Galaxy Digital Doubles Down: Snaps Up 4,272 Bitcoin in Q2 2025 While Scaling Back Ethereum

Galaxy Digital just made a power move—loading up on Bitcoin while quietly reducing its Ethereum stash. Here’s why it matters.

The Bitcoin Bet: Galaxy scooped up 4,272 BTC last quarter, signaling aggressive confidence in the OG crypto. No half-measures here—just cold, hard accumulation.

Ethereum Trim: Meanwhile, ETH exposure got a haircut. Maybe they’re tired of gas fees, or maybe they’re just hedging like the rest of Wall Street—only their CFO knows for sure.

The Bigger Picture: Institutions keep playing hot potato with crypto allocations. One thing’s clear: when Galaxy moves, the market watches. (And yes, traditional finance still doesn’t get it.)

Galaxy Digital Increases Bitcoin Holdings, Cuts Back On Ethereum

According to the Q2 2025 report, Galaxy Digital posted a net income of $30.7 million for the quarter, reflecting strong financial performance across its Core business segments. A key milestone during the quarter was the company’s official listing on Nasdaq under the ticker GLXY, which took place on March 16.

Galaxy’s net digital asset holdings now stand at approximately $1.2 billion at current market prices – a 40% increase compared to Q1 2025. The jump in portfolio value was largely driven by the sharp rise in Bitcoin’s price over the past three months.

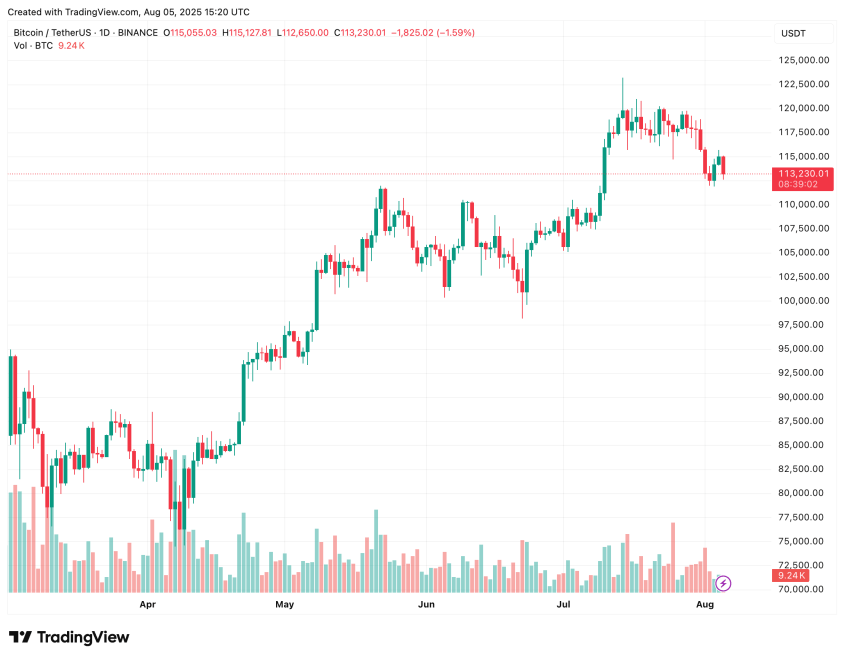

To recap, BTC was trading NEAR $70,500 on March 31. By June 30, it had surged to $108,700, marking a gain of more than 50% in just one quarter.

