XRP Price Prediction 2025: Can Institutional Frenzy and Technical Breakout Push It to $4?

- Current Market Overview: Where Does XRP Stand Today?

- Technical Analysis: What Do the Charts Say About XRP's Potential?

- Institutional Activity: Who's Buying XRP Behind the Scenes?

- ETF Developments: How Are New Products Impacting XRP?

- Price Targets: What Are Realistic Projections for XRP?

- Risks and Considerations: What Could Derail the Rally?

- Frequently Asked Questions

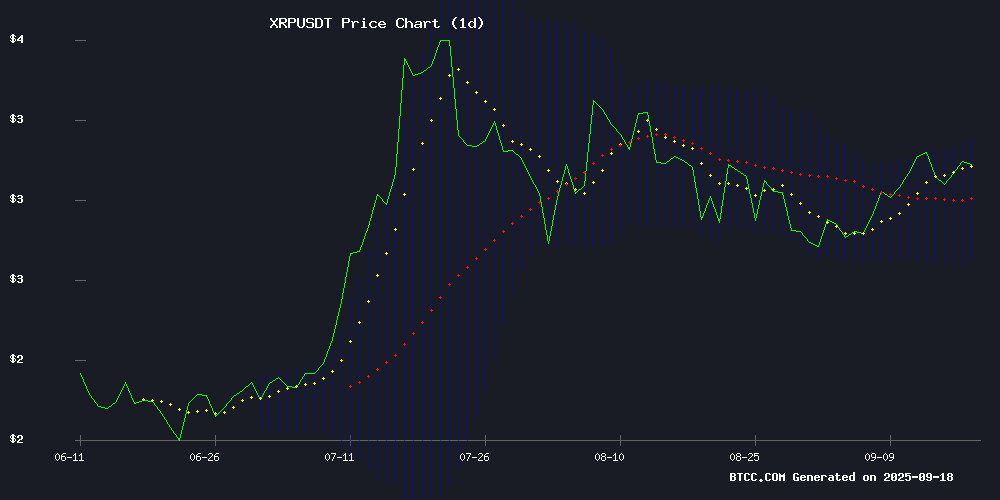

As we approach the final quarter of 2025, XRP stands at a critical juncture, trading around $3.11 with bullish indicators emerging. The cryptocurrency has shown remarkable resilience despite market volatility, with institutional players like BlackRock reportedly accumulating positions and technical patterns suggesting potential upside. This analysis examines whether XRP can reach the $4 milestone, exploring the confluence of technical factors, institutional activity, and market sentiment driving its price action.

Current Market Overview: Where Does XRP Stand Today?

As of September 19, 2025, XRP is trading at $3.115, comfortably above its 20-day moving average of $2.9391, which serves as immediate support. The MACD indicator shows a bearish crossover but with narrowing divergence (-0.1204 MACD line vs -0.0404 signal line), hinting at potential momentum shift. Price action is testing the upper Bollinger Band at $3.1807, a level that could either act as resistance or springboard for further gains.

Source: BTCC Trading Platform

Technical Analysis: What Do the Charts Say About XRP's Potential?

The technical setup presents a compelling case for XRP bulls. The token has formed a descending triangle breakout pattern on the daily chart, with the $3.10 resistance level finally giving way after multiple tests. According to TradingView data, the daily RSI sits at 62 - bullish but not yet overbought - suggesting room for further upside.

"Breaking above $3.18 could open the path toward $3.60 initially, with $4 becoming viable if institutional flows continue," notes the BTCC research team. The Ichimoku Cloud has turned bullish for the first time since June, with price action now above both the conversion and baseline lines.

Institutional Activity: Who's Buying XRP Behind the Scenes?

Market chatter has intensified about institutional accumulation, with unconfirmed reports suggesting BlackRock and JPMorgan have been quietly building positions. While concrete evidence remains scarce, the launch of the first U.S. spot XRP ETF through the REX-Osprey partnership lends credence to institutional interest.

On-chain data shows significant exchange outflows, including a single 146 million XRP withdrawal from Binance last week. Futures open interest has surged to $8.47 billion, up from $7.37 billion just seven days prior, according to CoinMarketCap derivatives data.

ETF Developments: How Are New Products Impacting XRP?

The financial product landscape for XRP has expanded dramatically in 2025. The $XRPR ETF now provides U.S. investors with regulated exposure, while platforms like Solmining offer yield-generation mechanisms for XRP holders. These developments have created additional demand channels beyond traditional exchange trading.

Analysts speculate that ETF approval rumors may have contributed to the September 10 price surge, when 116.7 million XRP changed hands in a single hour - more than double the 24-hour average volume.

Price Targets: What Are Realistic Projections for XRP?

Based on current technicals and fundamentals, here's a probability-weighted outlook:

| Target Level | Probability | Timeframe | Key Drivers |

|---|---|---|---|

| $3.60 | High | Short-term | Bollinger Breakout, ETF momentum |

| $4.00 | Medium-High | Medium-term | Institutional accumulation, technical momentum |

| $5.00+ | Medium | Long-term | Supply shock scenario, broader adoption |

Risks and Considerations: What Could Derail the Rally?

While the outlook appears bullish, several factors warrant caution. Exchange reserves have increased from 2.9B to 3.6B XRP recently, indicating potential selling pressure. The SEC's ongoing scrutiny of crypto assets remains a wild card, though Ripple's legal victories have provided some regulatory clarity.

From a technical perspective, failure to hold above $3.03 support could trigger a retest of the $2.70-$2.90 range. The market also appears somewhat frothy, with altcoins like DeepSnitch AI's token attracting speculative capital away from established assets.

Frequently Asked Questions

What is the current XRP price as of September 2025?

As of September 19, 2025, XRP is trading at $3.115 according to BTCC exchange data, with 24-hour trading volume exceeding $7.5 billion across major platforms.

Can XRP really reach $4 in 2025?

While not guaranteed, the combination of technical breakout potential, institutional demand, and ETF developments creates favorable conditions for XRP to test $4 before year-end. The $3.60 level appears as a more immediate target.

Is BlackRock really buying XRP?

While analyst Versan Aljarrah has speculated about institutional accumulation, including by BlackRock, concrete evidence remains unverified. The launch of XRP-related financial products suggests growing institutional interest, but direct confirmation of specific players' activities is lacking.

What's the best exchange to trade XRP?

BTCC offers competitive trading conditions for XRP, with DEEP liquidity and advanced charting tools. The platform provides secure access to XRP markets alongside comprehensive market data and analysis tools.

How does the XRP ETF work?

The REX-Osprey XRP ETF (ticker: XRPR) holds physical XRP tokens while offering traditional stock-like trading. It provides regulated exposure without requiring investors to manage private keys or use crypto exchanges directly.