Bitcoin’s 51% Attack Risk Soars as Just Two Mining Pools Now Control Majority Hashrate

Bitcoin's decentralized foundation faces its greatest test yet as mining power concentrates in alarming new patterns.

Hashrate Hegemony Emerges

Two mining pools now command over 51% of Bitcoin's total computational power—crossing the threshold where protocol integrity traditionally faces existential risks. This isn't theoretical vulnerability; it's mathematical reality playing out in real-time across global mining operations.

The Centralization Paradox

Bitcoin's security model relies on distributed participation, yet market forces consistently push toward consolidation. Mining rewards follow economies of scale—creating perverse incentives that contradict crypto's decentralized ethos. Professional miners chase efficiency while ironically undermining the very system they secure.

Network Security at Crossroads

Potential attack vectors multiply when hashpower concentrates. Transaction reversals, double-spending attacks, and chain reorganization become technically feasible—though economically complicated—for dominant pools. The threat isn't necessarily malicious intent; it's the structural risk created by disproportionate influence.

Finance's cynical take? Wall Street would call this 'operational synergy' while shorting the network's native token. Bitcoin either solves this concentration problem or becomes the very centralized system it was designed to replace.

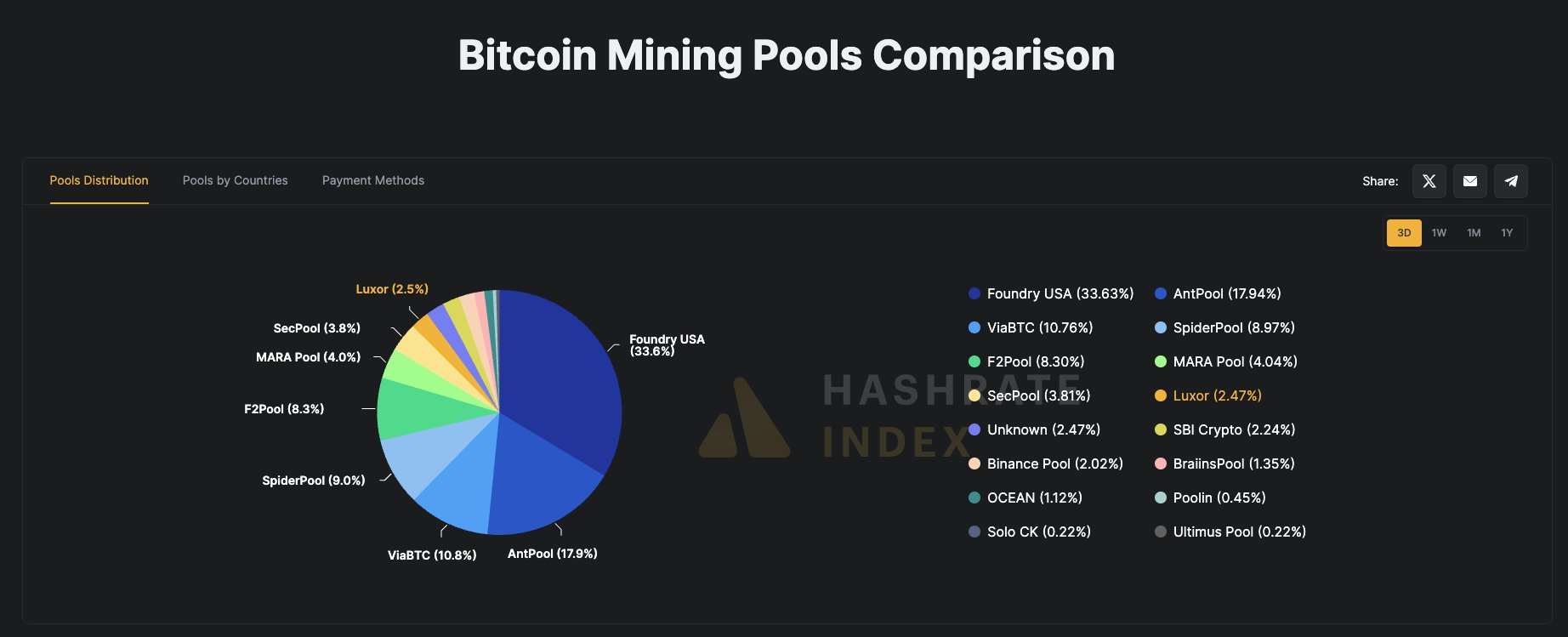

Foundary & AntPool Make Up For The Majority Of The Bitcoin Hashrate

As pointed out by X user Leo Lanza in a post, two mining pools have gained control of more than 51% of the bitcoin Hashrate. The “Hashrate” here refers to a measure of the total amount of computing power that miners have connected to the network.

BTC runs on a consensus mechanism known as the Proof-of-Work (PoW), in which validators compete against each other using computing resources to get the chance to add the next block to the chain. The Hashrate tracks this power being employed by miners as a whole.

Below is a chart from Blockchain.com that shows the trend in the 7-day average of the global Bitcoin Hashrate.

As is visible in the graph, the 7-day average Bitcoin Hashrate has witnessed a rise recently and is now nearly at the all-time high (ATH). Thus, it seems validators are in expansion mode.

While the Hashrate makes a collective measure of the computing power that the miners have attached, these resources never actually work in tandem due to the nature of PoW. This competition is actually what secures the BTC network.

PoW only works, however, as long as participants involved are sufficiently decentralized. If a particular miner was to gain control of the majority of the Hashrate, they can, in theory, alter the blockchain to their will.

Such an attack is popularly known as a 51% attack. Other consensus mechanisms like Proof-of-Stake (PoS) can also fall prey to this method. For example, if a staker (miner-equivalent on PoS networks) assumes control of over 51% of the staked ETH, they can take over the ethereum blockchain.

Today, Bitcoin has grown so much that a 51% hack is extremely hard to pull off. Even so, it isn’t outright impossible. One threat to BTC’s decentralization comes in the FORM of mining pools, groups where individual miners coalesce to get a better shot at earning revenue.

And this is where the current concern lies: two pools are sitting on more than 51% of the Bitcoin Hashrate.

As data from Hashrate Index shows, Foundary USA and AntPool currently have 33.6% and 17.9% of the BTC mining power, respectively. Combined, they make up for 51.5% of the global Hashrate.

Though, while this may be true, an attack should still be unfeasible. As mentioned before, these pools are still made up of individual miners, each of which need to be coordinated to pull off a takeover. Beyond the logistical problem, any successful attack would crash the Bitcoin price and directly hurt the miners involved.

BTC Price

At the time of writing, Bitcoin is trading around $113,700, down almost 6% over the last week.