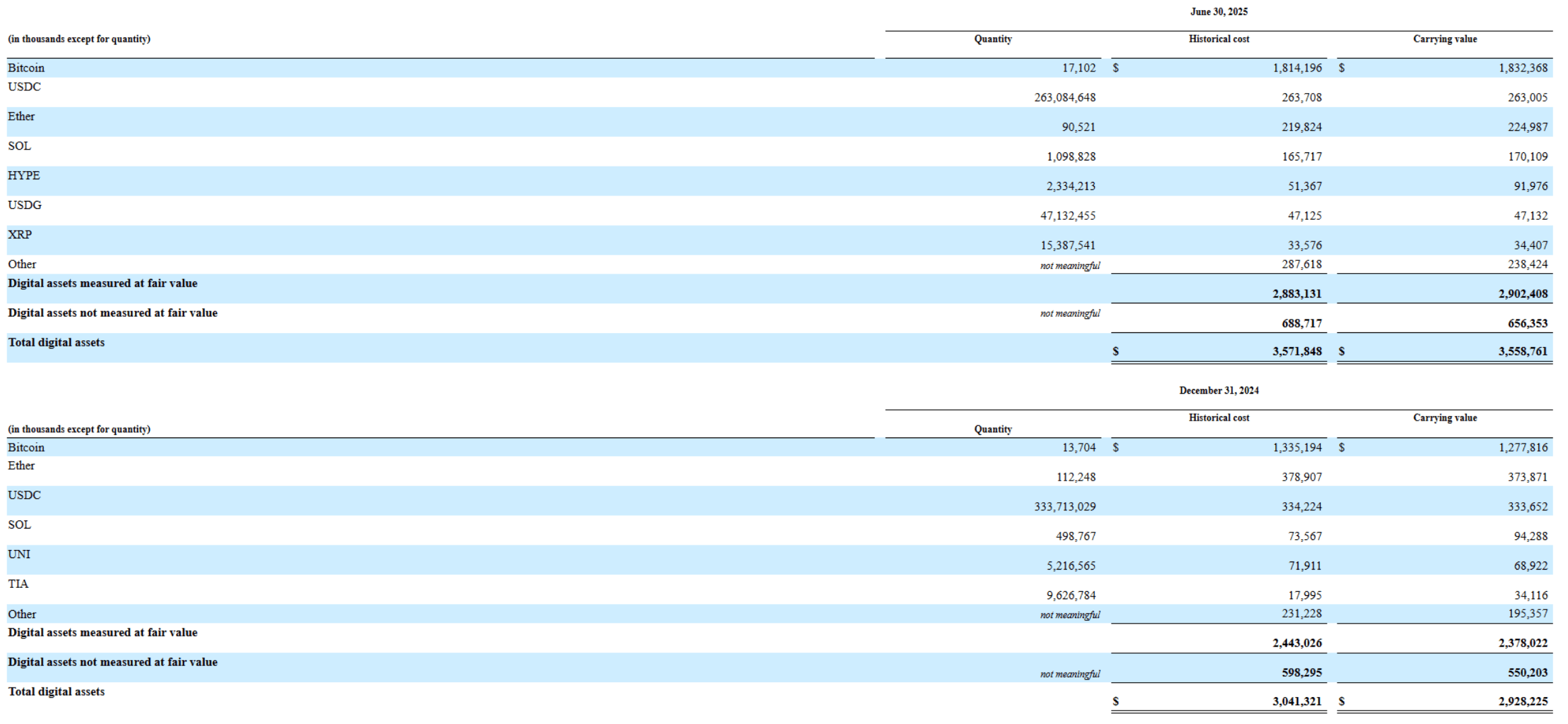

The table below shows that as of June 30, the firm held 17,102 BTC, up from 12,830 BTC at the end of Q1. However, this accumulation came alongside a reduction in the company’s ETH and XRP positions, suggesting a cautious or rebalanced approach toward altcoins.

Specifically, Galaxy’s ETH holdings declined from 155,026 ETH on March 31 to 90,521 ETH by the end of June. Other digital assets in the firm’s portfolio include solana (SOL), Hype (HYP), SUI, and stablecoins such as Circle’s USDC.

In addition to changes in crypto holdings, the firm also reported a strong increase in assets under management (AUM), which rose to $8.9 billion – up 27% quarter-over-quarter. Assets under stake also climbed to $3.1 billion, representing a 34% increase. The company anticipates continued strength into Q3, stating:

July marked the strongest monthly financial performance for our Digital Assets operating business in the firm’s history, with record results in Global Markets and steady progress in Asset Management & Infrastructure Solutions.

Will Galaxy Digital Adjust Its Crypto Strategy?

While Galaxy Digital increased its BTC holdings and reduced ETH exposure in Q2, recent developments suggest the firm may adjust its portfolio strategy based on capital rotation and shifting market trends.

Last week, a Satoshi-era Bitcoin wallet linked to Galaxy Digital initiated a massive sale of 22,700 BTC. The sell-off weighed on the market, bringing Bitcoin’s net realized profit down to $1.4 billion.

Meanwhile, Galaxy Digital CEO Mike Novogratz recently stated that Ethereum is likely to outperform Bitcoin in the near term, citing ETH’s expanding ecosystem and accelerating innovation. At press time, BTC trades at $113,230, down 1.6% in the past 24 hours.