SOL Price Prediction 2024: Bullish Signals Emerge Despite Short-Term Bearish Pressure

- Is SOL Currently Overbought or Oversold?

- How Does Ecosystem Growth Impact SOL's Valuation?

- What Are the Key Factors Influencing SOL's Price Action?

- SOL Price Projections: 2025 Through 2040

- Frequently Asked Questions

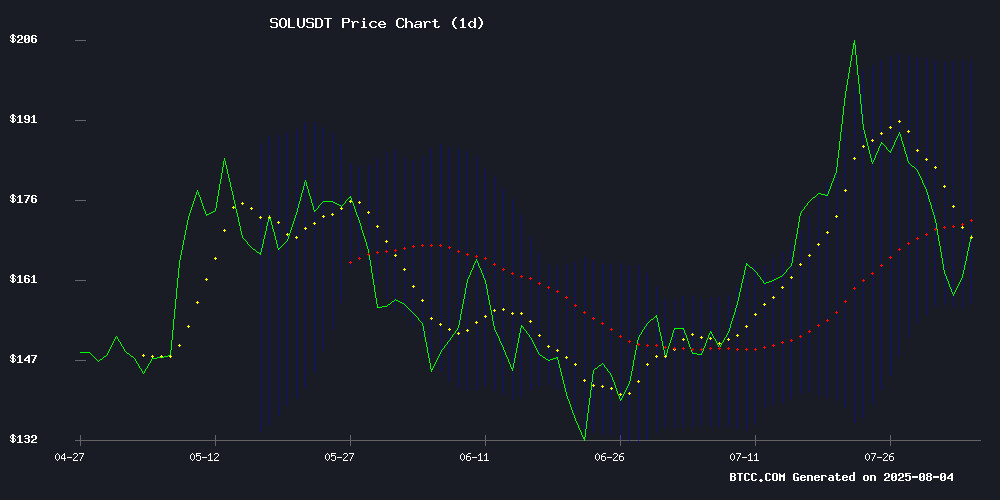

Solana (SOL) presents a fascinating case study in crypto market dynamics - technical indicators flash conflicting signals while ecosystem developments suggest long-term potential. Currently trading at $168.44, SOL sits below its 20-day moving average ($179.27) but shows bullish MACD crossover and oversold Bollinger Band conditions. The recent Seeger smartphone shipments demonstrate real-world adoption, though capital rotation toward AI projects like Unilabs creates near-term headwinds. Our analysis combines technical indicators, on-chain data, and ecosystem developments to project SOL's trajectory through 2040, with price targets ranging from $145-$320 in 2025 to $8,000-$15,000+ by 2040 under optimal conditions.

Is SOL Currently Overbought or Oversold?

SOL's current position at $168.44 reveals intriguing technical contradictions. The price sits 6% below its 20-day MA ($179.27), typically a bearish signal, yet the MACD shows a bullish crossover with the 12-day EMA (1.5249) crossing above the 26-day EMA (-7.9585). The positive histogram value (9.4833) confirms growing upward momentum. Meanwhile, Bollinger Bands place SOL NEAR its lower band ($156.85), suggesting potential oversold conditions. "This divergence between price action and momentum indicators often precedes trend reversals," notes the BTCC research team. The $151-$148 range emerges as critical support, while resistance looms at $179 (20-day MA) and $202 (recent high).

How Does Ecosystem Growth Impact SOL's Valuation?

Solana Mobile's shipment of 150,000 Seeger smartphones represents more than hardware sales - it's ecosystem expansion with economic implications. The 3% price bump following the announcement reflects market recognition of this growth. The Seeger devices feature Seed Vault Wallet technology and access to Solana's dApp Store (100+ applications), creating tangible utility. "We're not just selling phones; we're building an economically aligned mobile ecosystem," explains Emmett Hollyer, solana Mobile's GM. The TEEPIN security framework enables trustless interactions, potentially driving long-term network effects. However, competition emerges as traders rotate capital toward AI projects like Unilabs (with its Market Pulse analytics) and payment platform Remittix, demonstrating the fluid nature of crypto markets.

What Are the Key Factors Influencing SOL's Price Action?

Several concurrent developments shape SOL's trajectory:

| Factor | Impact | Details |

|---|---|---|

| Seeger Smartphones | +3% price increase | 150K units shipped, dApp integration |

| ETF Applications | Potential upside | Grayscale/VanEck filings under SEC review |

| Whale Activity | Short-term pressure | $17M transfer to exchanges |

| HODLer Accumulation | Long-term support | 102% net position increase |

The most intriguing development might be long-term holder behavior. Glassnode data shows a 102% surge in HODler Net Position Change since July 30, with coins moving to cold storage rather than exchanges. This accumulation during price dips historically precedes rallies, suggesting smart money positioning for the next cycle.

SOL Price Projections: 2025 Through 2040

Combining technicals, on-chain data, and ecosystem developments yields these projections:

| Year | Price Range | Catalysts |

|---|---|---|

| 2025 | $145-$320 | ETF decisions, mobile adoption |

| 2030 | $600-$1,200 | Institutional adoption, scaling |

| 2035 | $2,500-$5,000 | Mainstream DeFi integration |

| 2040 | $8,000-$15,000+ | Network effects, potential flippening |

These estimates assume successful execution of Solana's roadmap and favorable macroeconomic conditions. The wide 2025 range ($145-$320) accounts for potential ETF approval/disapproval scenarios, while longer-term projections factor in network effect compounding.

Frequently Asked Questions

What's causing SOL's current price volatility?

SOL faces competing pressures - bullish factors like Seeger smartphone adoption and ETF potential versus bearish technicals and capital rotation to AI projects. This creates heightened volatility as traders weigh short-term signals against long-term potential.

How reliable are these long-term SOL price predictions?

All long-term crypto projections carry significant uncertainty. Our 2040 estimates assume continued ecosystem growth, successful scaling, and mainstream adoption. Actual results could vary substantially based on regulatory developments, competition, and macroeconomic factors.

Should I buy SOL now or wait for a deeper pullback?

With SOL near Bollinger Band support ($156.85) and showing accumulation by long-term holders, current levels may offer favorable risk/reward. However, traders seeking confirmation might wait for a break above the 20-day MA ($179.27) or MACD confirmation. This article does not constitute investment advice.

How does Solana's smartphone strategy differ from other blockchain projects?

Unlike gimmicky "blockchain phones," Solana Mobile focuses on creating an economically aligned ecosystem. The Seeger's SKR token incentivizes participation, while TEEPIN security enables trustless dApp interactions - potentially creating sustainable network effects beyond speculative hype.

What would make SOL reach $15,000 by 2040?

A $15,000 SOL WOULD require massive adoption - think Solana becoming the backbone for decentralized mobile networks, hosting major DeFi protocols, and potentially challenging Ethereum's dominance. While ambitious, crypto's history shows such growth trajectories aren't impossible for leading projects.