Crypto Bounces Back Fast—But Where’s the Rocket Fuel?

Crypto's latest pullback proved shorter than a Bitcoin maximalist's attention span—but the rebound lacks conviction. Here's why traders aren't popping champagne yet.

The V-Shaped Mirage

Markets ripped higher after last week's dip, yet volume tells the real story: this rally runs on fumes, not FOMO. No cascade of fresh capital, just algorithmic sharks circling stale liquidity.

Institutional Deja Vu

Wall Street's 'crypto curious' still treat digital assets like a Vegas side bet—throwing chump change while waiting for regulators to gift-wrap legitimacy. Spoiler: the SEC's printer is jammed.

The Bottom Line

Until Bitcoin decisively smashes through its last ATH or a major ETF gets approved (we're looking at you, BlackRock), this remains a trader's market—volatile, cynical, and allergic to diamond hands.

The pullback in cryptocurrencies to a three-week low after a record-breaking July didn't last beyond the weekend.

Still, the reversal has only little momentum, with Bitcoin trading a touch above $114,500 after falling to a three-week low of $113,979 last week.

Digital assets surged during and after "Crypto Week," and the OG token hit a new all-time high, just above $123,000, just before US President Donald TRUMP signed the "GENIUS Act" into law.

The drama in a jam-packed week of economic data and events reflected the differing bets and sentiment in financial markets last week.

For cryptos, the biggest jobs data revisions since the pandemic and the firing of the chief of the statistics department played a key role.

Of course, Trump's latest salvo of tariffs weighed on risk assets, with bets of a significant economic hit reflected in the pullback across markets toward the end of last week.

Broadly, July was a record-setting month for global stocks and cryptos.

But trades at the end of the month and the start of August pointed to payoffs turning into pain.

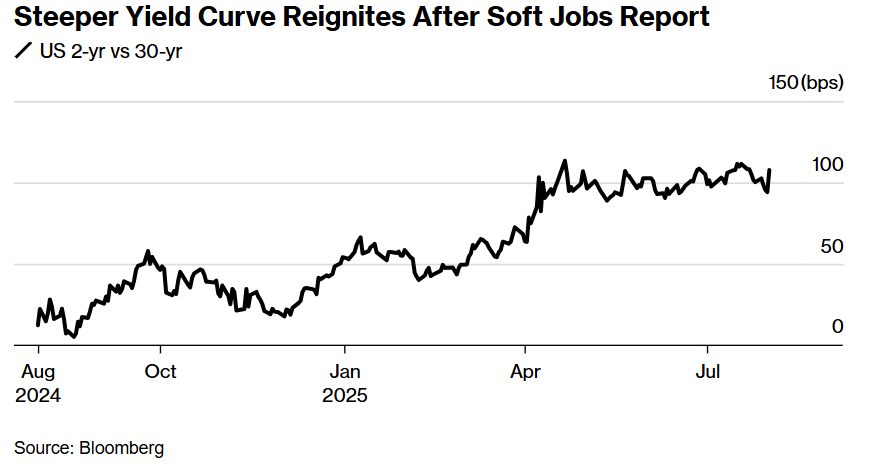

Just as bond investors were beginning to lose faith in one of their preferred strategies, they experienced a resurgence.

Treasuries experienced a significant increase on Friday as an unexpectedly poor US payroll report triggered a wave of buying activity, reversing a month of declines in the bond market.

