Tether Goes Green in Brazil: How Bitcoin Mining Meets Renewable Farming for a Crypto-Powered Future

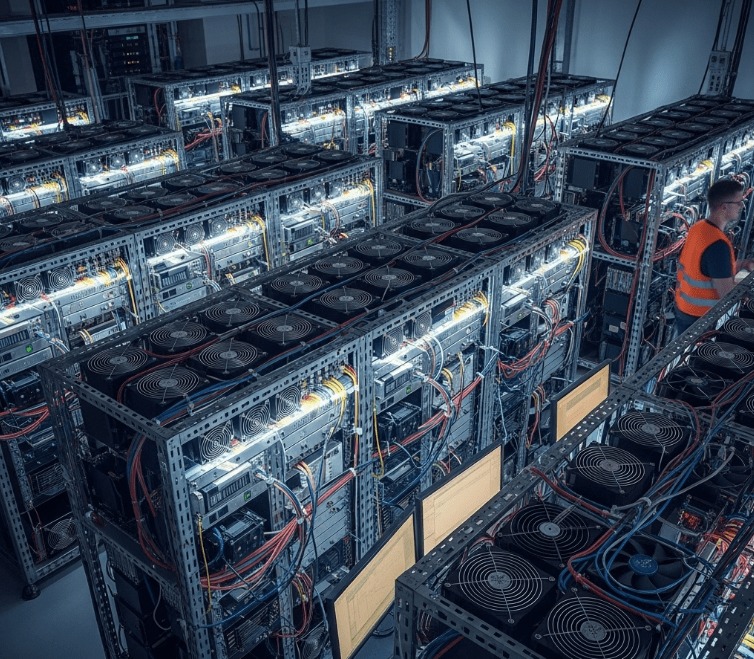

Tether's latest move plants crypto squarely in the soil of sustainability—literally. The stablecoin giant is bringing Bitcoin mining to Brazilian farms, merging blockchain with biomass in a play that could redefine 'green crypto.'

Harnessing the power of renewable energy, Tether's initiative sidesteps the industry's energy FUD while giving farmers a lucrative sideline. Because nothing says 'agricultural revolution' like ASICs next to soybeans.

Will it work? The math looks solid—cheap energy, underutilized land, and a tokenized twist on crop rotation. But let's see if Wall Street's ESG brigade finally stops clutching their pearls over Bitcoin's carbon footprint... or just finds a new reason to short it.

Energy And Bitcoin Join Forces

According to Adecoagro CEO Mariano Bosch, the company wants to stabilize a slice of its power sales by swapping spot‑market swings for a fixed demand channel.

The idea is simple. When wind or solar output tops what the grid can use, instead of cutting back, the extra juice will fire up bitcoin rigs. That should help Adecoagro lock in prices and turn idle electrons into potential upside if Bitcoin climbs.

![]() Tether and Adecoagro join forces for green mining in Brazil@Tether_to and Adecoagro, a South American agro-industrial company, have signed a preliminary agreement to explore Bitcoin mining powered by renewable energy. The project aims to integrate mining with sustainable… pic.twitter.com/OjSqD8LXOZ

Tether and Adecoagro join forces for green mining in Brazil@Tether_to and Adecoagro, a South American agro-industrial company, have signed a preliminary agreement to explore Bitcoin mining powered by renewable energy. The project aims to integrate mining with sustainable… pic.twitter.com/OjSqD8LXOZ

— Atlas21 (@Atlas21_news) July 3, 2025

Tether Mining OS Goes Open

Based on reports, Tether isn’t just writing checks. The company will install and manage the mining hardware with its own site‑management software, Tether Mining OS.

Paolo Ardoino, Tether’s CEO, said the system will be open‑sourced soon. Mining farms from Europe to Asia could download the code, tweak it, and run cleaner operations. That push for transparency is a way to show critics that crypto mining can fit into a low‑carbon world.

Since Juan Sartori sits both as Tether’s Head of Business Initiatives and Adecoagro’s board chair, an independent committee had to sign off on the deal.

Reports have disclosed that the group reviewed the terms to make sure neither side got an unfair edge. That extra check helps guard against conflicts in related‑party transactions and keeps investors on board.

For Adecoagro, the math is straightforward. Every megawatt not sold cheaply during midday solar peaks could instead crank out Bitcoin rewards.

Right now, the company could direct dozens of megawatts toward mining, and still feed enough power back to farms and towns. If Bitcoin holds above key levels, those mining profits may outpace selling on the spot market.

Tether sees more than energy value. The firm has been growing its footprint of sustainable mines in North America and Europe already. This partnership adds South America to the list.

Paolo Ardoino said it also serves as a blueprint: tap cheap green energy, run it through smart software, and share the results with the industry.

Featured image from Meta, chart from TradingView