Binance Democratizes Bitcoin Options: Retail Traders Can Now Write Contracts Like Pros

Wall Street’s playground just got a crypto makeover. Binance—the exchange that never sleeps—is handing retail traders the keys to the options writing kingdom. No VIP passes required.

Finally, the little guy gets to play house.

For years, writing options was reserved for whales and hedge funds with seven-figure collateral. Now, your aunt HODLing 0.1 BTC can sell calls from her smartphone. The irony? Most retail traders barely understand gamma exposure—but hey, since when has ignorance stopped anyone in crypto?

Volatility hunters, meet your new toy.

Binance’s move could flood the market with amateur-written contracts. Expect tighter spreads, sloppier pricing, and glorious liquidity. Just don’t cry when your naked short call gets assigned during a 20% BTC moon mission. (Pro tip: maybe learn what ‘assignment’ means first.)

The ultimate test? Whether retail’s appetite for risk matches institutional precision. Spoiler: it won’t—but the chaos will be entertaining. After all, what’s finance without a few sacrificial lambs?

Binance Opens Up Bitcoin Options Writing Access

In a website announcement, Binance has revealed expanded bitcoin Options offerings for its users. Options refer to a type of derivatives contract that grants investors the right to buy or sell the associated asset at a set price on or before a pre-determined date.

Options contracts can be of two types. A “call” gives the holder the right to buy the asset and typically corresponds to a bullish bet. Meanwhile, a “put” grants the right to sell, often signaling a bearish sentiment.

On Binance, retail users could so far only buy Bitcoin Options contracts, but following the latest launch, they can now also “write” the contracts. That is, they can now create and sell them to other traders.

Whenever a trader writes a contract, the buyer has to pay a premium in exchange. This premium represents an upfront income for the writer and gives the purchaser the right to exercise the option under the agreed terms.

If the market moves in the favor of the contract holder, the writer may be forced to take an unfavorable trade and incur a loss. On the other hand, if the purchaser loses the bet, the option expires unused and the writer keeps the premium as profit.

Binance is the largest cryptocurrency exchange in the world in terms of trading volume, so Options writing being available to all users could mark a notable shift in the sector. “This expansion allows users to take advantage of more flexible and strategic trading opportunities, including expressing market views, managing risk, and enhancing yield through Options selling strategies,” said the platform.

In order to access Options writing, traders will need to upgrade their accounts to the Options Long & Short Sell trading mode. For now, only BTC is available to all users, while ETH, BNB, XRP, SOL, and Doge remain restricted to selected traders.

