BREAKING: JPMorgan & Coinbase Forge Game-Changing Alliance – Convert Points to Crypto, Bank-Linked Wallets Launch Imminent

Wall Street meets Web3 in a seismic partnership that’ll have both crypto degens and suit-clad bankers reaching for their wallets.

From loyalty points to Bitcoin

JPMorgan and Coinbase just rewrote the playbook. Now you can convert those forgotten credit card points into Ethereum, Solana, or other digital assets—because nothing says ‘loyalty’ like dumping airline miles for memecoins.

Your bank account is now a crypto on-ramp

The integration allows direct purchases through existing bank relationships, effectively turning traditional finance into a stalking horse for crypto adoption. Jamie Dimon’s infamous anti-Bitcoin rants? Officially ironic.

Why this matters

This isn’t just about convenience—it’s a Trojan horse. By bridging banking infrastructure with crypto’s wild west, the duo could onboard millions who’d never bother with seed phrases or decentralized exchanges.

The fine print cynicism

Of course, JPMorgan takes no custody risk—they’ll happily facilitate your crypto trades while keeping their balance sheet firmly in fiat. Some partnerships are more equal than others.

Bottom line: The walls between TradFi and crypto just got thinner. Whether that’s brilliant strategy or desperate FOMO depends on which side of the ledger you’re on.

JPMorgan Has Partnered Up With Crypto Exchange Coinbase

As announced via a press release, JPMorgan and Coinbase have made a strategic partnership to roll out a set of features aimed at making crypto access mainstream.

JPMorgan Chase is the largest bank in the US and one of the biggest globally, holding over $4 trillion in assets. Coinbase, meanwhile, is the leading American crypto exchange, serving major institutional entities and acting as custodian for most of the Bitcoin and ethereum spot exchange-traded funds (ETFs).

The two giants are joining forces to launch three new offerings for the bank’s 80 million+ customers: the ability to use Chase credit cards for making purchases on Coinbase, redemption of Chase Ultimate Reward Points for the stablecoin USDC, and a direct link between bank accounts and Coinbase wallets. The credit card purchase service is expected to go live in fall of this year, while the other two are planned for 2026.

“This marks the first time a major credit card rewards program will be used to fund a crypto wallet,” read the press release. Under the scheme, 100 Chase Ultimate Reward Points will equal $1 in USDC redemption.

The partnership isn’t the first foray into digital assets for JPMorgan. A report from earlier in the month revealed that the bank is considering offering loans backed on Bitcoin and Ethereum collateral. Also, CEO Jamie Dimon has said that JPMorgan will explore stablecoins.

“This partnership marks a significant step forward in empowering our customers to take control of their financial futures,” said Melissa Feldsher, Head of Payments and Lending Innovation at JPMorgan Chase.

The bank’s involvement in crypto could be especially relevant for the sector given its massive scale. JPMorgan Chase is considered a Global Systematically Important Bank (G-SIB), which means that world economic stability is hinged on it.

Max Branzburg, Head of Consumer & Business Products at Coinbase, said:

We’re excited to partner with JPMorganChase to onboard the next generation of consumers into crypto. Together, we are expanding choice and lowering barriers to entry for consumers to participate in the future of financial services onchain.

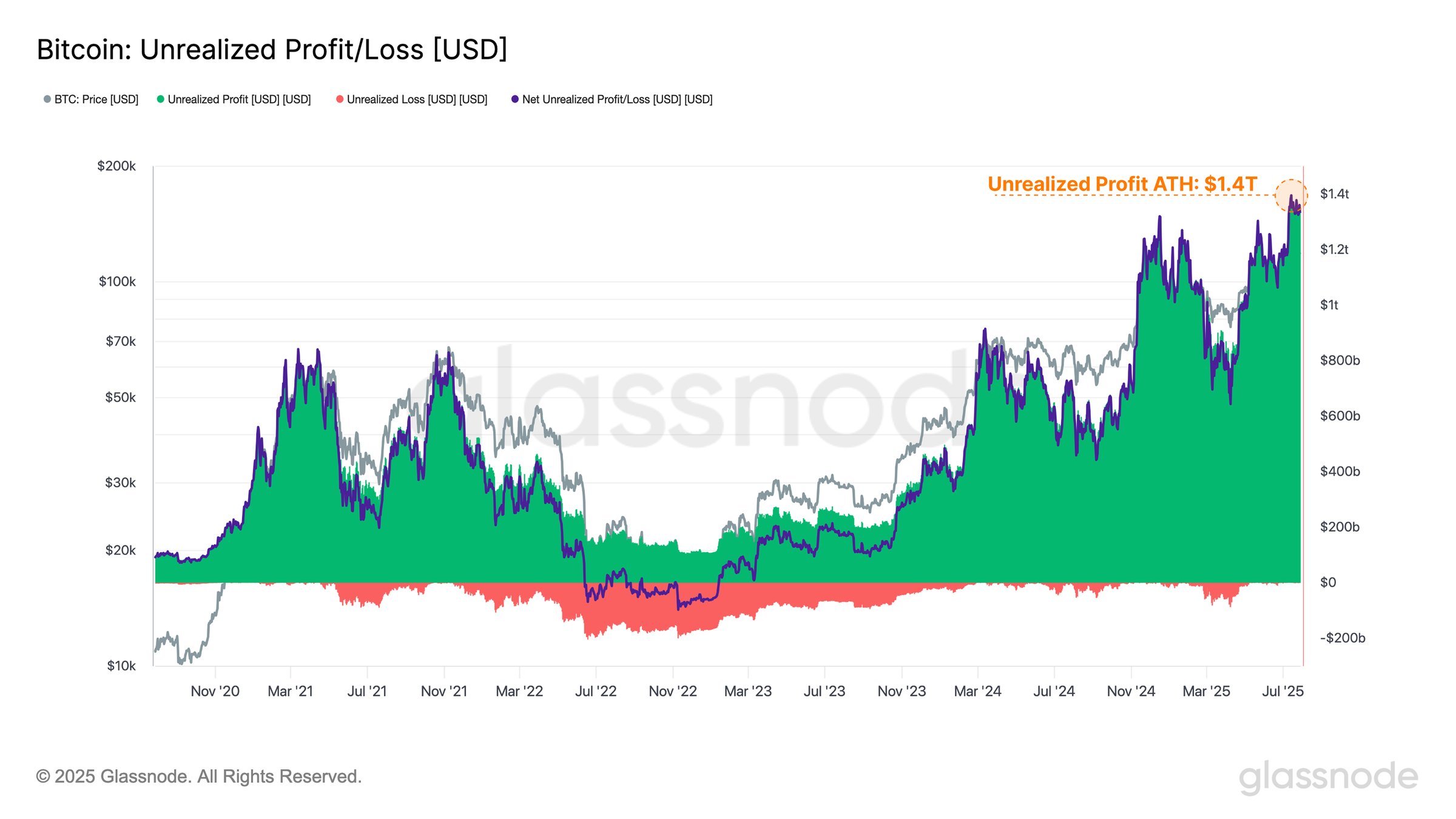

Total Bitcoin Unrealized Profit Held By Investors Has Set A New Record

According to data from on-chain analytics firm Glassnode, the total unrealized profit of the Bitcoin investors recently touched the $1.4 trillion mark, a new all-time high.

“This massive paper gain concentration sets the stage for potential future distribution pressure if prices continue higher,” explained Glassnode. So far, though, since this record has been reached, bitcoin has succumbed to sideways movement, with its price still trading around $117,700.