Bitcoin Bulls Charge Past Market Noise—Here’s Why They’re Not Sweating the Dip

Volatility? Just another Tuesday for crypto true believers.

While paper hands panic-sell, long-term holders keep stacking sats like it’s 2021. The real play? Zooming out past the 15-minute charts.

Fun fact: Traders who held through 80% drawdowns now laugh all the way to their cold wallets. Meanwhile, Wall Street still can’t decide if Bitcoin’s a ’risk asset’ or digital gold—classic finance brain.

Despite the largest crypto’s pullback from its peak levels, the options market indicates that traders continue to exhibit strong optimism, as evidenced by open interest hitting a new record high.

Based on data gathered by CoinGlass, the cumulative value of outstanding options contracts in favor of the OG token hit $48.2 billion. The leading digital currency experienced a decline of up to 3.4%, dropping to $107,357 on Friday, following its peak at a record $111,980 the previous day. It’s currently trading at $109,874 as of pubolication time.

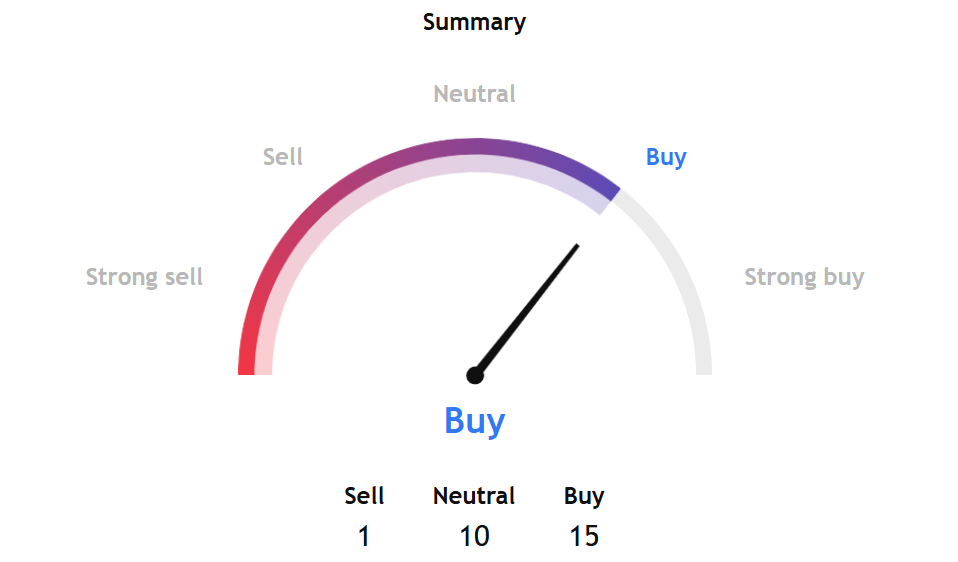

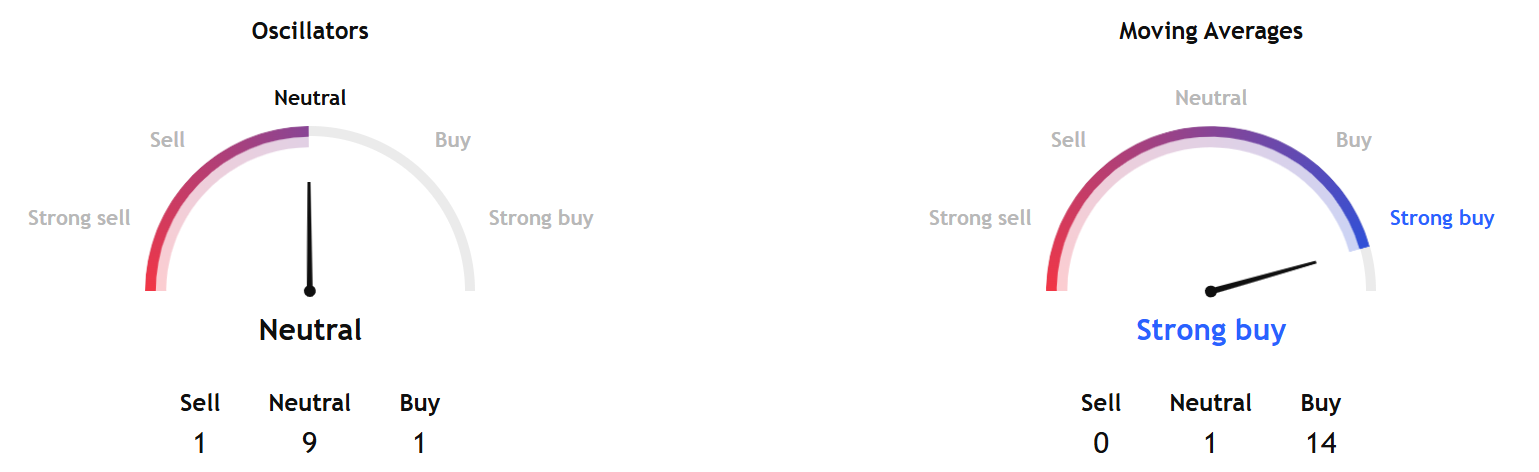

The summary of BTC/USD technical analysis by TradingView, based on an overview of the most popular technical indicators, such as Moving Averages, Oscillators, and Pivots, points to a buy order.

Compared to last week, TradingView shows oscillator indicators pointing to ’neutral’ from ’sell’ and moving averages indicators reflecting a ’strong buy’ signal.

