🚨 Philippines SEC Cracks Down: Unregistered Crypto Platforms in Crosshairs (2025 Alert)

Manila’s financial watchdog just dropped a regulatory hammer—and crypto traders better pay attention.

The Warning Shot: The Philippines Securities and Exchange Commission (SEC) is circling unlicensed digital asset platforms, urging citizens to verify registrations or risk getting burned. No specifics on targets—just a blanket red flag for anything operating outside their sandbox.

Why It Matters: With crypto adoption surging in Southeast Asia, regulators are playing whack-a-mole with offshore exchanges and shady DeFi projects. The SEC’s move follows regional peers like Thailand and Malaysia tightening KYC screws.

The Irony: Meanwhile, traditional banks in Manila still charge 5% forex fees for remittances—but sure, crypto’s the ‘risky’ one.

Active traders, check your platform’s paperwork. The SEC isn’t bluffing this time.

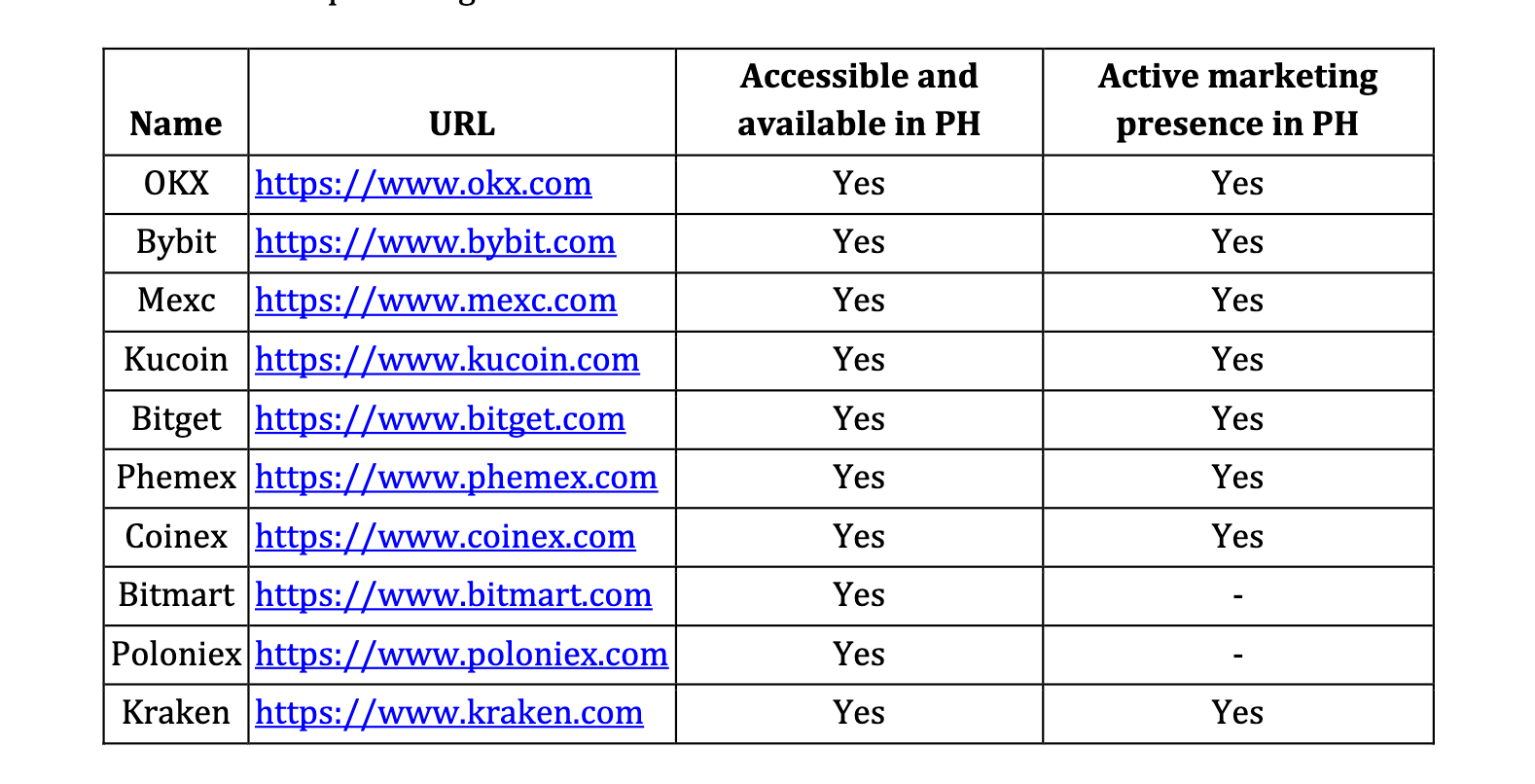

The Securities and Exchange Commission (SEC) of the Philippines has issued a warning to the public about engaging with unregistered crypto platforms, namingthat are "operating without the required registration or authorization from the Commission, as mandated under SEC CASP Rules and Guidelines, which came into effect on 05 July 2025."

This action is part of the SEC's ongoing efforts to protect Filipino investors from financial risks associated with unregulated entities. The advisory went on to highlight the significant risks Filipino investors expose themselves to when dealing with such platforms, such as total loss of their funds, no legal recourse and exposure to fraud, market manipulation, and identity theft.

The regulator also cast doubt on the robustness of due diligence and compliance processes at unregulated entities, citing concerns that these platforms may be exploited for money laundering and terrorist financing (ML/TF), exposing the country to cross-border illicit finance and reputational risk.

The SEC's actions are supported by new frameworks, including, which establish the SEC Rules on Crypto-Asset Service Providers (VASP Rules) and their operational guidelines. These rules mandate that all crypto-asset service providers must register as domestic corporations and have a minimum paid-up capital of P100 million.

The Commission also stressed that it would, "upon complaint, take legal and regulatory action against violators, which may include Cease and Desist Orders, blocking of access to websites and applications in violation or any other appropriate enforcement action.

The commission has taken similar actions in the past against other unregistered platforms. For example, the SEC pursued a geo-blocking enforcement action against.

Additionally, in partnership with the National Telecommunications Commission (NTC), the SEC successfully blocked the website of the unlicensed investment platformafter it was found to be actively promoting its services to Filipinos without the proper registration.

Stay ahead of the curve. Click here to join the Blockhead community on Telegram today.