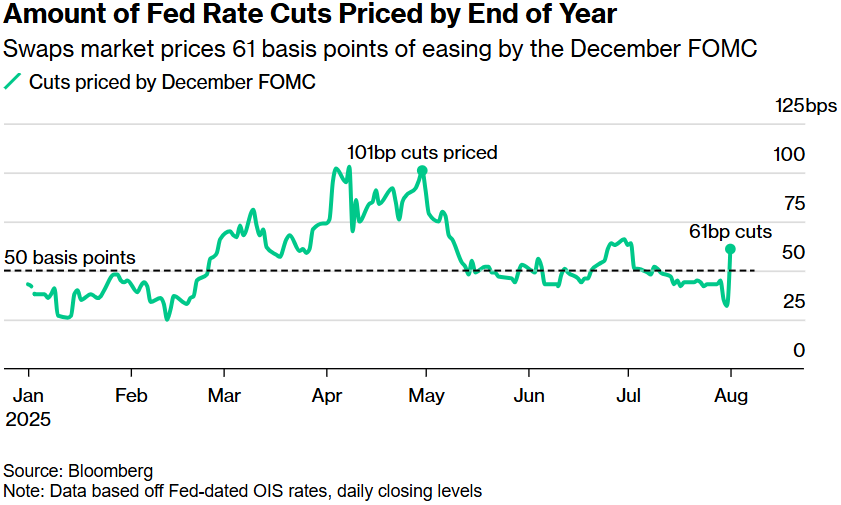

The revised figures, which saw a significant reduction of 258,000 jobs from the estimates for May and June, prompted traders to aggressively place new bets on potential interest-rate cuts by the Federal Reserve.

Overnight-indexed swaps indicated that there is over an 80 percent probability of a cut next month, while also fully accounting for an additional cut by the end of the year.

The unexpected nature of the data propelled a rally across all maturities, with the most significant movement occurring at the short end.

The primary movers were the two-year notes, which are sensitive to interest rates, as their yields dropped by over a quarter point, marking the largest single-day decrease since December 2023.

This resulted in an expanding disparity between yields on short- and long-term debt, benefiting those who positioned themselves in favor of the steepening trend.

This approach had been underperforming since April, resulting in a challenging situation that led to financial losses throughout July, prompting many to exit their positions.

The cost of financing the position played a crucial role: Due to the high expenses associated with maintaining it, a sustained steepening trend is essential to justify holding such a bet.

However, ambiguous economic indicators and uncertainties regarding tariffs have resulted in the market lacking a driving force.

For cryptos, the risk of a recession weighs less than stagflation, which seems to be at play.

Data suggests the Fed's job will get more complicated as we head into September, with the growth momentum slowing and tariffs showing up in inflation more broadly.

Cryptos need Fed rate cuts for their next big leg up.

While bets have surged since Friday for the Fed to bring out its knife again next month amid extreme pressure from Trump, the reasoning of the cut will weigh on markets, eventually.

Any inflation doubts will also weigh on cryptos as the expected two rate cuts this year can easily turn into just one forced reduction and no more.

