Bitcoin Funding Rates Plunge to Multi-Month Lows — Is a Massive Short Squeeze Brewing?

Funding rates across crypto exchanges just hit their most negative levels since Q1—and traders are getting antsy.

When the market pays you to short Bitcoin, it's usually time to start buying. The last time funding flipped this bearish, BTC ripped 40% in three weeks. Coincidence? Wall Street would say yes—then charge you 2% for the privilege of hearing their wrong answer.

Perpetual contracts are bleeding premium as leverage gets flushed out. Retail's capitulating while institutions quietly accumulate. Sound familiar? It should—this is the same playbook we saw before the 2023 rally.

Three key levels to watch: $58K (support), $63K (liquidation zone), $69K (all-time high). Break through the mid-range and the squeeze could send BTC flying faster than a VC dumping his 'utility token' bags.

Pro tip: When crypto Twitter starts screenshotting their short positions, the smart money starts loading spot. The question isn't if the market will punish overleveraged bears—it's how violently.

Declining Funding Rates Reflect Increased Short-Side Positioning: Glassnode

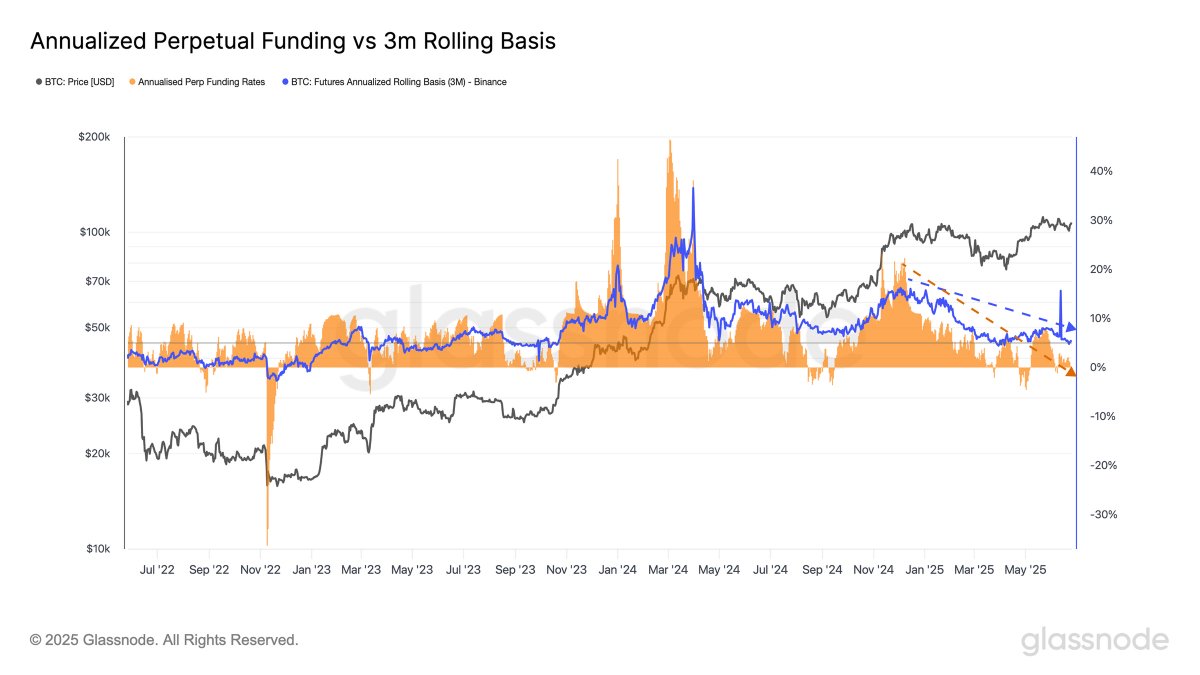

In a June 27 post on the X platform, on-chain analytics firm Glassnode revealed that the funding rate for Bitcoin, which has been on a decline over the past few months, seems to be stuck in a downward trend. The relevant indicators here are “Annualized Perpetual (perp) Funding Rates” and “Binance 3-Month (3M) Futures Annualized Rolling Basis” metrics.

The Annualized Perp Funding Rates is a key metric that tracks the periodic payments between long and short traders in the derivatives (perpetual futures) market. This indicator offers timely insights into the sentiment and leverage in the cryptocurrency derivatives market.

When the funding rate is high or positive, it implies that the long traders are paying the traders with short positions. Typically, this direction of the periodic payment suggests a strong bullish sentiment in the market. Meanwhile, a negative value of the metric means that short traders are paying long traders — suggesting a bearish market sentiment.

On the other hand, the 3-Month (3M) Futures Annualized Rolling Basis estimates the annualized yield from buying a cryptocurrency on the spot market and concurrently selling the crypto’s futures contract expiring in 3 months. Typically, futures contracts trade at a higher price than the spot asset — a difference that traders can exploit for profit.

As shown in the chart above, the Annualized Perp Funding Rates and 3-Month (3M) Futures Annualized Rolling Basis have been falling since last November. “Despite high futures activity, appetite for long exposure is fading, reflecting increased caution and possibly more neutral or short-side positioning,” Glassnode noted.

In essence, the declining funding rates and 3-month rolling basis indicate that short traders are continuously crowding the derivatives market. While there has been a cautious approach to the market from traders, institutional flows into US-based Bitcoin exchange-traded funds and an improving macroeconomic climate have been quite a silver lining.

Hence, even if the funding rates keep falling, but the macroeconomic environment and institutional capital inflow remain steady, the market could witness a short squeeze — where short traders are forced to close their positions. This potential scenario is even supported by the fact that the market tends to MOVE in the crowd’s opposite direction.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $107,180, showing no significant movement in the past 24 hours.