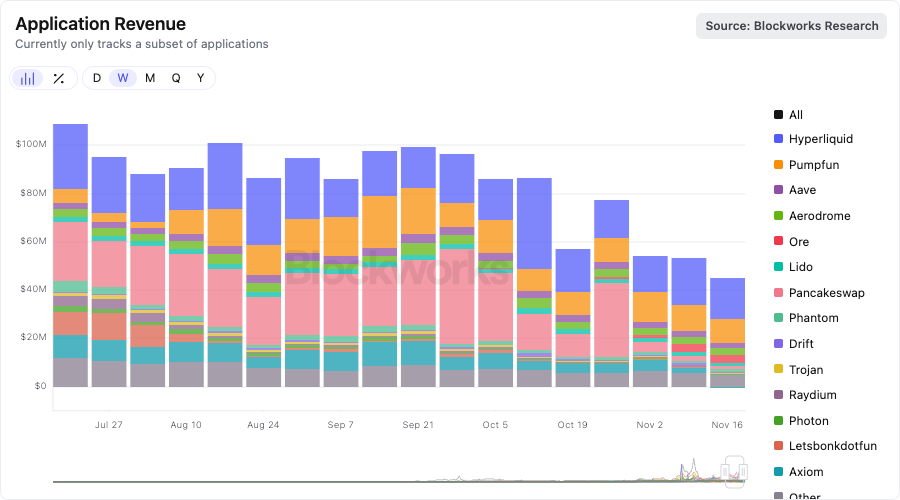

Hyperliquid continues to lead in terms of application revenue, making $17.1 million over the past week, followed by Pump.fun, which made $9.6 million. Despite Pump.fun having a lower multiple based on these revenue figures, the token has held up worse than HYPE. The PUMP/HYPE pair is down 23.4% over the past week.

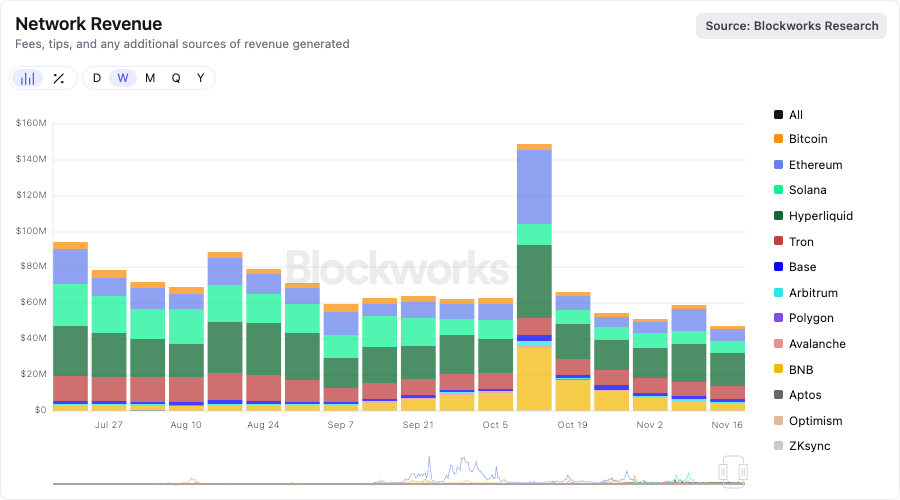

In terms of chain revenue, Solana has held up surprisingly well, despite the continued downturn in memecoin activity (apart from pump.fun). Over the past two months, Solana revenue market share has shrunk from 21% of all chains to 12%. Despite this, the chain still has higher revenue compared to Ethereum, but now sits behind Hyperliquid and Tron.

MSTR outstanding mNAV has fallen to 0.9. Earlier today, Saylor announced that MSTR bought 8,178 BTC for ~$835.6 million at ~$102,171 per BTC. Although Saylor is unlikely to sell, NAV less than 1 makes issuance increasingly difficult, leading to fewer buys and potentially lower mNAV.

In the most recent Upbit 10 listings, the median listing-day price jump was 70%, with an average of 115%, compared to roughly 40% on Binance for non-meme listings — reflecting South Korea’s highly active retail investor base, where enthusiasm for new assets often drives short-term price spikes (read more).

Loopscale deposits have grown by about 28% over the past 90 days to $93 million, with active loans growing at a similar rate to $34 million. For comparison, both Kamino deposits and outstanding loans have experienced negative growth over the same period (read more).

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.