Ethereum Fuels Futures Frenzy: Altcoin Open Interest Rockets Toward $45B Milestone

Ethereum isn't just leading the charge—it's dragging the entire altcoin complex into the green. Open interest levels scream 'FOMO' as traders pile into derivatives like there's no tomorrow.

The $45B OI showdown

That towering open interest figure isn't just a number—it's a flashing neon sign of leverage stacking up faster than a degenerate gambler's chip tower. ETH's dominance here proves institutional players still treat it as the altcoin market's golden child.

Futures traders chasing the dragon

The rebound's got all the hallmarks of classic crypto overextension—massive positions, crowded trades, and that distinctive scent of gamma exposure hanging in the air. Just don't mention what happened last time OI got this frisky.

Wall Street's playing with decentralized matches again—what could possibly go wrong?

Ethereum, XRP, Solana, And Dogecoin Have Seen A Rise In Open Interest

In a new post on X, the on-chain analytics firm Glassnode has talked about the trend in the Futures Open Interest of four top altcoins: Ethereum (ETH), Dogecoin (DOGE), XRP (XRP), and Solana (SOL).

The Futures Open Interest here refers to a metric that keeps track of the total amount of futures market positions related to a given asset or group of assets that are currently open on all centralized derivatives exchanges. It takes into account both shorts and longs.

When the value of the metric rises, it means investors are opening up fresh positions on the market. Such a trend can be a sign that speculative interest in the coin is going up. On the other hand, the indicator registering a drop suggests the holders are either pivoting to de-risking or getting forcibly liquidated by their platform.

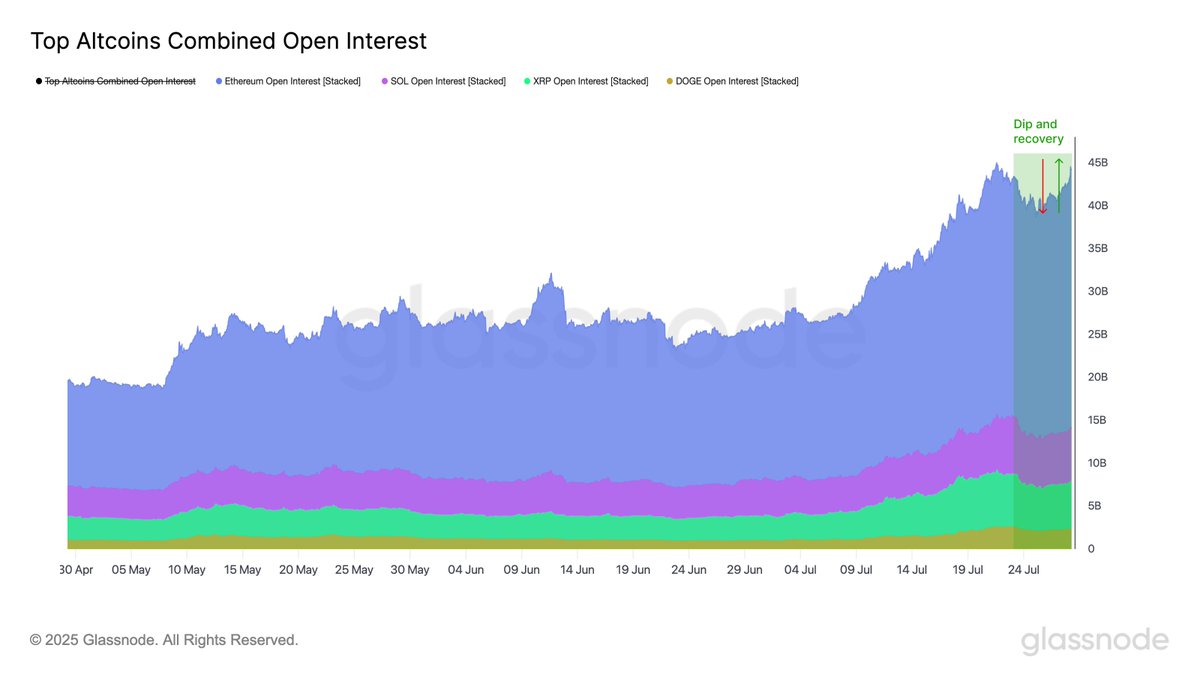

Now, here is the chart shared by Glassnode that shows the trend in the Futures Open Interest for Ethereum, Solana, XRP, and dogecoin over the last few months:

As displayed in the above graph, the combined Futures Open Interest for these top altcoins hit a high of $45 billion last week, but speculative interest cooled off, and the metric witnessed a decline.

This week, the traders appear to be back in full force as the indicator has almost fully recovered, reaching the $44.5 billion mark following a sharp rebound. It’s also visible in the chart that Ethereum sawthe largest part of the swing, while Solana and XRP were more stable. Dogecoin more or less avoided the rollercoaster entirely with a nearly flat trend.

