Bitcoin Defies Tariff Chaos to Reclaim Bullish Throne

Bitcoin shrugs off macro noise as institutional inflows surge

Tariff tantrums? Not in crypto-land. While traditional markets flinch at trade war headlines, Bitcoin’s chart paints a different story—one of relentless demand from whales and hedge funds playing the long game. The king coin isn’t just weathering the storm; it’s stealing liquidity.

Behind the resilience: A perfect storm of ETF approvals, halving scarcity, and that sweet, sweet institutional FOMO. Wall Street’s late to the party (as usual), but their trillion-dollar pockets are finally propping up the market. Meanwhile, retail traders still think ‘buy the dip’ means waiting for a 10% correction.

Cynical take: Watch gold bugs panic as Bitcoin eats their inflation hedge—and their lunch.

Monday started with losses for risk assets in the days ahead of the tariff-pause deadline. US President Donald TRUMP once again threatened to go through with higher reciprocal tariffs with only a handful of deals to show for since the pause in April.

However, Bitcoin regained momentum to rise back again over $109,000 after falling below that level last week. For Bitcoin, $110,000 is acting as a key resistance level at the moment. Whether the OG token breaches its all-time high of about $111,000 will be a key focus for investors this week.

Bitcoin is up about 17% in 2025, after more than doubling in each of the prior two years and gaining momentum since the US approved ETFs and large institutions rolled in.

Heading into this week, risk assets seemed to be immune to Trump's tariffs rhetoric, with Wall Street benchmarks closing out last week at fresh record highs in over a $10 trillion rally since April lows.

Since the tariff-driven turbulence in April, equity markets have risen strongly, with the continued strength of the US economy playing a role. Investors are still wary because the trade war has cast a shadow over inflation and company profits.

At the start of this week, stocks seem to be struggling with their momentum. Once the 90-day tariff deadline expires on Wednesday, we may expect to see high tariff amounts bandied around again.

While this could disrupt the relatively stable volatility circumstances observed for the past two months, it is expected that the impact will be significantly lower than what was observed in April.

Threats of a resumption of 50% tariff levels could briefly hit the benign risk environment.

Due to its recent surge, the S&P 500 is almost ready to trigger a sell signal. Investors may consider selling some of their holdings once the index breaches 6,300, which WOULD be just 0.3% above Thursday's close.

With the House's adoption of a $3.4 trillion budget bill containing tax cuts, bubble risks are expected to increase during the summer.

Next Step for Bitcoin?

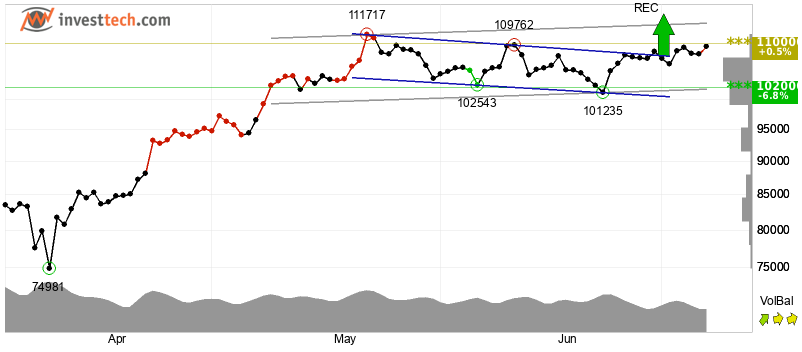

Just last week, Bitcoin hit a new record high weekly close of $109,200. This strongly suggests that, despite the recent volatility in the cryptocurrency market, the bull market is continuing.

For a long time, several analysts thought the market was going to have a prolonged slump.

Nonetheless, strength was evident in the charts and market signals. Major investors maintained their buying, market liquidity continued to rise, and key support levels remained unchanged.

Bitcoin is currently trading at approximately $109,428. While bitcoin has been oscillating between key price zones, the market as a whole has been drifting sideways in recent days. A price breach above $112,000 would signal the beginning of a fresh upward momentum.

In that case, Bitcoin might enter a price discovery stage, opening the door to potential new all-time highs.

