Ethereum Surges Back to $3,900—$4,000 Target Now in Sight as Bulls Charge

Ethereum flexes its muscles again, punching through $3,900 resistance like a trader ignoring risk management. The next stop? A psychological battleground at $4,000—where Lambo dreams and margin calls collide.

Fueling the rally: A mix of spot ETF speculation and developers actually delivering upgrades (for once). Meanwhile, Bitcoin maximalists grumble into their orange-pilled coffee.

Technical outlook: The daily chart shows clean breaks above key moving averages—rare elegance in crypto’s normally chaotic price action. RSI flirts with overbought territory, but since when did that stop a proper FOMO rally?

Institutional whispers: Grayscale’s ETH trust premium turns positive as Wall Street hedgies dip toes in—probably just hedging against their own VC shitcoin bags.

Closing thought: If this holds, $4K becomes a self-fulfilling prophecy. If not? Well, there’s always the ‘long-term hold’ copium. Either way, the gas fee extortion continues unabated.

Ethereum (ETH) price is back to $3,900, according to fresh data posted today by market analyst Michael van de Poppe. The largest altcoin has experienced a notable recovery, exploring around the $3,900 region after a recent consolidation. This resurgence has been triggered by robust market conditions and increasing trading volumes, which give the asset the strength to potentially surpass the $4,000 resistance zone.

$ETH is back to $3,900 and is likely going to attack that $4K resistance in the coming days.

The markets are strong, volume is picking up, more volatility is coming in and the joy will be back.

Why ETH is Bullish

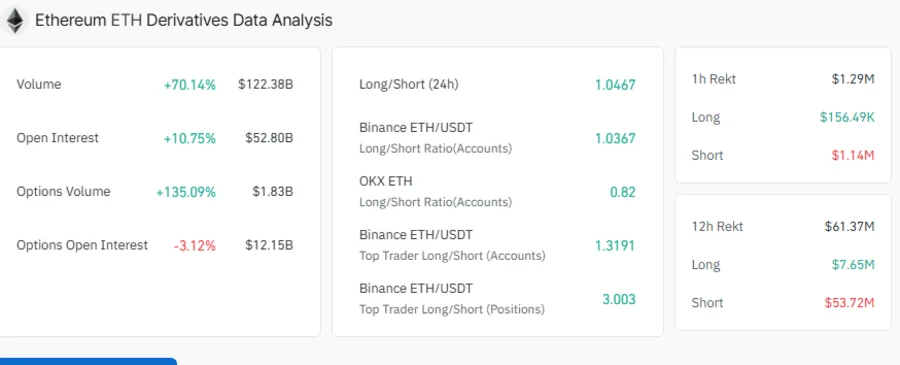

ETH’s performance has been supported by multiple catalysts. The asset has performed better than solana (SOL) in inflows of funds, as indicated by the SOL/ETH Hot Capital Ratio, which is in a clear downtrend, now its YTD low at 0.045. This suggests users increasingly prefer ETH over SOL. Furthermore, ETH Open Interest (OI) has increased to $52.80 billion, surging by 10.75% over the past 24 hours.

Another important factor is that institutional investors continue purchasing ETH tokens. According to data from Lookonchain, today, an unknown institution created a new wallet and bought 10,396 ETH worth $40.6 million from FalconX. Also, four days ago, the whale created six wallets and bought 171,015 ETH valued at $667 million from trading platforms, including FalconX, Galaxy Digital, and BitGo.

Ethereum buyers, especially long-term customers and institutional participants, are displaying robust belief in the asset’s capability. With every decline in the market, these consumers are purchasing more Ether tokens, significantly increasing their holdings. This behaviour is considered an indicator of robust enthusiasm in Ether’s potential and its capability to perform better during this market cycle. The buying spree has been noticed since Q1 this year when Bitcoin crossed a ground-breaking $100,000 in late January, an event that also triggered the start of a bull market phase for altcoins.

What’s Next for ETH?

As the Ether price now nears to breach the $4,000 resistance level, market participants are keen on whether the asset could maintain the upward movement. If it can manage, it is anticipated to continue its uptrend toward $4,074 and higher, reaching unprecedented levels in the process.