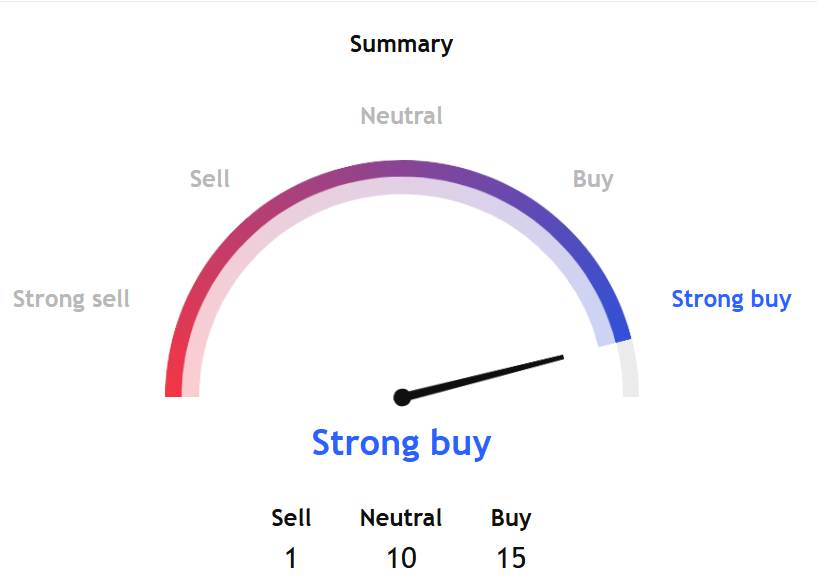

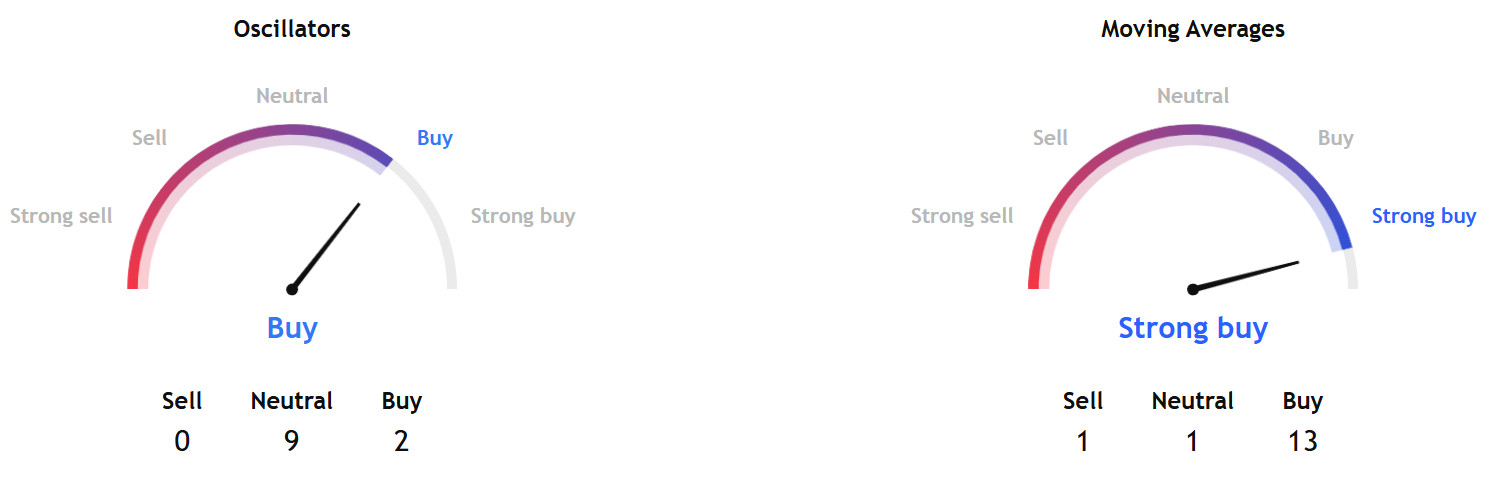

Despite all the sluggish commentary, TradingView's BTCUSD technical analysis summary points to a 'strong buy' signal for the week ahead.

Even the indicators under oscillators, which were 'neutral' last week, have recovered to point to a 'buy' stance, while moving averages show a 'strong buy' signal.

Tradingview's Market Cap BTC Dominance indicator shows the OG token is expected to dominate within the crypto sector once again, stalling a runup in altcoins seen recently.

Market capitalization relative to the total value of all cryptocurrencies is one measure of a coin's supremacy.

You can see the size of a currency about the entire crypto market and how everything else is valued by comparing them.

To get it, take the total market capitalization of all 125 coins, divide it by the market capitalization of a single coin, and then multiply the result by 100.

Separately, InvestTech's Algorithmic Overall Analysis pointed to a 'hold ' signal.

In the one to six weeks recommendations, InvestTech gave a negative score for Bitcoin.

The research noted that a weaker rate is indicated by Bitcoin's breaking of the floor of the short-term rising trend channel.

Following a fake break of the rectangle formation, the price has responded. The token will receive fresh negative signals if it breaks below $114,242, while it will receive a strong positive signal if it breaks above the opposite side of the pattern.

Support for the currency is still at $110,000, while resistance is at $120,800.

There is a poor correlation between the highs and lows of volume and the price peaks and valleys. Another factor that devalues the token is the negative volume balance.

Overall, bitcoin is seen as having a 'negative' technical outlook in the near term.

InvestTech assesses the token as technically 'neutral' for the medium-long term.

Elsewhere

Crypto Curiosity Meets Caution: Navigating Singapore’s Digital Asset Journey SafelySingapore’s crypto revolution is here—but only those choosing regulated, trusted platforms will thrive safely.![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Blockcast

In this episode, we dive into the world of crypto payments with Joey Isaacson, CEO and co-founder of Nook. Joey Isaacson shares his journey from working at tech giants like Facebook and Uber to entering the crypto space through Coinbase. He discusses the challenges and opportunities in making crypto accessible to the masses, focusing on simplifying DeFi lending and the importance of user-friendly design.

Access the episode from your preferred podcast platform here.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

![]()

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code at https://coinfest.asia/tickets.