🚀 Bitcoin Smashes Records: Soars Past $124K to Claim Spot as World’s 5th Largest Asset

Bitcoin just rewrote the rulebook—again. The original cryptocurrency blasted past $124,000 today, cementing its status as a global financial heavyweight. Move over, traditional assets—there’s a new contender in the top five.

From internet funny money to institutional darling

No one’s laughing at ‘magic internet money’ now. With this surge, Bitcoin’s market cap now dwarfs most national GDPs—take that, fiat currencies. The asset once dismissed by Wall Street now makes gold bugs sweat and central bankers nervous.

The trillion-dollar disruptor

This isn’t just another price spike—it’s a fundamental shift. Bitcoin’s latest rally puts it squarely in the ‘too big to ignore’ category, even for those stuffy hedge fund managers still clinging to their spreadsheets. Meanwhile, traditional finance scrambles to retrofit 20th-century regulations for this 21st-century phenomenon.

The cynical take?

Somewhere in Manhattan, a banker just ordered another martini after realizing his annual bonus is now worth less than a single BTC. The revolution will be digitized—and it’s coming for your portfolio.

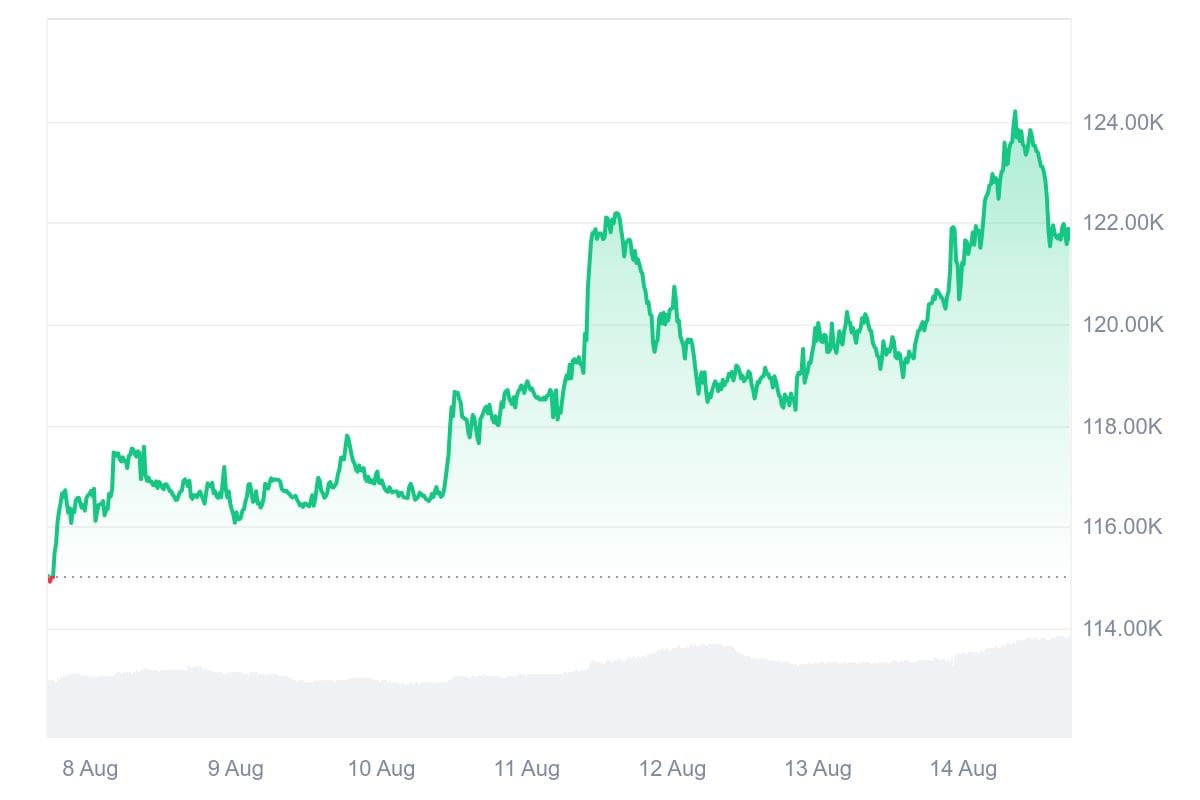

Bitcoin reached a new all-time high of $124,126 on Thursday, breaking above its previous record set in July as the world's largest cryptocurrency continues its march toward mainstream acceptance.

The milestone pushed Bitcoin's market capitalization to $2.4 trillion, making it the fifth-largest asset globally by market value and surpassing Google's parent company Alphabet.

The cryptocurrency has since pulled back to around $121,700 as of publication time.

The rally has been fueled by strong institutional demand through exchange-traded funds, with Bitcoin ETFs attracting $1.89 billion in inflows since Friday. ethereum ETFs have also gained momentum, recording their first $1 billion daily inflow on Monday and continuing with $523.9 million on Tuesday and $729.1 million on Wednesday, according to data from Farside.

Market data shows bullish sentiment remains strong, with Taker Buy Volume reaching $12.24 billion. Mining sell pressure has also eased, with miner reserves dropping from 1.8 million BTC to 1.806 million BTC in recent days.

The Federal Reserve's monetary policy outlook continues to support risk assets, with markets pricing in a 93.9% probability of an interest rate cut in September, according to the CME's Fed Watch tool. Lower rates typically benefit Bitcoin and other cryptocurrencies by reducing the opportunity cost of holding non-yielding assets.

Bitcoin's surge past $124,000 represents a significant psychological milestone as the cryptocurrency trades at levels that seemed unimaginable just years ago. The cryptocurrency's performance has outpaced traditional assets this year, with institutional adoption through ETFs providing a regulated pathway for investment that has attracted billions in new capital.

Stay ahead of the curve with the latest industry news on Blockhead’s Telegram channel!