Ethereum Could Dethrone Bitcoin as the Ultimate Store of Value – VanEck’s Bombshell Prediction

Move over, Bitcoin—Ethereum’s gunning for the crown. A new VanEck report suggests ETH might just be the future’s go-to digital gold, leaving BTC maximalists sweating.

Why? Smart contracts, yield opportunities, and an ecosystem that actually does something beyond sitting there like a speculative rock. Imagine that—utility as a store of value. Revolutionary.

Wall Street’s still trying to figure out how to short both while pretending they ‘believed all along,’ of course.

Ethereum A Better Store Of Value Than Bitcoin?

In recent years, a growing number of companies have diversified their treasuries by allocating capital to digital assets – most notably Bitcoin. However, emerging trends show that corporations are also beginning to accumulate Ethereum, recognizing its potential as both a yield-generating and deflationary asset.

VanEck’s report emphasizes that while Bitcoin’s finite supply and predictable issuance policies make it a strong candidate for a store of value, Ethereum provides greater financial flexibility. In particular, ETH holders can stake their assets to earn rewards, collect network revenue, and participate in DeFi protocols to generate additional yield.

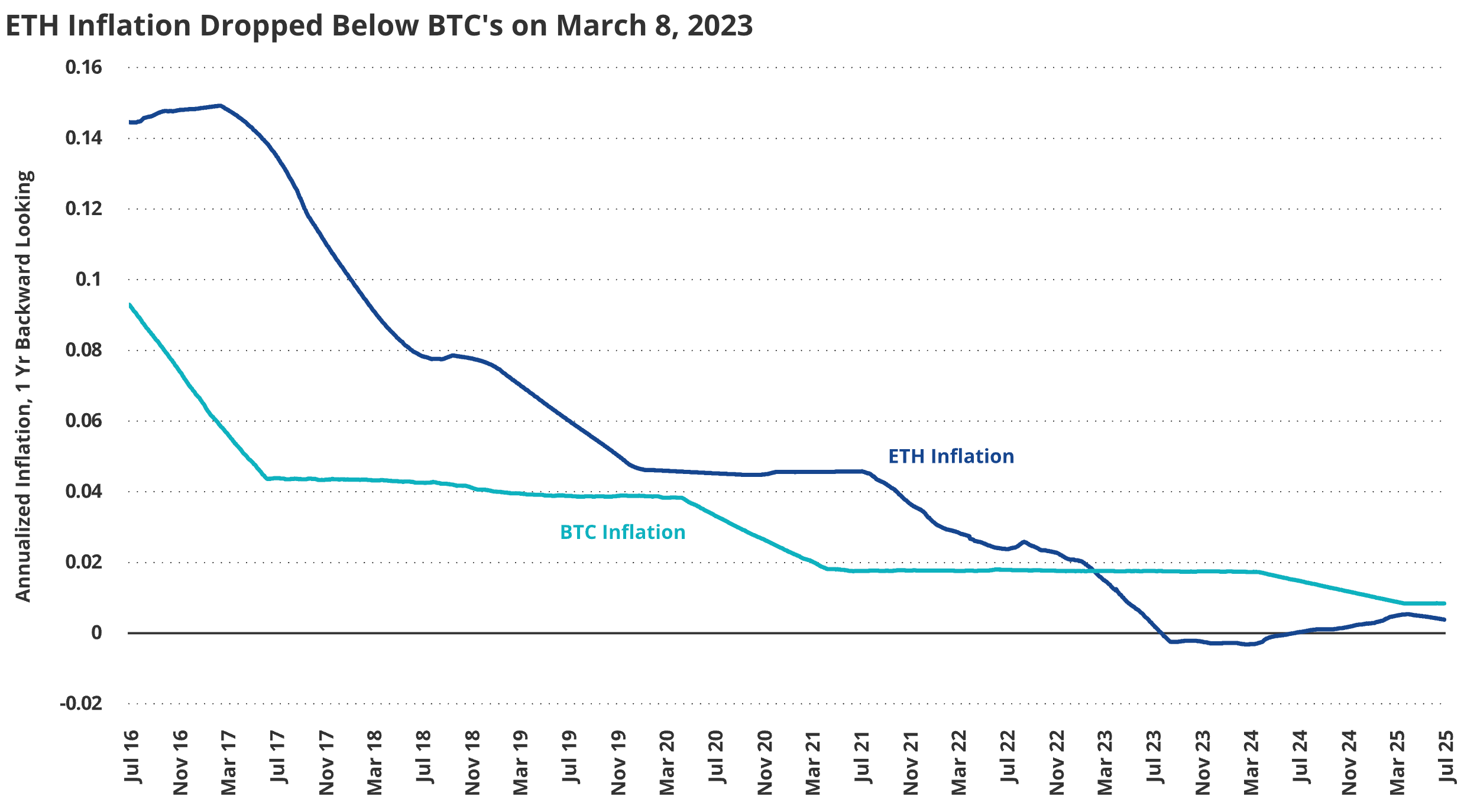

The report also highlights key differences in the monetary policies of both networks. Ethereum’s initial issuance rate at launch was 14.4%, compared to Bitcoin’s 9.3%. However, two major policy changes have since dramatically reduced ETH’s inflation rate – bringing it below Bitcoin’s.