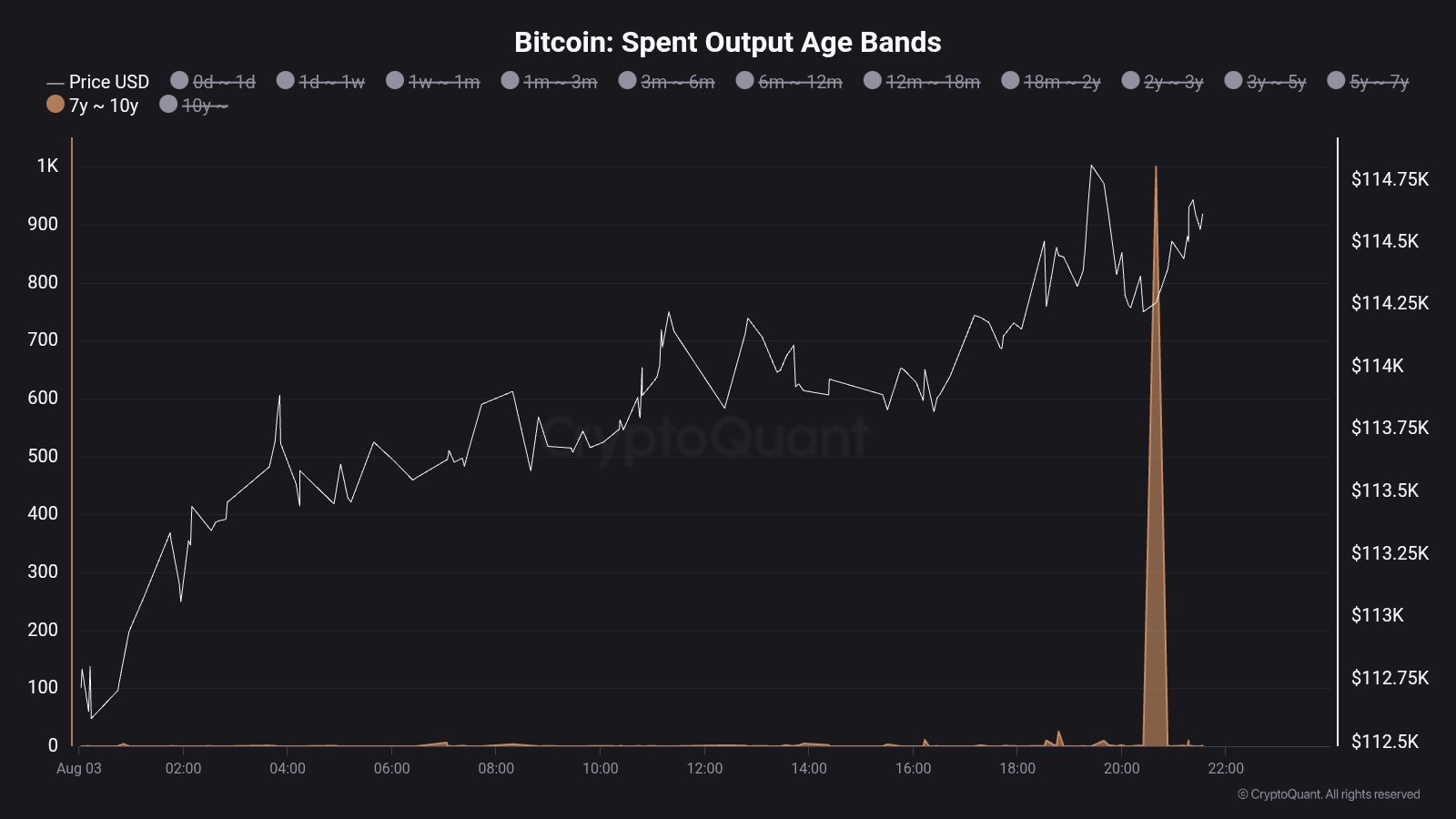

In some other news, there was a significant movement of dormant Bitcoin during the weekend, as CryptoQuant author Maartunn has pointed out in an X post.

With this transaction, the network saw the movement of 1,000 BTC inactive since between seven and ten years ago, worth $114 million today. In another post, the analyst has explained using a chart what relevance transfers involving dormant tokens like this one have for the market.

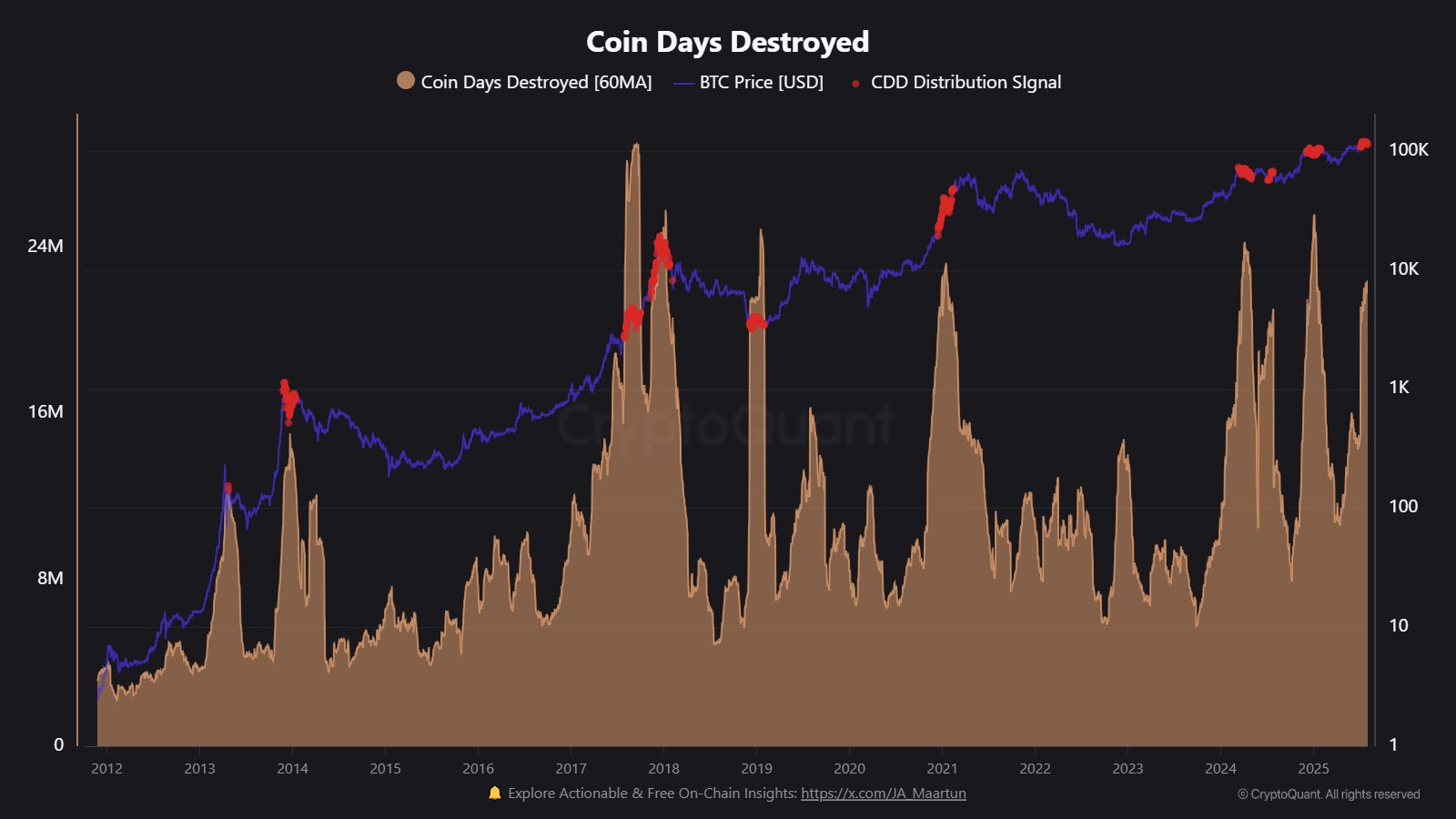

From the graph, it’s visible that spikes in transfers of old Bitcoin have historically reflected elevated distribution on the network.

BTC Price

Bitcoin has broken out of its recent sideways range with a downward MOVE that has brought its price to $114,300.