The OG token is facing key resistance at $110,000 and the key support levels of $105,500 at the moment.

Last week's strong closing comes at a crucial moment. Important crypto laws and market regulations will be debated during Crypto Week, which begins on July 14, in the United States Congress.

That will potentially attract substantial sums of money from investors, with these rulings expected to provide much-needed clarity to the cryptocurrency markets.

Currently, risk appetite is being limited due to tariff uncertainty. The deadline for final specifics is July 9, and removing them might open the door to more involvement from altcoins.

Many are predicting a likely surge towards the end of July, a decline in August, and then another robust MOVE in September or October.

The price indicators show that Bitcoin has further potential for growth, and the momentum is still bullish.

Although the market is not going to soar to new heights in a single day, it is anticipated to rise steadily before experiencing corrections and consolidations.

What Technical Analyses Are Telling Us?

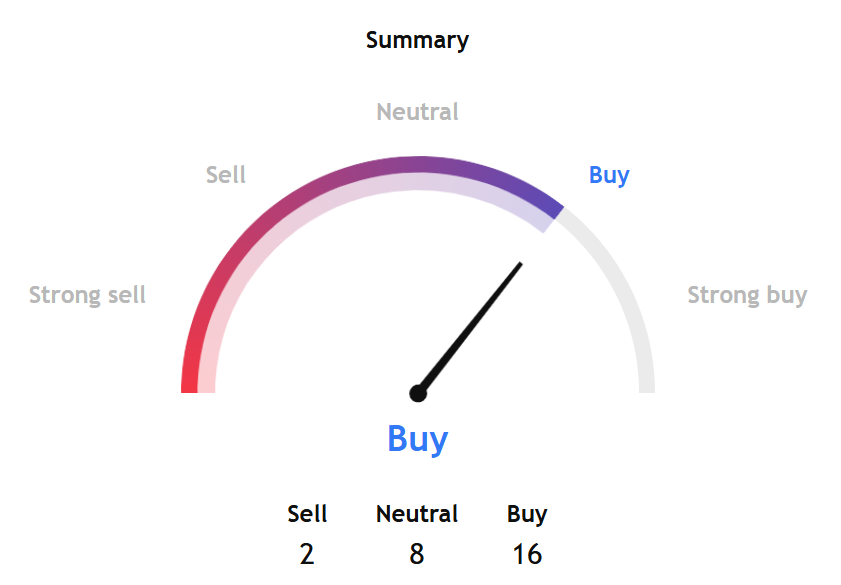

TradingView's BTCUSD technical analysis gauge shows a 'buy' signal in the overall summary for the week ahead.

Popular technical indicators, including moving averages, oscillators, and pivots, FORM the basis of TradingView's Bitcoin summary.

The summary shows only two indicators pointing to a "sell" signal.

While the oscillators' indicators show a "neutral" stance, the moving averages' indicators show a "strong buy" signal.

