Bitcoin Smashes All-Time High—Here’s Why Everyone’s Losing Their Minds

Bitcoin just bulldozed through its previous price ceiling—and the crypto crowd is losing it.

Why this rally feels different

No fancy charts needed. When BTC punches through resistance levels like a bull in a china shop, even your Uber driver starts dropping 'support levels' in conversation. The memes write themselves.

Wall Street's predictable meltdown

Meanwhile, traditional finance bros are scrambling to explain how 'this time it's different' while quietly moving 5% of their portfolio into crypto—just in case. (We see you, Goldman Sachs.)

The internet's collective freakout proves one thing: love it or hate it, Bitcoin isn't going anywhere. Except maybe the moon.

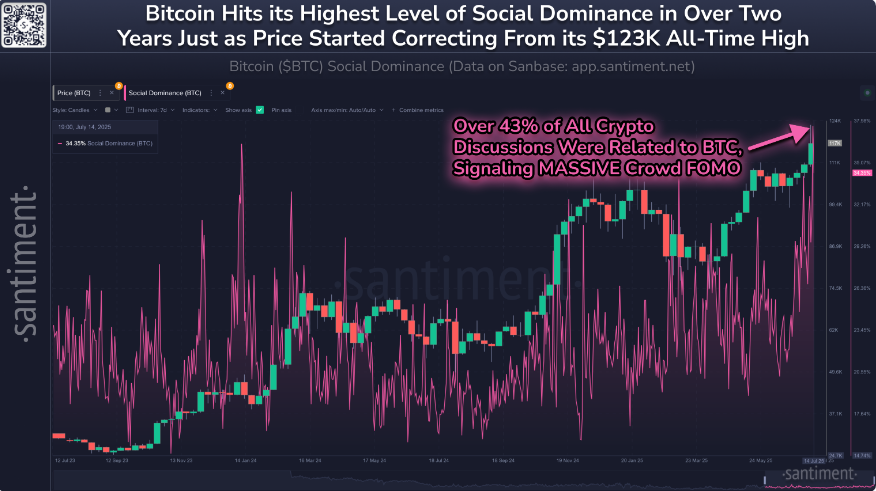

Social Media Frenzy Signals Pullback

Based on reports from Santiment, spikes in online talk often match local tops in price. Santiment analyst Brian Quinlivan pointed out that retail traders may have been jumping in too late. He noted similar spikes on June 11 and July 7 that were followed by dips. When nearly half of all crypto posts focus on one coin, retail FOMO can push prices up briefly. But sentiment then cools, and traders get priced out.

Analysts Weigh Pros And Cons

CryptoQuant’s Axel Adler Jr says the market isn’t overheated yet. His “peak signal” gauge has not triggered, suggesting more room to run. On the other hand, Galaxy Digital’s Michael Harvey expects a short pause before any further gains. Harvey told Cointelegraph that consolidation around current levels is his base case. But he also left open the chance of another MOVE higher before the end of July.

Quinlivan’s earlier cautions proved accurate. After the June 11 social spike, bitcoin slipped. The same thing happened after a July 7 surge in optimism. Those episodes make it clear that online buzz and price tops often go hand in hand. Traders who watched those patterns could have waited for a cooldown and entered on dips.

What Traders Should Watch NextBased on reports, the next key entry point may come after sentiment cools again. Watching social dominance alongside on‑chain signals could give a clearer picture. If the peak signal from CryptoQuant finally lights up, it might mean true exhaustion. Until then, Bitcoin’s ride could see more jerks up and down.

Such market movements capture the dual‑edged quality of hype. On the one hand, large rallies attract new money and enthusiasm. On the other, they can be indicative of tops that result in pullbacks. At the moment, the indicators point both ways. Traders might be best advised to remain vigilant, temper their enthusiasm with prudence, and choose their spots carefully.

Featured image from Unsplash, chart from TradingView