Generally, a rise in the Futures Open Interest can be a hint that the market might be about to turn more volatile. Given that Ethereum has seen the sharpest uptick in speculative interest, it may be more prone to seeing a violent leverage flush.

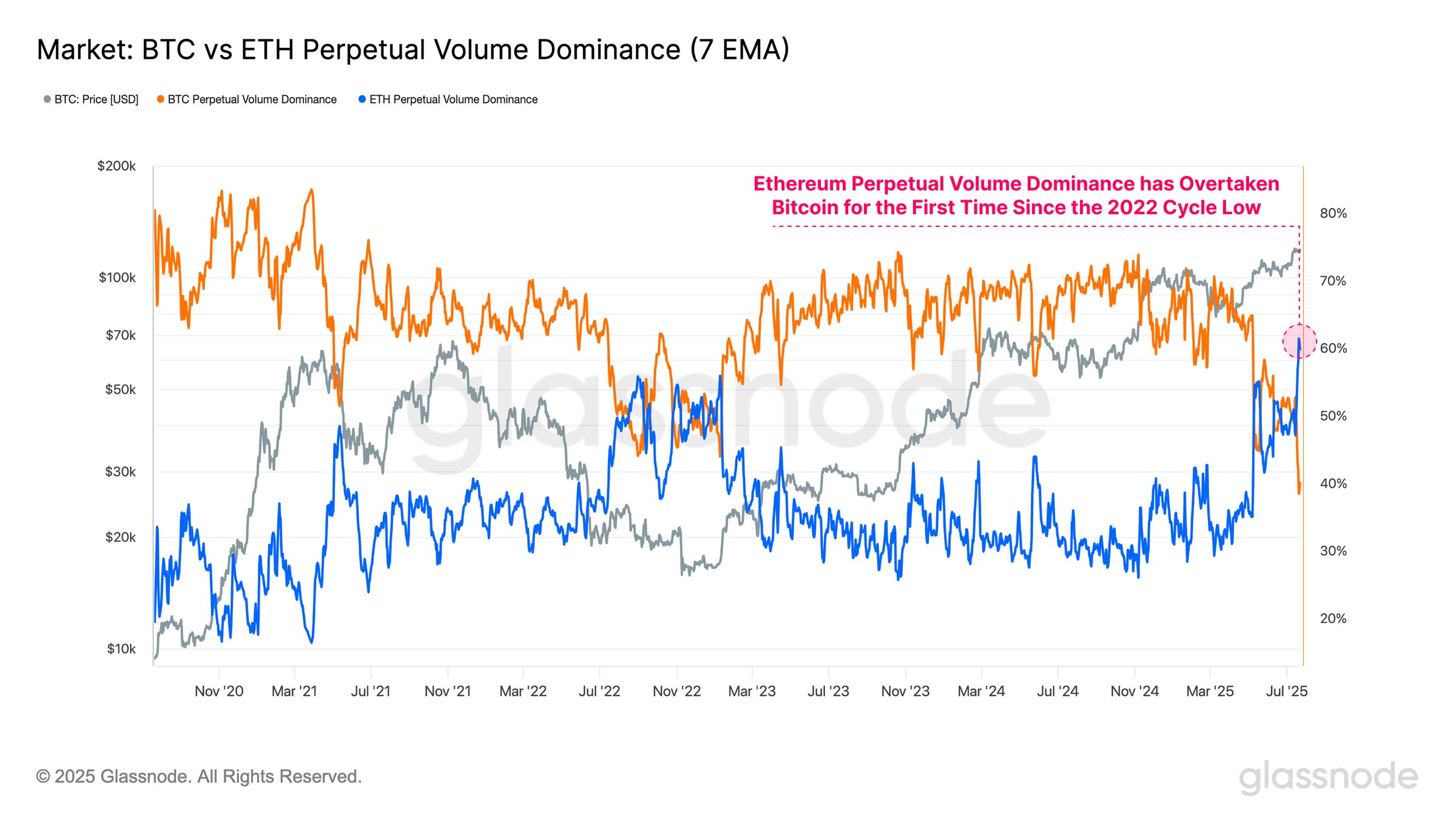

In related news, Ethereum is dominating in the Perpetual Futures market, as the analytics firm has pointed out in another X post.

As Glassnode has highlighted in the chart, the Ethereum Perpetual Futures Volume dominance has recently overtaken Bitcoin’s for the first time since the 2022 cycle low. “This shift confirms a meaningful rotation of speculative interest toward the altcoin sector,” notes the analytics firm.

BTC Price

Bitcoin has continued its recent trend of sideways movement as its price is still trading around the $118,900 level.