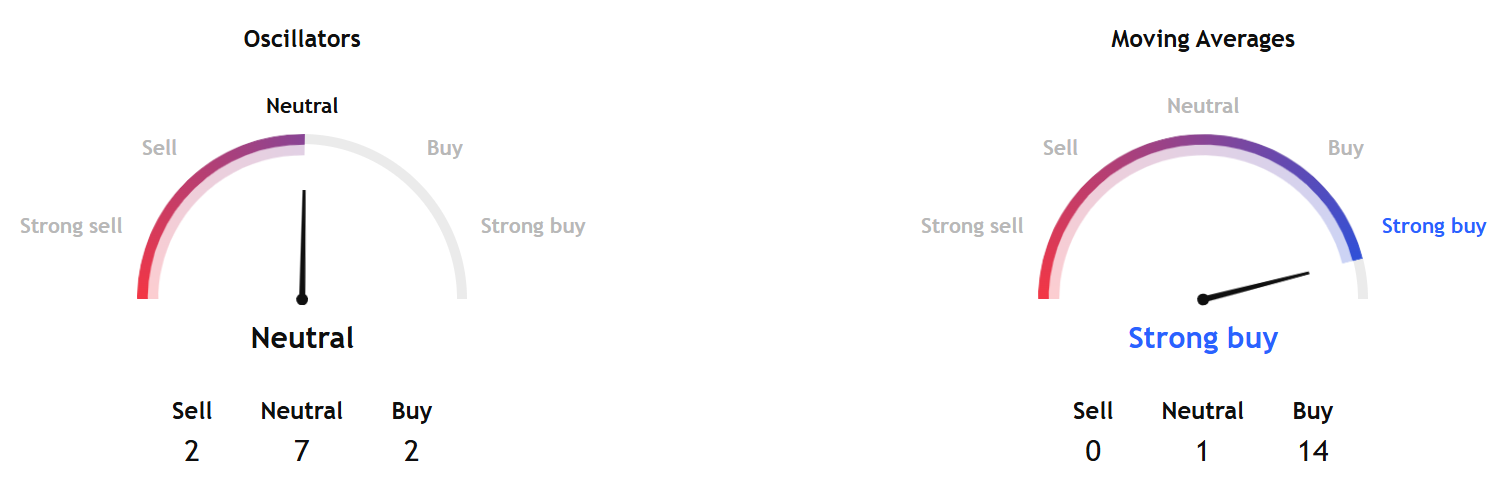

Only the Momentum (10) and Williams Percent Range (14) indicators within the oscillators display a "sell" signal. InvestTech's overall algorithmic analysis for Bitcoin gives a "positive" score. The recommendation for one to six weeks from InvestTech points to a "Weak Positive."

InvestTech's analysis shows that for now, Bitcoin's price is moving within what appears to be a horizontal trend channel. This shows that investors are still unsure of where the market is heading and are waiting for more signs.

If the break is upwards, it's a good sign; if it's downhill, it's a bad one.

The breakout of the rectangle's resistance at $107,710 has sent a bullish signal for the token. An additional increase to $115,727 or higher is anticipated.

At $110,000, the OG token is encountering significant resistance, which may lead to a negative reaction.

With the relative strength index (RSI) above 70, the short-term momentum of the cryptocurrency appears to be very favorable.

Investors are becoming more optimistic, which might lead to Bitcoin's price growing even more. But a high RSI can indicate that the token is overbought and could respond negatively.

In the medium term, InvestTech reports that rising trends indicate the token is performing well and that investors are increasingly interested in purchasing it.

At $106,000, the cryptocurrency broke out of its barrier level. This data points to an additional increase.

The rise in the RSI curve is evidence of the trend's positivity.

All things considered, the technical outlook for Bitcoin in the medium to long term appears bullish.

SoSoValue data shows that Daily Total Net Open Interest (Delta) was $1.14 billion last week, suggesting a rise in the number of open contracts for "calls."

This means that market makers are hedging their positions by acquiring more underlying assets, which typically leads to an increase in ETF purchases.

SoSoValue also showed a healthy daily net inflow and an increase in US BTC ETFs' share in Bitcoin's market cap, rising to about 6.3% of the OG token's overall market value from about 6.1% last week.

In terms of technical analysis, Bitcoin is considered somewhat positive in the short term, with a breach of the current all-time high allowing the token to surge even higher.

Elsewhere

Coinfest Asia 2025 Unveils Crypto’s Biggest NamesWith a crypto user base of over 21 million in Indonesia and increased interest in real-world asset tokenization, Coinfest Asia 2025 aims to serve as a platform for deeper conversations, cross-sector integration, and long-term innovation.![]()

![]()

![]()

![]()

![]()

![]()

![]()

Blockcast

This week, host Takatoshi Shibayama interviews Eric van Miltenberg, SVP of Strategic Initiatives at Ripple, discussing the APEX 2025 conference, Ripple's evolution from a payment-focused company to a broader financial solutions provider, and the future of the crypto industry.

They explore the similarities between the internet boom and the current blockchain landscape, the importance of regulatory clarity, and the potential of tokenization in various sectors. Eric shares insights on Ripple's strategic acquisitions and the company's commitment to addressing real-world problems through innovative technology.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

![]()

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code at https://coinfest.asia/tickets.