SOL Price Prediction 2025: Will Solana Shatter the $200 Barrier With These Bullish Signals?

- What Are the Key Technical Indicators for SOL?

- How Is Market Sentiment Influencing SOL's Price?

- What Fundamental Factors Could Drive SOL Higher?

- What Are the Key Price Levels to Watch?

- Could SOL Reach $200 in 2025?

- SOL Price Prediction: Questions and Answers

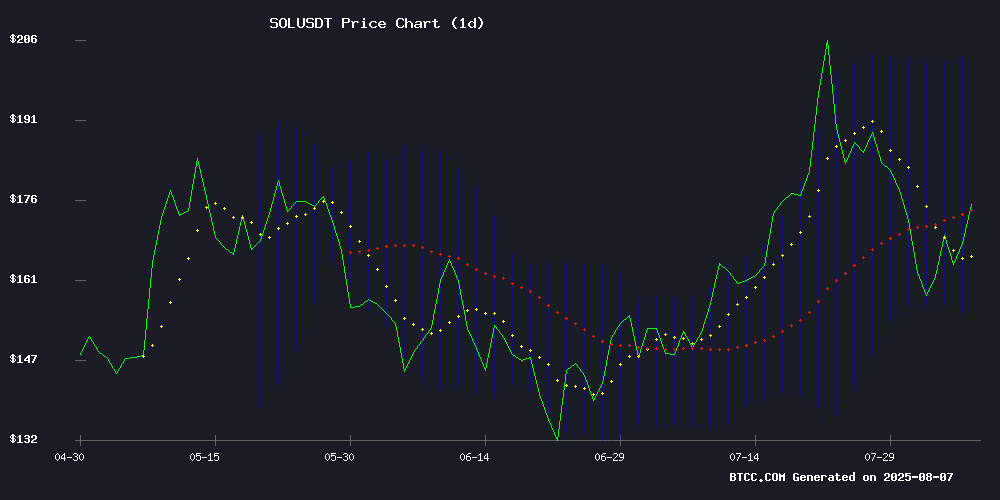

Solana (SOL) is showing intriguing technical and fundamental signals that could propel it toward $200 and beyond. Currently trading at $170.95, SOL faces key resistance at $178.13 (20-day MA) while exhibiting bullish MACD momentum (+9.2878) and tightening Bollinger Bands ($154.29-$201.98). The cryptocurrency benefits from ecosystem growth (50% revenue surge in July), regulatory tailwinds (SEC staking ruling), and strong meme coin activity. This analysis examines whether SOL can break through critical resistance levels to reach $200, exploring technical patterns, market sentiment, and fundamental drivers shaping its price trajectory.

What Are the Key Technical Indicators for SOL?

SOL's current technical setup presents a fascinating tug-of-war between bullish and bearish signals. The price sits at $170.95 as of August 7, 2025, below the psychologically important 20-day moving average of $178.13 - typically seen as a bearish short-term signal. However, the MACD tells a different story with its positive histogram reading of +9.2878, suggesting underlying bullish momentum hasn't been exhausted yet.

The Bollinger Bands are particularly interesting, showing a classic squeeze pattern with the upper band at $201.98 and lower at $154.29. In my experience, these volatility contractions often precede significant price movements. The chart shows SOL testing a contracting triangle pattern with resistance at $168, while the 100-hour moving average provides dynamic support around $165.

Source: TradingView

How Is Market Sentiment Influencing SOL's Price?

Market sentiment for solana leans cautiously optimistic, with several bullish catalysts emerging in recent weeks. The SEC's favorable ruling on liquid staking removed a significant regulatory overhang, while Solana's ecosystem continues to demonstrate remarkable growth. July saw a 50% month-over-month revenue increase to $164 million across Solana applications - outperforming all other Layer 1 and Layer 2 chains for the tenth consecutive month.

The meme coin sector remains particularly vibrant, with Pump.fun reclaiming dominance from letsBONK.fun in a dramatic shift. On August 6, Pump.fun recorded $144.5 million in graduation volume compared to letsBONK.fun's $34.6 million. This meme coin activity, while volatile, drives significant network usage and fee generation.

What Fundamental Factors Could Drive SOL Higher?

Beyond technicals, several fundamental developments could propel SOL toward $200:

| Factor | Impact |

|---|---|

| SEC Staking Ruling | Removes regulatory uncertainty for staking protocols |

| Ecosystem Growth | 50% revenue surge in July across Solana apps |

| Meme Coin Activity | Drives network usage and fee generation |

| Exchange Supply | 10% reduction in available SOL (33.06M to 30.78M) |

The reduction in exchange supply is particularly noteworthy - when SOL's price previously crossed above its exchange supply trendline, it triggered rallies of 18% in six days and 3% in three sessions. This supply squeeze could create favorable conditions for price appreciation.

What Are the Key Price Levels to Watch?

SOL's path to $200 involves navigating several critical technical levels:

- Immediate Resistance: $172 (76.4% Fibonacci level)

- Key Breakout Point: $175 (could trigger move to $182)

- Major Resistance: $200 (upper Bollinger Band at $201.98)

- Support Levels: $168 (triangle resistance), $165 (100-hour MA), $162 (recent swing low)

The BTCC team notes that "a sustained MOVE above the 20-day MA at $178.13 could reignite bullish sentiment, while failure to hold $168 may trigger further downside." The $168-$178 zone remains pivotal for SOL's near-term direction.

Could SOL Reach $200 in 2025?

The $200 target appears achievable but requires SOL to overcome several technical hurdles. The tightening Bollinger Bands suggest an impending volatility spike, with the upper band conveniently sitting at $201.98 - essentially our target. However, SOL must first reclaim its 20-day MA and sustain above $185 to build momentum toward $200.

Fundamentally, Solana's ecosystem continues to outperform competitors in key metrics. The network processed over $525 million in post-graduation trading volume for Pump.fun tokens alone on August 6, demonstrating robust activity. Stablecoin adoption adds another bullish element, with USDC supply on Solana surpassing 12 billion tokens and USDT exceeding 2 billion.

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

SOL Price Prediction: Questions and Answers

What is Solana's current price and key technical levels?

As of August 7, 2025, SOL is trading at $170.95. Key levels include resistance at $172 (76.4% Fibonacci level) and $175, with support at $168, $165 (100-hour MA), and $162. The 20-day moving average at $178.13 serves as important resistance.

What technical patterns are forming on SOL's chart?

SOL is testing a contracting triangle pattern with resistance at $168, while Bollinger Bands show a squeeze between $154.29 and $201.98. A golden cross has formed (50-day MA above 200-day MA), typically a bullish signal.

What fundamental factors support SOL's price growth?

Key fundamentals include the SEC's favorable staking ruling, 50% monthly revenue growth in Solana's ecosystem, strong meme coin activity, and decreasing exchange supply (10% reduction from July 23-August 5).

What are the price targets if SOL breaks resistance?

If SOL breaks $175, next targets are $182 and $192. A sustained move above $200 could open the path to $256 according to some analysts. The upper Bollinger Band sits at $201.98.

What risks could prevent SOL from reaching $200?

Failure to hold $168 support could trigger downside to $162 or lower. Low trading volume at resistance levels or broader market weakness could also delay SOL's ascent to $200.