Solana’s New Rival Storms Crypto Scene: $32M Raised in Just 60 Days – What’s Fueling the Frenzy?

Move over, Solana—there's a new speed demon in town. A fresh blockchain contender has rocketed past the $32 million funding mark in two months flat, sending shockwaves through the crypto space. But what's driving the hype train?

The Lightning-Funded Challenger

While established chains battle scaling issues, this mystery project's war chest suggests institutional investors see blood in the water. That $32 million didn't materialize from memes and wishful thinking—smart money's placing bets on something disruptive.

Solana's Scaling Nightmare Meets Its Match?

With Solana's well-documented congestion woes, the timing couldn't be more brutal. The new protocol's backers are clearly banking on history repeating itself—remember how Ethereum killers emerged during gas fee frenzies?

The VC Angle: Deja Vu or Legit Threat?

Let's be real—Wall Street's crypto tourists love nothing more than a shiny new blockchain to overhype before the inevitable rug pull. But $32 million in 60 days? Even the most cynical hedge fund bros can't ignore those numbers.

One thing's certain: the 'Solana killer' narrative sells itself. Whether this is another vaporware project or the real deal, the fundraising alone guarantees we'll be hearing plenty more—until the next shiny object distracts the crypto crowd.

The Solana price performance in the first week of August hasn’t been too promising compared to the other giants. On the flip side, Unilabs Finance is making news as the next-generation AI asset management platform with over $32 million raised in 60 days. This AI-powered platform is positioning itself as a new Solana competitor as SOL holders shift capital into the new entrant.

![]()

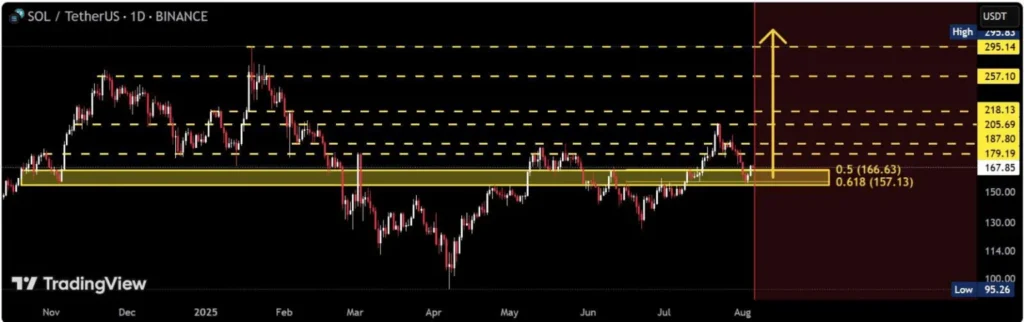

Solana (SOL) has entered August with a tough price trend after it dipped nearly 10% over the past week despite maintaining strong on-chain metrics. The major difference between fundamentals and market performance has left many investors questioning the solana price action and its short-term outlook amid the market volatility.

Source: TradingView

Total Value Locked (TVL) for SOL has grown by 2.67% in the last 24 hours. User retention is stable, and protocol-level throughput continues to scale impressively, with a 500% month-over-month increase in stablecoin growth within the ecosystem. These positive metrics stand in stark contrast to the solana price action.

Institutional interest shows mixed signals for the current Solana price trend. DeFi Dev Corp. reported a sharp 91% month-over-month increase in SOL exposure in its July earnings release. The firm now holds 1.18 million SOL, valued at approximately $204 million, representing a 112% increase in value month-over-month.

Source: TradingView

However, this aggressive institutional accumulation hasn’t translated into proportional Solana price growth. While SOL closed the month up by 11.57%, ethereum rallied by 48.76% in the same period. Market data suggests that smart money is currently favoring Ethereum over Solana price appreciation.

In comparison, ETH has seen a sharp rise in wallets holding over 10,000 ETH, while Solana is experiencing a decline in this large holder bracket. This trend is further weakening SOL’s relative strength in the market. The SOL/ETH ratio was testing a key yearly support level at the time of writing.

As the Solana price struggles to soar ahead, Unilabs Finance (UNIL) is securing institutional interest with the potential of landing a 25x growth in the network. This Optimism from Unilabs Finance has convinced the broader investor community to shift their capital to its ongoing presale mania to bet on its $0.009 token as the best Solana alternative in 2025.

The platform’s cutting-edge infrastructure is making noise as the leading PassiveFi network, while most SOL investors prioritize its token over other renowned projects. Since its grand presale launch, the project has surged by a whopping 200% and could score promising rallies in the upcoming cycles.

Unilabs Finance (UNIL) is turning heads with its impressive presale collection after growing enthusiasm boosts sign-ups on the platform overnight. In terms of statistical growth, the platform currently manages $30 million USDC in assets under management (AUM), securely held in cold storage to ensure optimal safety and custody.

For daily traders seeking end-to-end transparency, high returns, and full access to restricted trading environments, Unilabs Finance presents a one-stop investment hub to streamline trading strategies and maximize profit avenues. The platform is also rolling out attractive promotions and bonus offers to fuel its reward-centric approach for global users.

With Solana (SOL) claiming a potential price reversal in the network, Unilabs Finance could shift the spotlight to its fast-selling presale as more and more institutional investors explore its AI-powered platform for promising gains and long-term investment strategies.

Learn more about Unilabs Finance by visiting the presale below.