Altcoins in Freefall: Major Tokens Plunge 10%+ Amid Frenzied Sell-Off

Crypto markets bled red today as altcoins took a brutal beating—double-digit losses swept through top tokens while trading volumes exploded. Was this the long-awaited 'altcoin massacre' or just another Tuesday in crypto?

Blood in the streets (and on the charts)

Market movers got crushed under heavy selling pressure, with no clear catalyst beyond traders suddenly remembering 99% of these tokens have no revenue. Classic 'sell first, ask questions later' behavior from a market that still treats whitepapers like financial statements.

Volume spike hints at panic

The surge in trading activity suggests institutional bagholders might finally be cutting losses—or degenerate traders are doubling down on leverage plays. Either way, liquidity providers are making bank while everyone else checks their portfolio through splayed fingers.

As the dust settles, one truth remains: in crypto, the only thing faster than gains are the corrections. Just ask the 'this time it's different' crowd—they'll have plenty of time to explain during the next Zoom happy hour from their parents' basements.

- Altcoins records losses as traders rotate positions amid heavy market pressure.

- Sui leads in trading volume despite double-digit drop in price.

- Mid-cap and Layer 1 tokens hit by combined selloff across altcoin market.

The altcoin market recorded a decline over the past 24 hours, with several high-volume tokens experiencing price declines. According to crypto market data, large losses affected both emerging and established projects as investor positions and trading behavior shifted under sudden market pressure. Despite the decline in valuations, trading activity remained strong, showing sustained engagement from traders despite the general price correction.

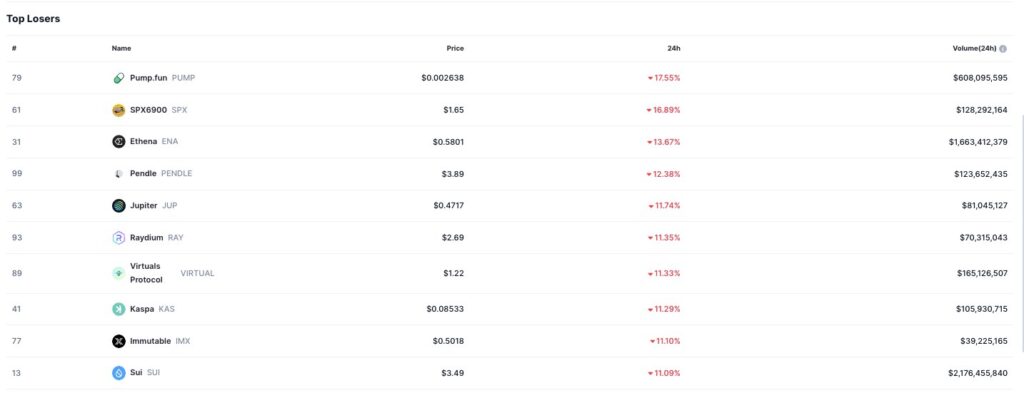

Pump.fun (PUMP) led the decline among top losers, falling by 17.55% to $0.002638. The asset remained highly liquid, with more than $608 million in 24-hour trading volume. SPX6900 (SPX) followed recording, a decline of 16.89% to reach $1.65. Ethena (ENA) also saw a loss, dropping 13.67% to $0.5801. Notably, ENA posted the second-highest trading volume among the listed assets, hitting $1.66 billion.

Losses Extend Across Mid-Cap Projects

Beyond the top three, additional tokens also posted double-digit losses. Pendle (PENDLE) fell by 12.38%, now trading at $3.89. Jupiter (JUP) followed with an 11.74% decrease to $0.4717. Meanwhile, Raydium (RAY) and Virtuals Protocol (VIRTUAL) each recorded losses above 11%, priced at $2.69 and $1.22, respectively. Raydium saw a trading volume of $70.3 million, while Virtuals Protocol reached $165.1 million, reflecting moderate yet active participation during the decline.

These assets, while lower in market cap compared to large caps, remained active in trading channels, implying that traders across the board were responding to market indicators, possibly driven by short-term catalysts or portfolio realignments.

Layer 1 Tokens and Sui Join the Downtrend

Most Layer 1 blockchain tokens did not escape the wider sell-off. Kaspa (KAS) declined by 11.29% to $0.08533, and Immutable (IMX) dropped by 11.10% to $0.5018. Like the rest of the market, such projects, which are usually monitored for infrastructure building and network movement, were also affected by price correction.

SUI (SUI), a LAYER 1 that has heavy market adoption, dropped 11.09% to 3.49. Sui, however, led by trading volume of over 2.17 billion, the highest among the tokens listed.