Bitcoin’s Dominance Is Unstoppable—But Lightning Network Faces Existential Threat, Ex-Core Dev Garzik Claims

Bitcoin's march toward global adoption may be inevitable—but its Lightning Network scaling solution is headed for a dead end, warns former Bitcoin Core developer Jeff Garzik. The controversial take sparks fresh debate as institutional money floods into crypto.

Lightning's make-or-break moment

The layer-2 protocol designed for fast, cheap transactions now faces scaling limitations that could prove fatal, according to Garzik. While Bitcoin's base layer continues attracting billions in institutional investment, Lightning struggles with routing complexity and liquidity challenges.

Wall Street's crypto hypocrisy

Traditional finance giants keep dismissing Bitcoin while quietly accumulating positions—a move as predictable as their 9-to-5 golf outings. Meanwhile, developers battle over scaling solutions that could determine whether Bitcoin evolves beyond 'digital gold' into a true payment network.

The verdict? Bitcoin isn't going anywhere—but its scaling future remains uncertain. As Garzik puts it: 'The market voted with its wallet, and Lightning lost.'

Bitcoin Lightning Is A Dead End

“Lightning is a failure. Very few people are using it, and it kept BTC locked on a bad sidetrack,” Garzik said, adding that the network “was a way to pump Lightning instead of alternate working solutions like layer-twos.” He pointed to hard numbers: “Look at the outcome. We have roughly 5,000 BTC on Lightning after seven years. Wrapped Bitcoin on Ethereum alone is 25 × that. Capital has already voted.”

Garzik blames Lightning’s limited traction on what he calls Bitcoin’s “vetocracy”—a governance culture in which any one faction can veto consensus changes. That culture, he argues, has “o-ified” the base LAYER since the 2017 block-size stalemate: “Bitcoin development basically stopped after 2017. OP_CAT, covenants—perfectly safe opcodes—have been studied to death, but the politics won’t let them in. So builders left. They went where they could ship.”

According to the former Core maintainer, the flight is measurable. Public Lightning capacity hovers NEAR 5,300 BTC, or roughly $500 million, while Wrapped BTC and related bridged tokens now exceed 130,000 BTC—over $14 billion in raw collateral. Node counts tell the same story: about 16,000 publicly visible Lightning nodes versus more than 600,000 addresses holding Wrapped BTC.

Garzik’s critique is philosophical as well as technical. He repeated a line that startled the live audience: “Bitcoin is a social network first and a monetary network second. Its value comes from people coordinating around it, not from any single line of code. But that same social layer can veto innovation, and that’s how we got stuck.”

Because the social consensus resists base-layer change, Garzik sees the future in sidechains like his own project, Hemi. The platform embeds a fully validating BTC node inside an Ethereum-compatible roll-up, secured by proof-of-proof mining and BitVM fraud proofs. Smart contracts can “read and act on bitcoin Layer-1 without custodial bridges,” he said, calling the design “EVM trial-by-fire grafted onto Bitcoin super-finality.”

“All the things built in the past fifteen years—stablecoins, DeFi, identity—are coming to Bitcoin. The only question is whether Lightning zealots will stand in the way.”

Lightning proponents note that capacity figures exclude private channels and that routing revenues are beginning to attract professional operators. Yet even bullish research from Fidelity Digital Assets concedes that public capacity has plateaued between 4,400 BTC and 5,600 BTC since 2022, growing far more in dollar terms than in coins.

Garzik argues that stagnation is structural: “Lightning is great if you want to MOVE a coffee-cup’s worth of Bitcoin at light speed. It’s useless if you want autonomous lending, derivatives, or billion-dollar settlement. For that you need programmable trust, and Lightning doesn’t have it.”

But Bitcoin Will Outlive Everything

Despite the criticism, Garzik underlined that BTC’s monetary role is secure. “Bitcoin will live alongside gold. It’s the trunk; everything else is the foliage,” he said. The inevitability thesis rests on network effects, regulatory clarity, and deep-pocketed holders such as sovereign wealth funds: “Every incentive in the system points back to Bitcoin. That won’t change.”

But inevitability, he warned, is not growth: “Bitcoin isn’t going away, but it isn’t upgrading either. If we want self-sovereignty for eight billion people, we have to extend programmability without compromising the asset the world already trusts. That means Layer-2s—and that means leaving Lightning in the rear-view mirror.”

Whether the broader ecosystem agrees may hinge on tangible metrics in the coming year: capital allocated to Lightning versus emerging BitVM roll-ups, node counts versus wrapped-BTC supply, and, ultimately, the fees users are willing to pay for each path. For now, Garzik’s message is blunt: Bitcoin’s future is assured, but Lightning is not.

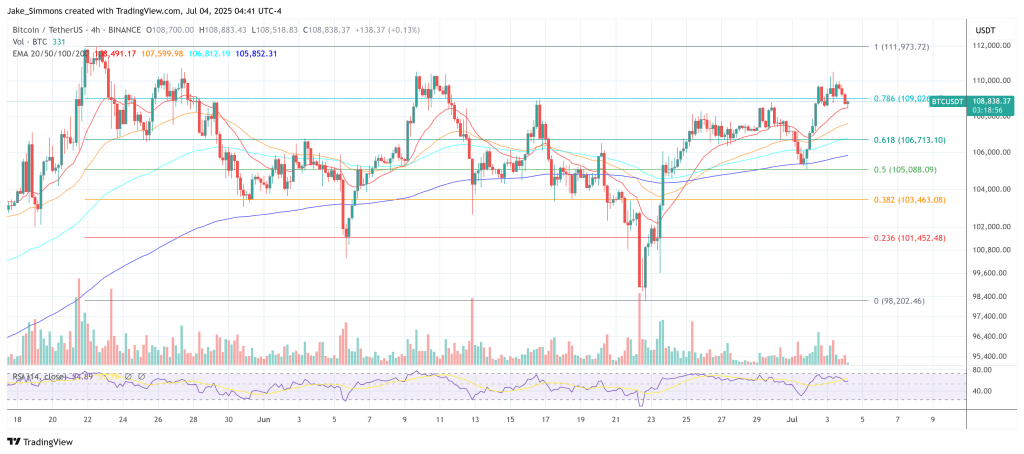

At press time, BTC traded at $108,838.