Only the MACD level (12, 26) shows a sell signal under the Oscillators indicators.

SoSoValue data shows The Daily Total Net Open Interest (Delta) at $662.17 million, reflecting an increase in open contracts for Calls. This suggests that market makers are hedging their positions with more underlying assets, which usually means more ETFs.

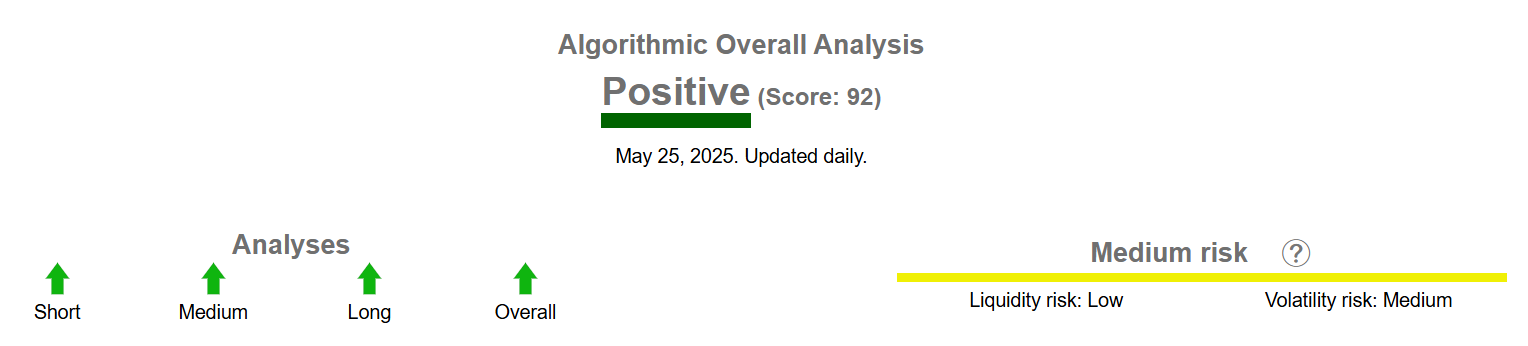

According to InvestTech, the algorithmic overall analysis points to a positive score of 92, which suggests the bull run is here to stay.

InvestTech’s short-term analysis says that the rising trends show that Bitcoin is doing well and that investors are becoming more interested in buying it. The price chart does not show any obstacle to further ascent. In case of a bad reaction, support for the currency is around $103,400.

The OG token is strengthened by a positive volume balance, meaning that volume is high when prices are rising and low when prices fall. There is a potential for a downward reaction when the RSI diverges negatively from the price. From a technical standpoint, the cryptocurrency is looking good in the near future.

InvestTech’s recommendation for one to six weeks is positive, with a score of 95.

Separately, data from crypto options exchange Deribit shows large volumes of call options with strike prices of $120,000 to $300,000 expiring on June 27. Deribit currently oversees almost $35 billion in cryptocurrency options.

Stay ahead of the curve. Join the Blockhead community on Telegram @blockheadco