$13 Billion Floods US Crypto ETFs in July – Best Month on Record

Wall Street's crypto love affair hits new highs—while traditional finance scrambles to keep up.

The gold rush goes digital

US crypto ETFs just smashed all records with a $13 billion July influx. That's not adoption—that's institutional FOMO in a three-piece suit.

Pension funds? More like moon-shot funds

When the suits start betting harder than degens, you know we've crossed into uncharted territory. Somewhere, a Goldman Sachs VP is explaining memecoins to a baffled retirement fund manager.

The cynical take

Nothing unclogs the innovation pipeline like the scent of fresh management fees. Welcome to financialization 2.0—where the rockets are digital but the baggage is still Wall Street vintage.

Crypto ETFs Outperform Vanguard’s S&P 500 Fund In July

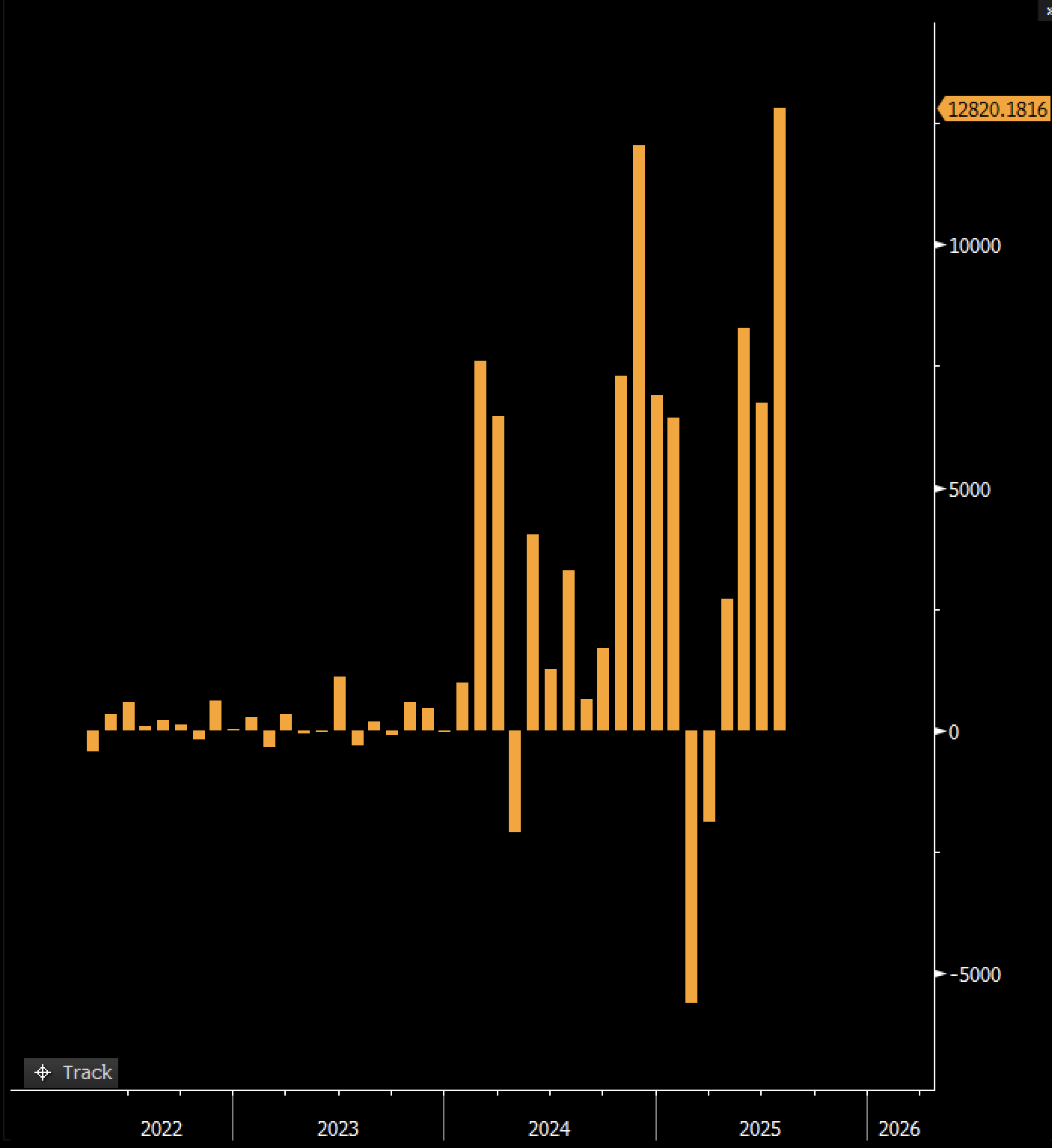

On Friday, August 1, Bloomberg ETF analyst Eric Balchunas took to the social media platform X to reveal that the US crypto ETF market just had its best monthly performance yet in July 2025. According to the latest market data, the investment products took in more than $12.8 billion in capital—at a pace of $600 million per day—in the past month.

To put into perspective, the pace of daily additions in July is about twice the average of the crypto exchange-traded funds. According to Balchunas, the digital asset-linked investment products outperformed every single ETF, including “the mighty VOO”—referring to Vanguard’s S&P 500 fund—over the past month.

Balchunas added:

Further, every ETF in category took in cash (ex the converted Trusts) w/ Bitcoin and Ether making equal contributions. Most all-around dominant performance since the Eagles ended the Chiefs in the Super Bowl. Will be hard to top.

The US crypto ETF market is led by the bitcoin spot ETFs, with a total asset of over $146.48 billion currently under management. The Bitcoin ETF is completely dominated by BlackRock’s IBIT, which has its total assets under management (AUM) at over $84 billion, and is followed by Fidelity’s FBTC at almost $23 billion.

Meanwhile, the ethereum spot exchange-traded funds, which launched more than 6 months after their BTC counterparts, have a total AUM of $20.1 billion. Unsurprisingly, BlackRock also leads this market, with its ETH ETF (ETHA) having a total of $10.71 billion in assets under management.

Crypto Market Cap Drops 5%

According to data from CoinGecko, the total crypto market capitalization stands at around $3.78 billion, having declined by 5% in the past 24 hours. On Friday, the crypto market succumbed to massive bearish pressure, with the top coins like Bitcoin, Ethereum, and Solana suffering major losses.