World’s Largest Solana Treasury Emerges—$1.65 Billion Fuel Ignites SOL Rally

Massive crypto treasury positions Solana for explosive growth—just as traditional finance scrambles to catch up.

The $1.65 Billion Catalyst

That treasury isn't just big—it's a statement. Solana's ecosystem now commands institutional-level capital, putting it squarely in the big leagues. Forget gradual adoption; this is a tidal wave of validation.

Market Momentum Builds

SOL's price action responds to fundamentals, not just hype. Active addresses surge, transaction volumes break records, and developer activity hits new peaks. The network isn't just growing; it's accelerating.

Institutional Validation

When serious money moves, it bypasses skeptics and cuts through noise. This treasury signals confidence not just in SOL's technology, but in its long-term viability against legacy systems—those slow, expensive pipelines banks still call 'innovation'.

Rally Conditions Optimized

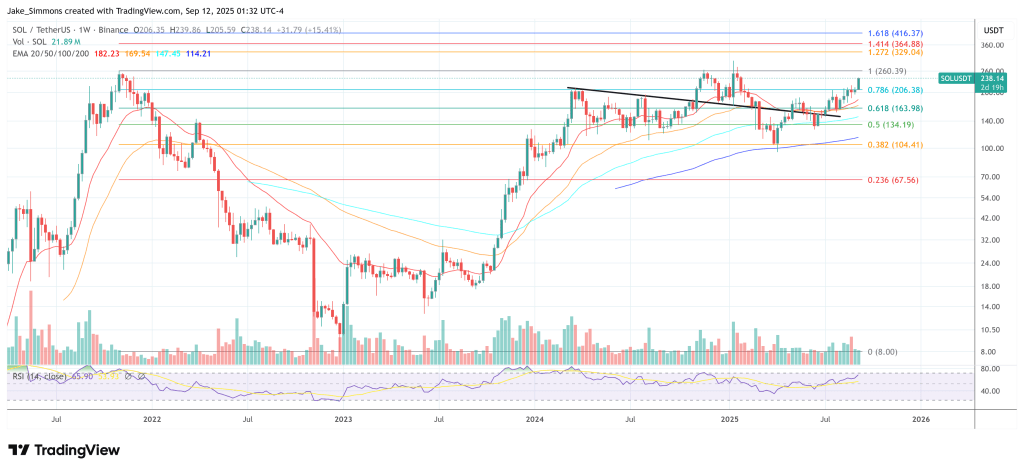

Liquidity meets momentum. With deep reserves backing development and adoption, Solana's positioned not just for a spike, but sustained dominance. The stage is set—watch the charts react.

Galaxy And Partners Build Largest Solana Treasury

Galaxy framed the move as infrastructure-first, not passive exposure. In a newsroom post, the firm wrote: “This will create the world’s largest Solana digital asset treasury strategy, which will use the proceeds for the purchase of SOL… This initiative is not about passive exposure. It is about building institutional-grade infrastructure, deploying capital at scale, and demonstrating Solana’s unmatched ability to support the full spectrum of financial activity—from trading and settlement to staking, lending, and beyond.”

Forward’s SEC-filed press release codifies the mechanics. It confirms the $1.65 billion in gross proceeds, the use of net proceeds “primarily to purchase SOL,” and the governance changes, including Samani’s elevation to chairman. The filing also itemizes a roster of additional participants across funds and founders, and discloses that Cantor Fitzgerald served as lead placement agent with Galaxy Investment Banking as co-placement agent and advisor.

Sponsors are explicit that Forward will operate the treasury, not just hold it. Galaxy’s note describes an “alpha generation” approach designed to compound SOL-per-share faster than simple token appreciation, leveraging Galaxy’s prime and validator stack, Jump’s trading and infrastructure edge (including the Firedancer client effort), and Multicoin’s strategy design.

Forward’s release mirrors that ambition: “By establishing a Solana treasury, Forward Industries is positioning itself to benefit from one of the fastest-growing blockchain networks… through staking, lending, and market making strategies.”

Two execution variables will shape market impact. First is purchase routing: as PIPE proceeds are converted to SOL via a mix of OTC and exchange execution, the cadence and venue choice will determine how much pressure reaches visible spot books versus being absorbed bilaterally.

Second is inventory utilization: staking raises headline yields but reduces liquid float; lending and market-making recycle inventory into liquidity pools, affecting borrow rates, basis and depth around key levels. In all cases, a capitalized, mandate-driven public-company buyer represents a durable incremental bid for SOL—one that tends to register first in derivatives funding, borrow and staking-rate regimes before settling into spot.

On-chain FLOW watchers are already tracking execution footprints. Lookonchain reported late Thursday via X: “Galaxy Digital is helping Forward Industries acquire $1.65B worth of $SOL… In the past 12 hours, Galaxy Digital has withdrawn 1,452,392 $SOL ($326M) from exchanges,” citing Arkham entity data and linking to Forward’s SEC exhibit.

Early Friday morning, Lookonchain added: “Galaxy Digital just bought another 706,790 SOL($160M). In the past 24 hours, their total buy has been a massive 2,159,182 SOL($486M).” Market reaction has been quick. SOL is up about 6% over the past 24 hours, leading major caps on the day at press time.