The first was Ethereum Improvement Proposal (EIP-1559), implemented in August 2021, which introduced a mechanism to “burn” a portion of transaction fees. This effectively created deflationary pressure during periods of high network activity, reducing the total supply of ETH.

The second transformative event was “The Merge” in September 2022, when Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism. This change drastically reduced issuance – from approximately 13,000 ETH/day to around 1,700 ETH/day – by eliminating the need to pay miners.

Following these changes, ETH’s inflation rate fell below Bitcoin’s for the first time in March 2023. Since then, ETH’s supply has grown by only 0.2%, compared to Bitcoin’s 3%. The report states:

Total supply of ETH fell between October 7th, 2022, and April 4th, 2024, moving from ~120.6M on to a low of ~120.1M on, achieving an annualized (-0.25%) inflation rate over the period. Since that time, ETH burn has been reduced due to the increase in Ethereum transaction throughput, and the network has accrued (+0.5%) in additional supply. Regardless, over that same period, BTC supply has increased (+1.1%).

Companies Flocking To ETH Accumulation

Over the past month, several companies have unveiled Ethereum-focused treasury strategies. For instance, cryptocurrency firm Bit Digital recently crossed 120,000 ETH in total holdings.

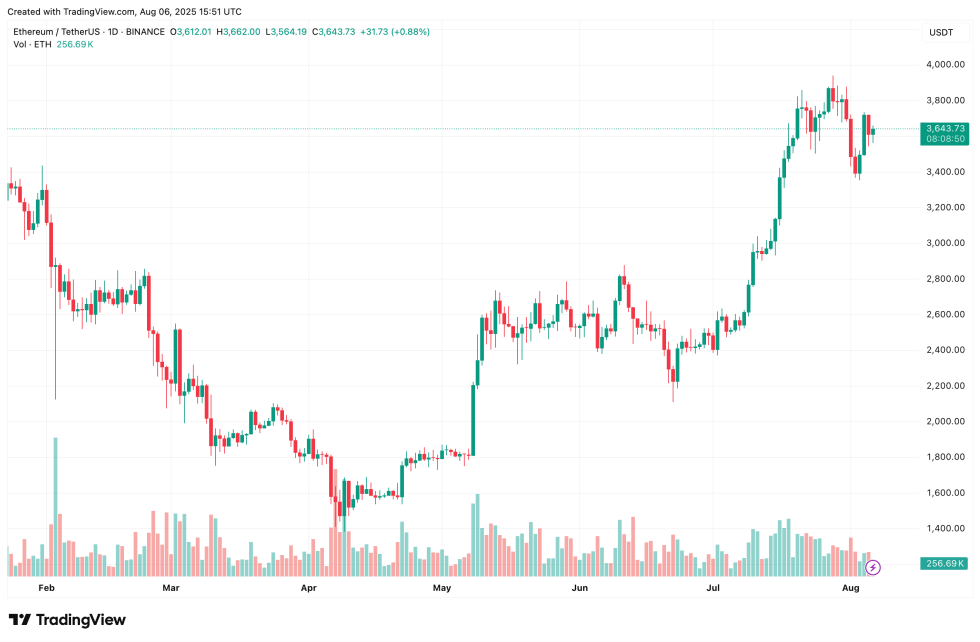

Meanwhile, Bitcoin mining firm BitMine Immersion Technologies revealed that its ETH holdings had surged past 833,000 tokens, making it the largest known corporate holder of the digital asset. At press time, ETH trades at $3,643, up 2.3% in the past 24 hours.