Solana Price Prediction: Analysts Bullish on $250 SOL After Galaxy Digital’s Massive $306M Treasury Move

Galaxy Digital just dropped a $306 million vote of confidence in Solana—and analysts are racing to upgrade their price targets.

The institutional whale move signals serious conviction in SOL's infrastructure play. Galaxy isn't dipping toes—it's diving headfirst into what many see as Ethereum's most credible competitor.

Price targets getting aggressive. $250 SOL is now in play according to street analysts, who point to the treasury move as validation of institutional accumulation patterns. They're betting that where Galaxy goes, other funds follow.

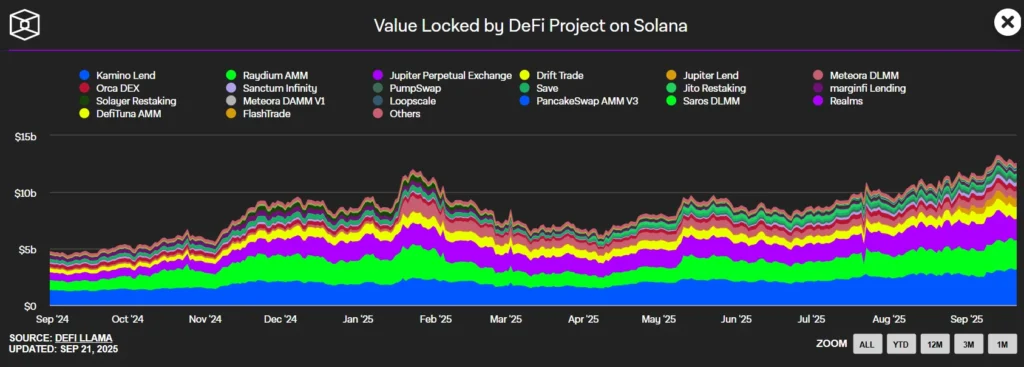

Timing isn't random. This comes as Solana's DeFi ecosystem hits escape velocity—though cynics might note Galaxy's timing is, as always, impeccably self-serving. Because nothing says 'conviction' like buying after a 200% run-up.

Watch the flows. If other institutions mirror Galaxy's play, SOL could see a supply crunch faster than a VC cashes out on retail. The message? Smart money is building positions—whether Main Street keeps up is tomorrow's problem.

Solana (SOL) has been on the institutional radar, with investors and market analysts believing that thegiven the recent increase in holdings by Galaxy Digital treasury to. The sixth-largest crypto is also rising with its bullish performance, with the rise in demand by corporate treasuries, and more ETFs gaining exposure.

In the meantime,is an altcoin that is poised to break out in 2025, and with theearly adopters are tracking the altcoin during this bull market.

Solana Price Poised for a Rally to $250

Technical indicators point to the fact that solana is about to make a decisive move to reach $250. SOL has recently broken a rising pattern, and it is now challenging an important point of resistance at approximately, which theare upholding very effectively.

Analysts observe that closing above this level daily may spark off a rapid rise to, since historically, there is low liquidity above the present levels.

Even more bullish are long-term models other than the short-term target. Fibonacci extension levels show that there is a possibility of hitting targets, and the market forecasts show that there are possibilities of hitting the

The DeFi activity and network development are quite high as theis over, which ranks second only to Ethereum. This is one of the assets that the chain has in support of the thesis that the market will remain on an upward trend in the coming months.

Institutional purchasing is a plus to the Solana bullish formation. Companies with an investment in funds and treasury are making continuous investments as long-term strategies to have exposure to blockchain. This accumulation wave lowers the supply and preconditions the situation when thecan take place, rushing Solana to new all-time highs.

Galaxy Digital Treasury Boost

Institutional focus increased whenvalued at $306 million in just one day, and then moved the tokens to its crypto custody account with Fireblocks. Galaxy has a long-term interest in the ecosystem of Solana, as it acquired a total of 6.5million SOL tokens worth aboutbillion over the course of five days.

This huge takeover was in line with other strategic actions. Galaxy raisedin collaboration with Multicoin Capital and Jump Crypto, on behalf of Forward Industries, a business rebranding to be the. These treasury operations at corporations lead to a steady demand, which sustains the price of Solana at the expense of market liquidity.

The use of ETFs also confirms the position of Solana. CoinDesk Crypto 5 ETFcreated by Grayscale that now includes Solana in addition to Bitcoin and Ethereum, provides institutions with a regulated exposure to SOL. This combination of thewith corporate treasury purchasing gives a solid base to the growth of the prices.

As these institutional and ETF-oriented inflows start picking up, Solana has had a better market story., in its turn, is becoming a similar opportunity to investors willing to pursue the same early-stage high-growth opportunities in the altcoin market.

MAGACOIN FINANCE in the Spotlight

is attracting the interest of investors as one of the most prospective crypto presales of 2025. Itsincreases the price of tokens with every round, giving first movers a bonus and indicating potential positive returns in the long term. This structure is reminiscent of the initial years of the most significant crypto projects, when the first adopters were able to gain exponentially.

In addition, theof MAGACOIN FINANCE are already subscribed to by thousands of investors, which is a good base to increase price in the future. This is topped by the rumor of several more listings in large exchanges, which can lead to a liquidity bonanza.

provide security and transparency, with MAGACOIN FINANCE having the strongest fundamentals andpotentially, making the crypto one of the most discussed altcoins of the year.

Conclusion

Solana is in high demand with the institutional momentum, as$306 million, enlarging its ETFs, which is taking SOL to a potential. Meanwhile,is a high-upside presale giving early adopters the possibility to invest in a project with

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance